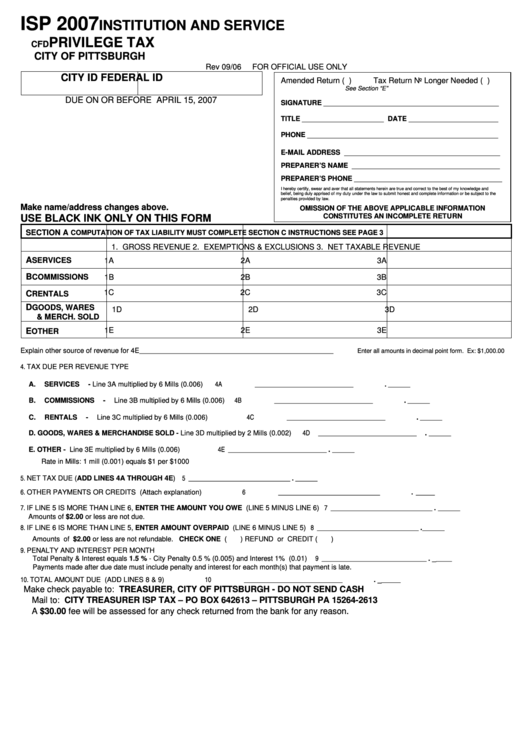

Form Isp - Institution And Service Privilege Tax - City Of Pittsburgh - 2007

ADVERTISEMENT

ISP 2007

INSTITUTION AND SERVICE

PRIVILEGE TAX

CFD

CITY OF PITTSBURGH

Rev 09/06

FOR OFFICIAL USE ONLY

CITY ID

FEDERAL ID

Amended Return ( )

Tax Return No Longer Needed ( )

See Section “E”

DUE ON OR BEFORE APRIL 15, 2007

SIGNATURE _____________________________________________

TITLE _____________________ DATE _______________________

PHONE _________________________________________________

E-MAIL ADDRESS ________________________________________

PREPARER’S NAME ______________________________________

PREPARER’S PHONE ______________________________________

I hereby certify, swear and aver that all statements herein are true and correct to the best of my knowledge and

belief, being duly apprised of my duty under the law to submit honest and complete information or be subject to the

penalties provided by law.

Make name/address changes above.

OMISSION OF THE ABOVE APPLICABLE INFORMATION

CONSTITUTES AN INCOMPLETE RETURN

USE BLACK INK ONLY ON THIS FORM

SECTION A

COMPUTATION OF TAX LIABILITY

MUST COMPLETE SECTION C

INSTRUCTIONS SEE PAGE 3

1. GROSS REVENUE

2. EXEMPTIONS & EXCLUSIONS

3. NET TAXABLE REVENUE

A

SERVICES

1A

2A

3A

B

COMMISSIONS

1B

2B

3B

1C

2C

3C

C

RENTALS

D

GOODS, WARES

1D

2D

3D

& MERCH. SOLD

1E

2E

3E

E

OTHER

Explain other source of revenue for 4E_____________________________________________________________

Enter all amounts in decimal point form. Ex: $1,000.00

4. TAX DUE PER REVENUE TYPE

4A _______________________________ . _______

A.

SERVICES - Line 3A multiplied by 6 Mills (0.006)

4B _______________________________ . _______

B.

COMMISSIONS - Line 3B multiplied by 6 Mills (0.006)

4C _______________________________ . _______

C.

RENTALS - Line 3C multiplied by 6 Mills (0.006)

4D _______________________________ . _______

D.

GOODS, WARES & MERCHANDISE SOLD - Line 3D multiplied by 2 Mills (0.002)

4E _______________________________ . _______

E.

OTHER - Line 3E multiplied by 6 Mills (0.006)

Rate in Mills: 1 mill (0.001) equals $1 per $1000

5. NET TAX DUE (ADD LINES 4A THROUGH 4E)

5 ________________________________ . _______

6. OTHER PAYMENTS OR CREDITS (Attach explanation)

6 ________________________________ . ______

7. IF LINE 5 IS MORE THAN LINE 6, ENTER THE AMOUNT YOU OWE (LINE 5 MINUS LINE 6)

7 ________________________________ . _______

Amounts of $2.00 or less are not due.

8. IF LINE 6 IS MORE THAN LINE 5, ENTER AMOUNT OVERPAID (LINE 6 MINUS LINE 5)

8 ________________________________ . _______

Amounts of $2.00 or less are not refundable. CHECK ONE (

) REFUND or CREDIT (

)

9. PENALTY AND INTEREST PER MONTH

9 _________________________________ . ______

Total Penalty & Interest equals 1.5 % - City Penalty 0.5 % (0.005) and Interest 1% (0.01)

Payments made after due date must include penalty and interest for each month(s) that payment is late.

10. TOTAL AMOUNT DUE (ADD LINES 8 & 9)

10 _______________________________ . _______

Make check payable to: TREASURER, CITY OF PITTSBURGH - DO NOT SEND CASH

Mail to: CITY TREASURER ISP TAX – PO BOX 642613 – PITTSBURGH PA 15264-2613

A $30.00 fee will be assessed for any check returned from the bank for any reason.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1 2

2 3

3 4

4