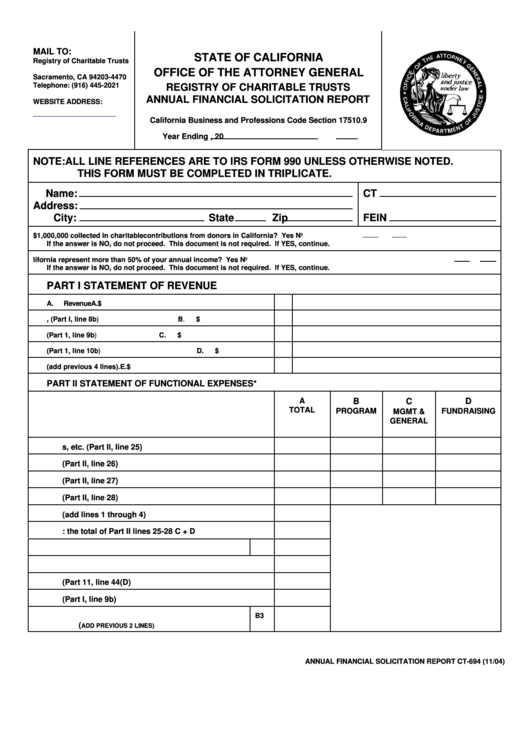

MAIL TO:

STATE OF CALIFORNIA

Registry of Charitable Trusts

P.O. Box 903447

OFFICE OF THE ATTORNEY GENERAL

Sacramento, CA 94203-4470

Telephone: (916) 445-2021

REGISTRY OF CHARITABLE TRUSTS

ANNUAL FINANCIAL SOLICITATION REPORT

WEBSITE ADDRESS:

California Business and Professions Code Section 17510.9

Year Ending

, 20

NOTE:

ALL LINE REFERENCES ARE TO IRS FORM 990 UNLESS OTHERWISE NOTED.

THIS FORM MUST BE COMPLETED IN TRIPLICATE.

Name:

CT

Address:

City:

State

Zip

FEIN

1.

Was more than $1,000,000 collected in charitable contributions from donors in California? Yes

No

If the answer is NO, do not proceed. This document is not required. If YES, continue.

2.

Do your charitable contributions collected from donors in California represent more than 50% of your annual income? Yes

No

If the answer is NO, do not proceed. This document is not required. If YES, continue.

PART I STATEMENT OF REVENUE

A.

Revenue

A.

$

B.

Cost/Basis of Sold Assets, (Part I, line 8b)

B.

$

C.

Special Fund-raising Expenses (Part 1, line 9b)

C.

$

D.

Cost of Goods Sold (Part 1, line 10b)

D.

$

E.

TOTAL REVENUE (add previous 4 lines).

E.

$

PART II STATEMENT OF FUNCTIONAL EXPENSES*

A

B

C

D

TOTAL

A..

Total salaries of all persons employed by the charity.

PROGRAM

FUNDRAISING

MGMT &

GENERAL

1. Compensation of officers, etc. (Part II, line 25)

2. Other salaries and wages (Part II, line 26)

3. Pension plan contributions (Part II, line 27)

4. Other employee benefits (Part II, line 28)

5. GROSS SALARIES (add lines 1 through 4)

6. Less: the total of Part II lines 25-28 C + D

7. TOTAL SALARIES

A7

B.

Fundraising Expenses

1. Fundraising Expenses (Part 11, line 44(D)

2. Special Fundraising Expenses (Part I, line 9b)

B3

3. TOTAL FUNDRAISING EXPENSES

(

ADD PREVIOUS 2 LINES)

ANNUAL FINANCIAL SOLICITATION REPORT CT-694 (11/04)

1

1 2

2