Print Form

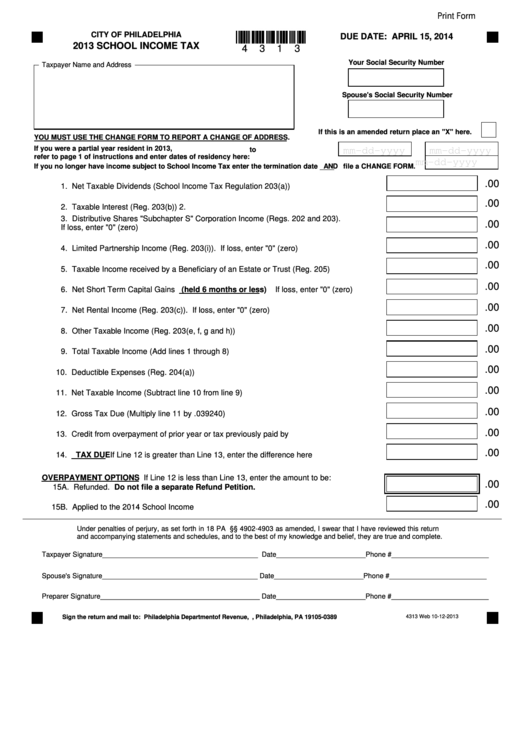

CITY OF PHILADELPHIA

DUE DATE: APRIL 15, 2014

2013 SCHOOL INCOME TAX

4

3

1

3

Your Social Security Number

Taxpayer Name and Address

Spouse's Social Security Number

If this is an amended return place an "X" here.

YOU MUST USE THE CHANGE FORM TO REPORT A CHANGE OF ADDRESS.

If you were a partial year resident in 2013,

mm-dd-yyyy

to

mm-dd-yyyy

refer to page 1 of instructions and enter dates of residency here:

mm-dd-yyyy

If you no longer have income subject to School Income Tax enter the termination date AND file a CHANGE FORM.

.00

1. Net Taxable Dividends (School Income Tax Regulation 203(a)).........................................1.

.00

2. Taxable Interest (Reg. 203(b)).............................................................................................2.

3. Distributive Shares "Subchapter S" Corporation Income (Regs. 202 and 203).

.00

If loss, enter "0" (zero)..........................................................................................................3.

.00

4. Limited Partnership Income (Reg. 203(i)). If loss, enter "0" (zero).....................................4.

.00

5. Taxable Income received by a Beneficiary of an Estate or Trust (Reg. 205).......................5.

.00

6. Net Short Term Capital Gains (held 6 months or less) If loss, enter "0" (zero)................6.

.00

7. Net Rental Income (Reg. 203(c)). If loss, enter "0" (zero)..................................................7.

.00

8. Other Taxable Income (Reg. 203(e, f, g and h))..................................................................8.

.00

9. Total Taxable Income (Add lines 1 through 8).....................................................................9.

.00

10. Deductible Expenses (Reg. 204(a))...................................................................................10.

.00

11. Net Taxable Income (Subtract line 10 from line 9).............................................................11.

.00

12. Gross Tax Due (Multiply line 11 by .039240).....................................................................12.

.00

13. Credit from overpayment of prior year or tax previously paid by extension.......................13.

.00

14. TAX DUE If Line 12 is greater than Line 13, enter the difference here ...........................14.

OVERPAYMENT OPTIONS If Line 12 is less than Line 13, enter the amount to be:

.00

15A. Refunded. Do not file a separate Refund Petition.....................................................15A.

.00

15B. Applied to the 2014 School Income Tax..........................................................................15B.

Under penalties of perjury, as set forth in 18 PA C.S. §§ 4902-4903 as amended, I swear that I have reviewed this return

and accompanying statements and schedules, and to the best of my knowledge and belief, they are true and complete.

Taxpayer Signature________________________________________ Date_______________________Phone #_________________________

Spouse's Signature________________________________________ Date_______________________Phone #_________________________

Preparer Signature_________________________________________ Date_______________________Phone #_________________________

4313 Web 10-12-2013

Sign the return and mail to: Philadelphia Department of Revenue, P.O. Box 389, Philadelphia, PA 19105-0389

1

1