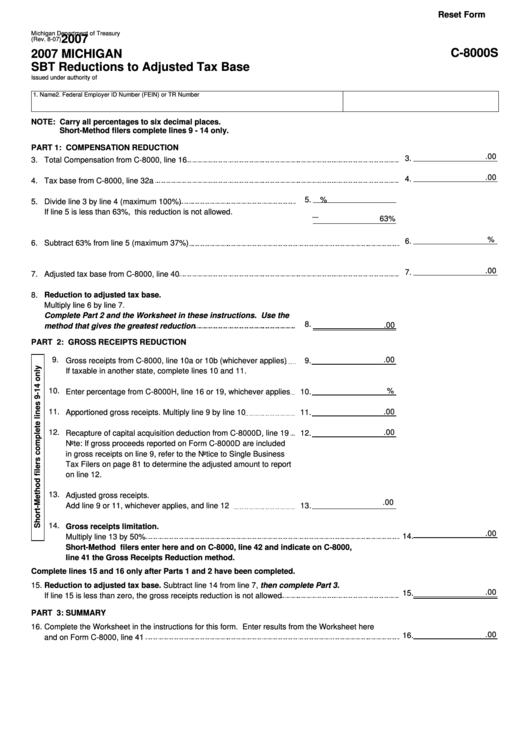

Reset Form

Michigan Department of Treasury

2007

(Rev. 8-07)

C-8000S

2007 MICHIGAN

SBT Reductions to Adjusted Tax Base

Issued under authority of P.A. 228 of 1975. See instruction booklet for filing guidelines.

1. Name

2. Federal Employer ID Number (FEIN) or TR Number

NOTE: Carry all percentages to six decimal places.

Short-Method filers complete lines 9 - 14 only.

PART 1: COMPENSATION REDUCTION

.00

3.

3.

Total Compensation from C-8000, line 16

.00

4.

4.

Tax base from C-8000, line 32a

5.

%

5.

Divide line 3 by line 4 (maximum 100%)

If line 5 is less than 63%, this reduction is not allowed.

_

63%

%

6.

6.

Subtract 63% from line 5 (maximum 37%)

.00

7.

7.

Adjusted tax base from C-8000, line 40

8.

Reduction to adjusted tax base.

Multiply line 6 by line 7.

Complete Part 2 and the Worksheet in these instructions. Use the

8.

.00

method that gives the greatest reduction

PART 2: GROSS RECEIPTS REDUCTION

9.

.00

Gross receipts from C-8000, line 10a or 10b (whichever applies)

9.

If taxable in another state, complete lines 10 and 11.

10.

%

Enter percentage from C-8000H, line 16 or 19, whichever applies

10.

11.

.00

Apportioned gross receipts. Multiply line 9 by line 10

11.

12.

.00

Recapture of capital acquisition deduction from C-8000D, line 19

12.

Note: If gross proceeds reported on Form C-8000D are included

in gross receipts on line 9, refer to the Notice to Single Business

Tax Filers on page 81 to determine the adjusted amount to report

on line 12.

13.

Adjusted gross receipts.

.00

Add line 9 or 11, whichever applies, and line 12

13.

14.

Gross receipts limitation.

.00

14.

Multiply line 13 by 50%

Short-Method filers enter here and on C-8000, line 42 and indicate on C-8000,

line 41 the Gross Receipts Reduction method.

Complete lines 15 and 16 only after Parts 1 and 2 have been completed.

15.

Reduction to adjusted tax base. Subtract line 14 from line 7, then complete Part 3.

.00

15.

If line 15 is less than zero, the gross receipts reduction is not allowed

PART 3: SUMMARY

16.

Complete the Worksheet in the instructions for this form. Enter results from the Worksheet here

.00

16.

and on Form C-8000, line 41

1

1