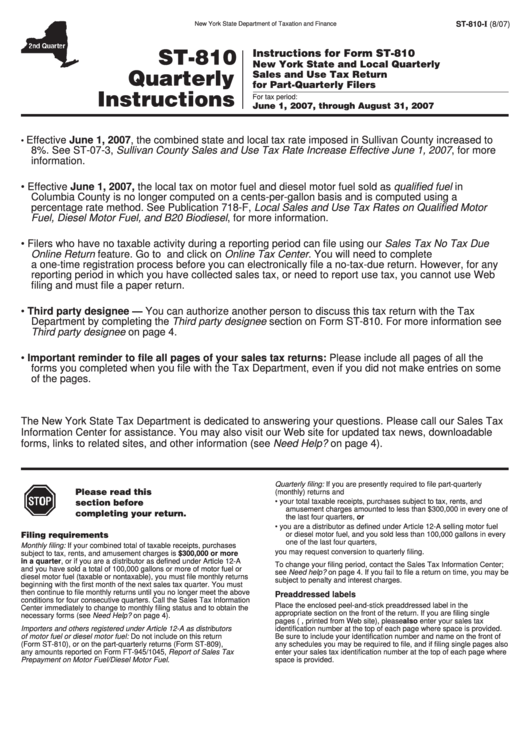

Instructions For Form St-810 - New York State And Local Quarterly Sales And Use Tax Return For Part-Quarterly Filers - 2007

ADVERTISEMENT

ST-810-

I

(8/07)

New York State Department of Taxation and Finance

ST-810

Instructions for Form ST-810

New York State and Local Quarterly

Quarterly

Sales and Use Tax Return

for Part-Quarterly Filers

Instructions

For tax period:

June 1, 2007, through August 31, 2007

Effective June 1, 2007, the combined state and local tax rate imposed in Sullivan County increased to

•

8%. See ST-07-3, Sullivan County Sales and Use Tax Rate Increase Effective June 1, 2007, for more

information.

• Effective June 1, 2007, the local tax on motor fuel and diesel motor fuel sold as qualified fuel in

Columbia County is no longer computed on a cents-per-gallon basis and is computed using a

percentage rate method. See Publication 718-F, Local Sales and Use Tax Rates on Qualified Motor

Fuel, Diesel Motor Fuel, and B20 Biodiesel, for more information.

• Filers who have no taxable activity during a reporting period can file using our Sales Tax No Tax Due

Online Return feature. Go to and click on Online Tax Center. You will need to complete

a one-time registration process before you can electronically file a no-tax-due return. However, for any

reporting period in which you have collected sales tax, or need to report use tax, you cannot use Web

filing and must file a paper return.

• Third party designee — You can authorize another person to discuss this tax return with the Tax

Department by completing the Third party designee section on Form ST-810. For more information see

Third party designee on page 4.

• Important reminder to file all pages of your sales tax returns: Please include all pages of all the

forms you completed when you file with the Tax Department, even if you did not make entries on some

of the pages.

The New York State Tax Department is dedicated to answering your questions. Please call our Sales Tax

Information Center for assistance. You may also visit our Web site for updated tax news, downloadable

forms, links to related sites, and other information (see Need Help? on page 4).

Quarterly filing: If you are presently required to file part-quarterly

Please read this

(monthly) returns and

section before

•

your total taxable receipts, purchases subject to tax, rents, and

amusement charges amounted to less than $300,000 in every one of

completing your return.

the last four quarters, or

•

you are a distributor as defined under Article 12-A selling motor fuel

Filing requirements

or diesel motor fuel, and you sold less than 100,000 gallons in every

one of the last four quarters,

Monthly filing: If your combined total of taxable receipts, purchases

you may request conversion to quarterly filing.

subject to tax, rents, and amusement charges is $300,000 or more

in a quarter, or if you are a distributor as defined under Article 12-A

To change your filing period, contact the Sales Tax Information Center;

and you have sold a total of 100,000 gallons or more of motor fuel or

see Need help? on page 4. If you fail to file a return on time, you may be

diesel motor fuel (taxable or nontaxable), you must file monthly returns

subject to penalty and interest charges.

beginning with the first month of the next sales tax quarter. You must

then continue to file monthly returns until you no longer meet the above

Preaddressed labels

conditions for four consecutive quarters. Call the Sales Tax Information

Place the enclosed peel-and-stick preaddressed label in the

Center immediately to change to monthly filing status and to obtain the

appropriate section on the front of the return. If you are filing single

necessary forms (see Need Help? on page 4).

pages (e.g., printed from Web site), please also enter your sales tax

Importers and others registered under Article 12‑A as distributors

identification number at the top of each page where space is provided.

of motor fuel or diesel motor fuel: Do not include on this return

Be sure to include your identification number and name on the front of

(Form ST-810), or on the part-quarterly returns (Form ST-809),

any schedules you may be required to file, and if filing single pages also

any amounts reported on Form FT-945/1045, Report of Sales Tax

enter your sales tax identification number at the top of each page where

Prepayment on Motor Fuel/Diesel Motor Fuel.

space is provided.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4