Form Ct-1096 - Connecticut Annual Summary And Transmittal Of Information Returns - 2004

ADVERTISEMENT

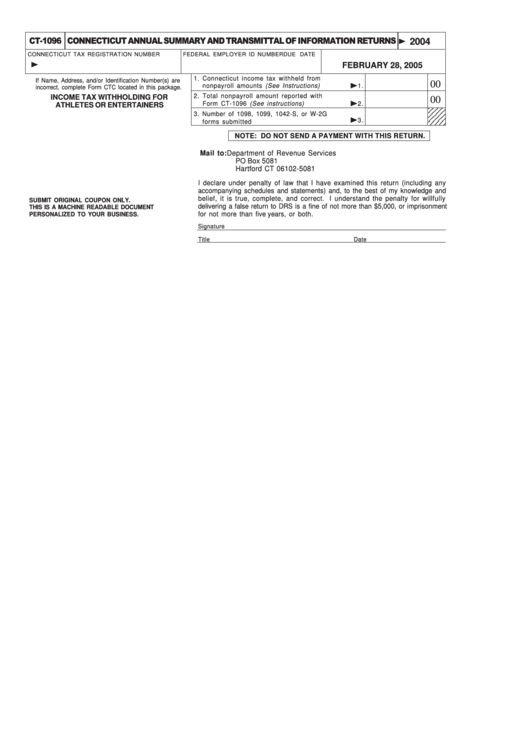

CT-1096 CONNECTICUT ANNUAL SUMMARY AND TRANSMITTAL OF INFORMATION RETURNS

2004

CONNECTICUT TAX REGISTRATION NUMBER

FEDERAL EMPLOYER ID NUMBER

DUE DATE

FEBRUARY 28, 2005

1 . Connecticut income tax withheld from

If Name, Address, and/or Identification Number(s) are

00

nonpayroll amounts (See Instructions)

1 .

incorrect, complete Form CTC located in this package.

2 . Total nonpayroll amount reported with

INCOME TAX WITHHOLDING FOR

00

Form CT-1096 (See instructions)

2 .

1 2 3 4 5

ATHLETES OR ENTERTAINERS

1 2 3 4 5

1 2 3 4 5

3 . Number of 1098, 1099, 1042-S, or W-2G

1 2 3 4 5

3 .

forms submitted

1 2 3 4 5

NOTE: DO NOT SEND A PAYMENT WITH THIS RETURN.

Mail to:

Department of Revenue Services

PO Box 5081

Hartford CT 06102-5081

I declare under penalty of law that I have examined this return (including any

accompanying schedules and statements) and, to the best of my knowledge and

belief, it is true, complete, and correct. I understand the penalty for willfully

SUBMIT ORIGINAL COUPON ONLY.

delivering a false return to DRS is a fine of not more than $5,000, or imprisonment

THIS IS A MACHINE READABLE DOCUMENT

for not more than five years, or both.

PERSONALIZED TO YOUR BUSINESS.

Signature

Title

Date

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2