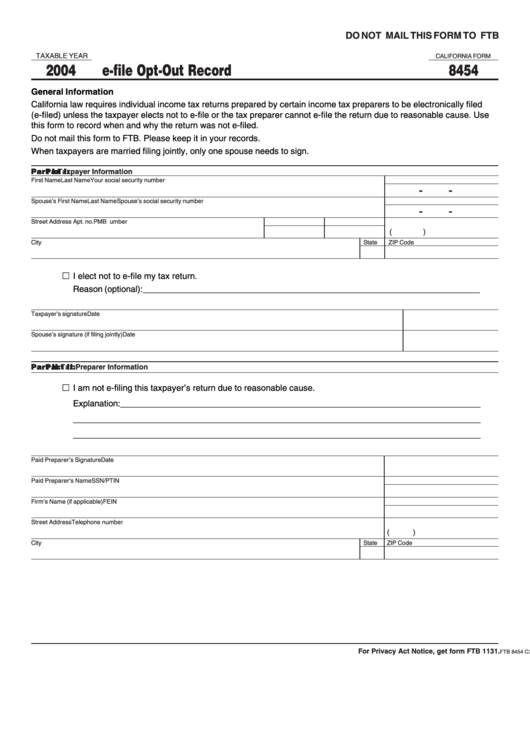

California Form 8454 - E-File Opt-Out Record - 2004

ADVERTISEMENT

DO NOT MAIL THIS FORM TO FTB

TAXABLE YEAR

CALIFORNIA FORM

2004

e-file Opt-Out Record

8454

General Information

California law requires individual income tax returns prepared by certain income tax preparers to be electronically filed

(e-filed) unless the taxpayer elects not to e-file or the tax preparer cannot e-file the return due to reasonable cause. Use

this form to record when and why the return was not e-filed.

Do not mail this form to FTB. Please keep it in your records.

When taxpayers are married filing jointly, only one spouse needs to sign.

Par

Par

Part I:

t I:

t I:

t I: Taxpayer Information

Par

Par

t I:

First Name

Last Name

Your social security number

-

-

Spouse’s First Name

Last Name

Spouse’s social security number

-

-

Street Address

Apt. no.

PMB no.

Telephone number

(

)

City

State

ZIP Code

I elect not to e-file my tax return.

Reason (optional):_______________________________________________________________________

Taxpayer’s signature

Date

Spouse’s signature (if filing jointly)

Date

Par

Par

Part II:

t II:

t II:

t II: Tax Preparer Information

Par

Par

t II:

I am not e-filing this taxpayer’s return due to reasonable cause.

Explanation:____________________________________________________________________________

______________________________________________________________________________________

______________________________________________________________________________________

Paid Preparer’s Signature

Date

Paid Preparer’s Name

SSN/PTIN

Firm’s Name (if applicable)

FEIN

Street Address

Telephone number

(

)

City

State

ZIP Code

For Privacy Act Notice, get form FTB 1131.

FTB 8454 C3 (REV 09-2004)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1