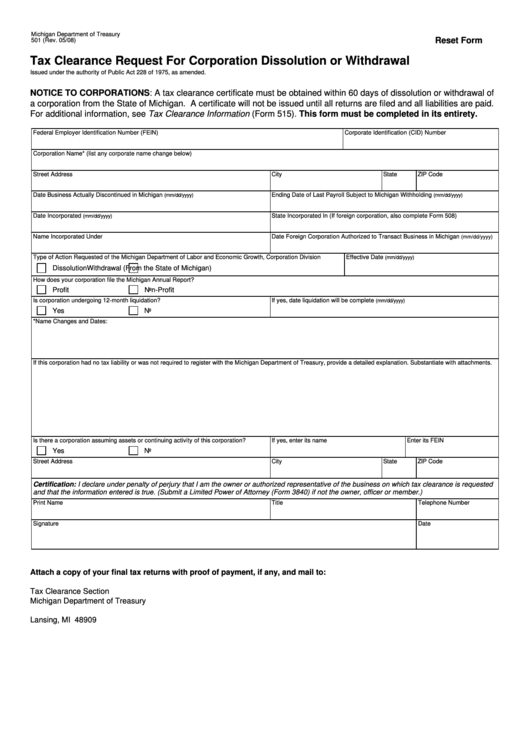

Michigan Department of Treasury

Reset Form

501 (Rev. 05/08)

Tax Clearance Request For Corporation Dissolution or Withdrawal

Issued under the authority of Public Act 228 of 1975, as amended.

NOTICE TO CORPORATIONS: A tax clearance certificate must be obtained within 60 days of dissolution or withdrawal of

a corporation from the State of Michigan. A certificate will not be issued until all returns are filed and all liabilities are paid.

For additional information, see Tax Clearance Information (Form 515). This form must be completed in its entirety.

Federal Employer Identification Number (FEIN)

Corporate Identification (CID) Number

Corporation Name* (list any corporate name change below)

Street Address

City

State

ZIP Code

Date Business Actually Discontinued in Michigan

Ending Date of Last Payroll Subject to Michigan Withholding

(mm/dd/yyyy)

(mm/dd/yyyy)

Date Incorporated

State Incorporated In (If foreign corporation, also complete Form 508)

(mm/dd/yyyy)

Name Incorporated Under

Date Foreign Corporation Authorized to Transact Business in Michigan

(mm/dd/yyyy)

Type of Action Requested of the Michigan Department of Labor and Economic Growth, Corporation Division

Effective Date

(mm/dd/yyyy)

Dissolution

Withdrawal (From the State of Michigan)

How does your corporation file the Michigan Annual Report?

Profit

Non-Profit

Is corporation undergoing 12-month liquidation?

If yes, date liquidation will be complete

(mm/dd/yyyy)

Yes

No

*Name Changes and Dates:

If this corporation had no tax liability or was not required to register with the Michigan Department of Treasury, provide a detailed explanation. Substantiate with attachments.

Is there a corporation assuming assets or continuing activity of this corporation?

If yes, enter its name

Enter its FEIN

Yes

No

Street Address

City

State

ZIP Code

Certification: I declare under penalty of perjury that I am the owner or authorized representative of the business on which tax clearance is requested

and that the information entered is true. (Submit a Limited Power of Attorney (Form 3840) if not the owner, officer or member.)

Print Name

Title

Telephone Number

Signature

Date

Attach a copy of your final tax returns with proof of payment, if any, and mail to:

Tax Clearance Section

Michigan Department of Treasury

P.O. Box 30199

Lansing, MI 48909

1

1