Form 150-604-002 - Quarterly Return - 2010

ADVERTISEMENT

Reset Form

Print Form

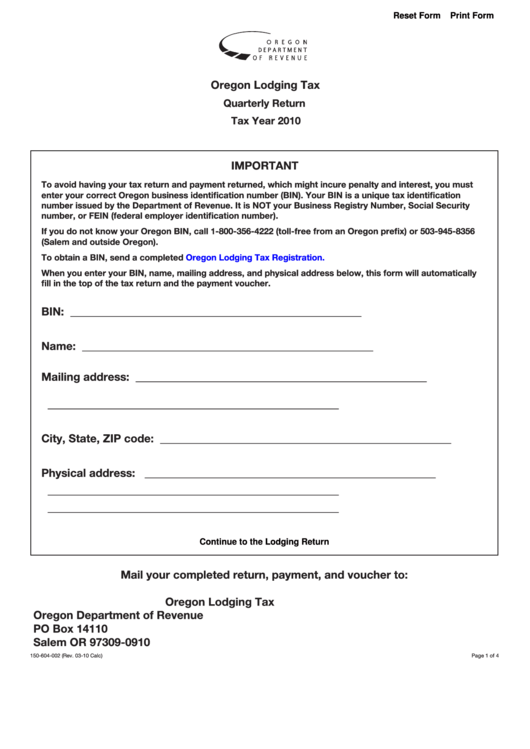

Oregon Lodging Tax

Quarterly Return

Tax Year 2010

IMPORTANT

To avoid having your tax return and payment returned, which might incure penalty and interest, you must

enter your correct Oregon business identification number (BIN). Your BIN is a unique tax identification

number issued by the Department of Revenue. It is NOT your Business Registry Number, Social Security

number, or FEIN (federal employer identification number).

If you do not know your Oregon BIN, call 1-800-356-4222 (toll-free from an Oregon prefix) or 503-945-8356

(Salem and outside Oregon).

To obtain a BIN, send a completed

Oregon Lodging Tax Registration.

When you enter your BIN, name, mailing address, and physical address below, this form will automatically

fill in the top of the tax return and the payment voucher.

BIN:

____________________________________________________

Name:

____________________________________________________

Mailing address:

____________________________________________________

____________________________________________________

City, State, ZIP code:

____________________________________________________

Physical address:

____________________________________________________

____________________________________________________

____________________________________________________

Continue to the Lodging Return

Mail your completed return, payment, and voucher to:

Oregon Lodging Tax

Oregon Department of Revenue

PO Box 14110

Salem OR 97309-0910

150-604-002 (Rev. 03-10 Calc)

Page 1 of 4

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4