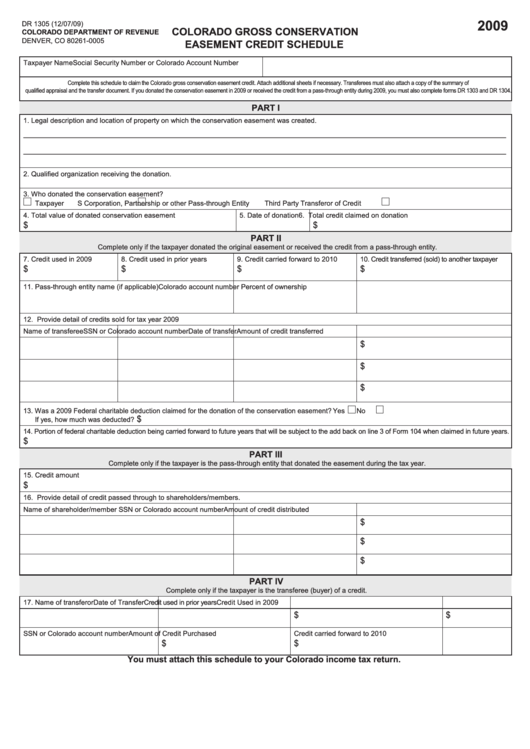

2009

DR 1305 (12/07/09)

COLORADO GROSS CONSERVATION

COLORADO DEPARTMENT OF REVENUE

DENVER, CO 80261-0005

EASEMENT CREDIT SCHEDULE

Taxpayer Name

Social Security Number or Colorado Account Number

Complete this schedule to claim the Colorado gross conservation easement credit. Attach additional sheets if necessary. Transferees must also attach a copy of the summary of

qualified appraisal and the transfer document. If you donated the conservation easement in 2009 or received the credit from a pass-through entity during 2009, you must also complete forms DR 1303 and DR 1304.

PART I

1. Legal description and location of property on which the conservation easement was created.

––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––

––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––

2. Qualified organization receiving the donation.

3. Who donated the conservation easement?

Taxpayer

S Corporation, Partnership or other Pass-through Entity

Third Party Transferor of Credit

4. Total value of donated conservation easement

5. Date of donation

6. Total credit claimed on donation

$

$

PART II

Complete only if the taxpayer donated the original easement or received the credit from a pass-through entity.

7. Credit used in 2009

8. Credit used in prior years

9. Credit carried forward to 2010

10. Credit transferred (sold) to another taxpayer

$

$

$

$

11. Pass-through entity name (if applicable)

Colorado account number

Percent of ownership

12. Provide detail of credits sold for tax year 2009

Name of transferee

SSN or Colorado account number

Date of transfer

Amount of credit transferred

$

$

$

13. Was a 2009 Federal charitable deduction claimed for the donation of the conservation easement? Yes

No

$

If yes, how much was deducted?

14. Portion of federal charitable deduction being carried forward to future years that will be subject to the add back on line 3 of Form 104 when claimed in future years.

$

PART III

Complete only if the taxpayer is the pass-through entity that donated the easement during the tax year.

15. Credit amount

$

16. Provide detail of credit passed through to shareholders/members.

Name of shareholder/member

SSN or Colorado account number

Amount of credit distributed

$

$

$

PART IV

Complete only if the taxpayer is the transferee (buyer) of a credit.

17. Name of transferor

Date of Transfer

Credit used in prior years

Credit Used in 2009

$

$

SSN or Colorado account number

Amount of Credit Purchased

Credit carried forward to 2010

$

$

You must attach this schedule to your Colorado income tax return.

1

1