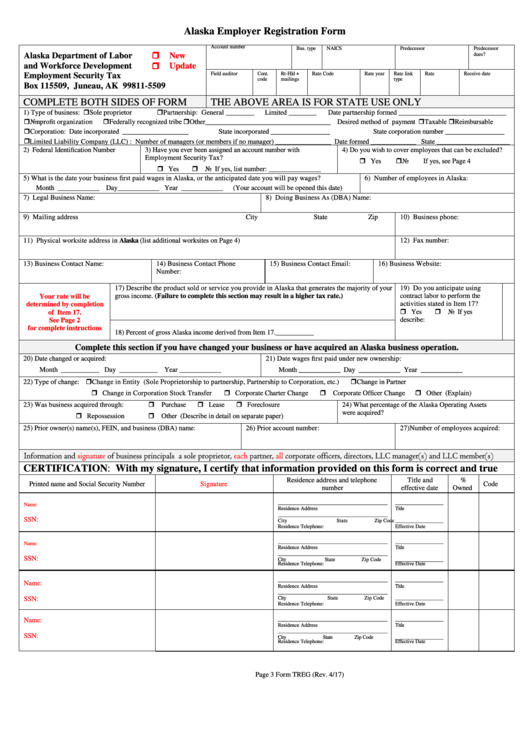

Form Treg - Alaska Employer Registration Form - 2017

ADVERTISEMENT

Alaska Employer Registration Form

Account number

Bus. type

NAICS

Predecessor

Predecessor

New

dues?

Alaska Department of Labor

Update

and Workforce Development

Field auditor

Cont.

Rt-Hld

Rate Code

Rate year

Rate link

Rate

Receive date

Employment Security Tax

&

code

mailings

type

P.O. Box 115509, Juneau, AK 99811-5509

COMPLETE BOTH SIDES OF FORM

THE ABOVE AREA IS FOR STATE USE ONLY

1) Type of business: Sole proprietor

Partnership: General ________

Limited ________

Date partnership formed _______________________________

Nonprofit organization

Federally recognized tribe Other____________________________________ Desired method of payment Taxable Reimbursable

Corporation: Date incorporated ___________________

State incorporated _________________

State corporation number _________________

Limited Liability Company (LLC) : Number of managers (or members if no manager) ________________ Date formed _____________ State _____________________

2) Federal Identification Number

3) Have you ever been assigned an account number with

4) Do you wish to cover employees that can be excluded?

Employment Security Tax?

Yes

No

If yes, see Page 4

Yes

No If yes, list number: _______________

5) What is the date your business first paid wages in Alaska, or the anticipated date you will pay wages?

6) Number of employees in Alaska:

Month ____________ Day ____________ Year ____________

(Your account will be opened this date)

7) Legal Business Name:

8) Doing Business As (DBA) Name:

9) Mailing address

City

State

Zip

10) Business phone:

11) Physical worksite address in Alaska (list additional worksites on Page 4)

12) Fax number:

13) Business Contact Name:

14) Business Contact Phone

15) Business Contact Email:

16) Business Website:

Number:

17) Describe the product sold or service you provide in Alaska that generates the majority of your

19) Do you anticipate using

gross income. (Failure to complete this section may result in a higher tax rate.)

contract labor to perform the

Your rate will be

determined by completion

activities stated in Item 17?

Yes

No If yes

of Item 17.

describe:

See Page 2

for complete instructions

18) Percent of gross Alaska income derived from Item 17. ___________

Complete this section if you have changed your business or have acquired an Alaska business operation.

20) Date changed or acquired:

21) Date wages first paid under new ownership:

Month ___________ Day ___________ Year ____________

Month ____________ Day ____________ Year ____________

22) Type of change: Change in Entity (Sole Proprietorship to partnership, Partnership to Corporation, etc.)

Change in Partner

Change in Corporation Stock Transfer

Corporate Charter Change

Corporate Officer Change

Other (Explain)

Purchase

Lease

Foreclosure

23) Was business acquired through:

24) What percentage of the Alaska Operating Assets

were acquired?

Repossession

Other (Describe in detail on separate paper)

25) Prior owner(s) name(s), FEIN, and business (DBA) name:

26) Prior account number:

27) Number of employees acquired:

Information and

signature

of business principals i.e. a sole proprietor,

each

partner,

all

corporate officers, directors, LLC manager(s) and LLC member(s)

CERTIFICATION: With my signature, I certify that information provided on this form is correct and true

Residence address and telephone

Title and

%

Printed name and Social Security Number

Signature

Code

number

effective date

Owned

_________________________________________

__________________

Name:

Residence Address

Title

_________________________________________

SSN:

City

State

Zip Code

__________________

Residence Telephone:

Effective Date

_________________________________________

__________________

Name:

Residence Address

Title

_________________________________________

SSN:

City

State

Zip Code

__________________

Residence Telephone:

Effective Date

_________________________________________

__________________

Name:

Residence Address

Title

_________________________________________

SSN:

City

State

Zip Code

__________________

Residence Telephone:

Effective Date

_________________________________________

__________________

Name:

Residence Address

Title

_________________________________________

SSN:

City

State

Zip Code

__________________

Residence Telephone:

Effective Date

Page 3

Form TREG (Rev. 4/17)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1 2

2