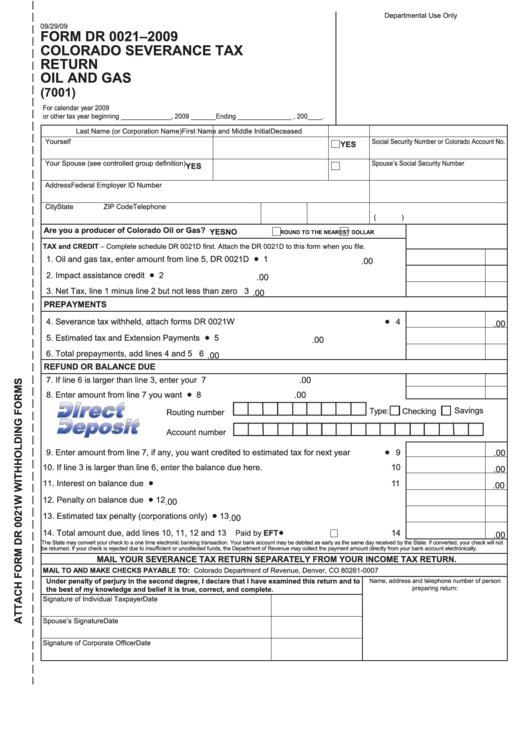

Form Dr 0021 - Colorado Severance Tax Return Oil And Gas (7001) - 2009

ADVERTISEMENT

Departmental Use Only

09/29/09

Form Dr 0021–2009

Vendor iD

coloraDo sEVErancE taX

rEturn

oil anD gas

(7001)

For calendar year 2009

or other tax year beginning ______________, 2009 _______Ending _______________ , 200____.

Last Name (or Corporation Name)

First Name and Middle Initial

Deceased

Yourself

Social Security Number or Colorado Account No.

YEs

Your Spouse (see controlled group definition)

Spouse’s Social Security Number

YEs

Address

Federal Employer ID Number

City

State

ZIP Code

Telephone

(

)

are you a producer of colorado oil or gas?

YEs

no

rounD to thE nEarEst Dollar

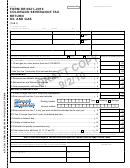

taX and crEDit – Complete schedule DR 0021D first. Attach the DR 0021D to this form when you file.

•

1. Oil and gas tax, enter amount from line 5, DR 0021D .............................................................

1

.00

•

2. Impact assistance credit ..........................................................................................................

2

.00

3. Net Tax, line 1 minus line 2 but not less than zero .................................................................... 3

.00

PrEPaYmEnts

•

4. Severance tax withheld, attach forms DR 0021W .........................................................................

4

.00

•

5. Estimated tax and Extension Payments ..................................................................................

5

.00

6. Total prepayments, add lines 4 and 5 ........................................................................................ 6

.00

rEFunD or BalancE DuE

7. If line 6 is larger than line 3, enter your overpayment................................................................ 7

.00

•

8. Enter amount from line 7 you want refunded...........................................................................

8

.00

Savings

Type:

Checking

Routing number

Account number

•

..................

9. Enter amount from line 7, if any, you want credited to estimated tax for next year

9

.00

............................................................ 10

10. If line 3 is larger than line 6, enter the balance due here.

.00

•

11. Interest on balance due ..........................................................................................................

11

.00

•

12. Penalty on balance due ..........................................................................................................

12

.00

•

13. Estimated tax penalty (corporations only) ..............................................................................

13

.00

•

14. Total amount due, add lines 10, 11, 12 and 13 ...............................................

14

Paid by EFt

.00

The State may convert your check to a one time electronic banking transaction. Your bank account may be debited as early as the same day received by the State. If converted, your check will not

be returned. If your check is rejected due to insufficient or uncollected funds, the Department of Revenue may collect the payment amount directly from your bank account electronically.

mail Your sEVErancE taX rEturn sEParatElY From Your incomE taX rEturn.

mail to anD maKE chEcKs PaYaBlE to: Colorado Department of Revenue, Denver, CO 80261-0007

under penalty of perjury in the second degree, i declare that i have examined this return and to

Name, address and telephone number of person

preparing return:

the best of my knowledge and belief it is true, correct, and complete.

Signature of Individual Taxpayer

Date

Spouse’s Signature

Date

Signature of Corporate Officer

Date

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1