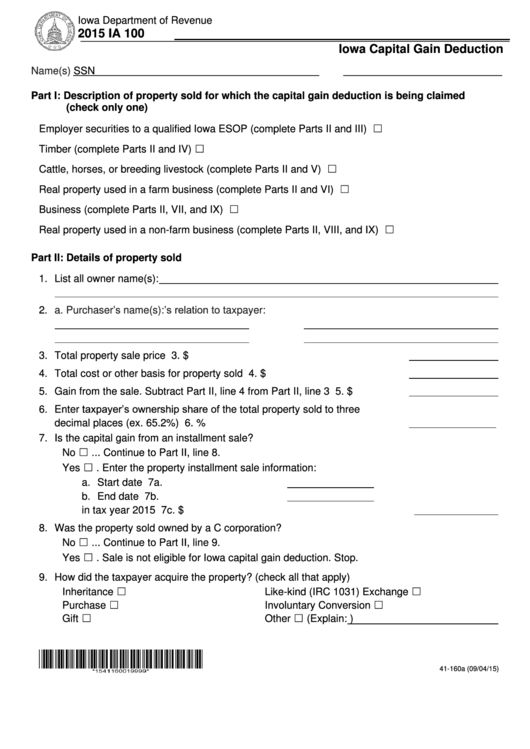

Iowa Department of Revenue

2015 IA 100

https://tax.iowa.gov

Iowa Capital Gain Deduction

Name(s)

SSN

Part I: Description of property sold for which the capital gain deduction is being claimed

(check only one)

Employer securities to a qualified Iowa ESOP (complete Parts II and III) ............ ☐

Timber (complete Parts II and IV)......................................................................... ☐

Cattle, horses, or breeding livestock (complete Parts II and V) ............................ ☐

Real property used in a farm business (complete Parts II and VI) ....................... ☐

Business (complete Parts II, VII, and IX) .............................................................. ☐

Real property used in a non-farm business (complete Parts II, VIII, and IX) ........ ☐

Part II: Details of property sold

1. List all owner name(s):

b. Purchaser’s relation to taxpayer:

2.

a. Purchaser’s name(s):

3. Total property sale price .............................................................................. 3. $

4. Total cost or other basis for property sold .................................................... 4. $

5. Gain from the sale. Subtract Part II, line 4 from Part II, line 3 ...................... 5. $

6. Enter taxpayer’s ownership share of the total property sold to three

decimal places (ex. 65.2%) .......................................................................... 6.

%

7. Is the capital gain from an installment sale?

No ☐ ... Continue to Part II, line 8.

Yes ☐ . Enter the property installment sale information:

a. Start date ............................................ 7a.

b. End date ............................................. 7b.

c. Principal received by the taxpayer in tax year 2015 ...................... 7c. $

8. Was the property sold owned by a C corporation?

No ☐ ... Continue to Part II, line 9.

Yes ☐ . Sale is not eligible for Iowa capital gain deduction. Stop.

9. How did the taxpayer acquire the property? (check all that apply)

Inheritance ☐

Like-kind (IRC 1031) Exchange ☐

Purchase ☐

Involuntary Conversion ☐

Gift ☐

Other ☐ (Explain:

)

41-160a (09/04/15)

1

1 2

2 3

3 4

4 5

5 6

6