Application Form For A Certificate Of Competency - The Association Of Taxation Technicians

ADVERTISEMENT

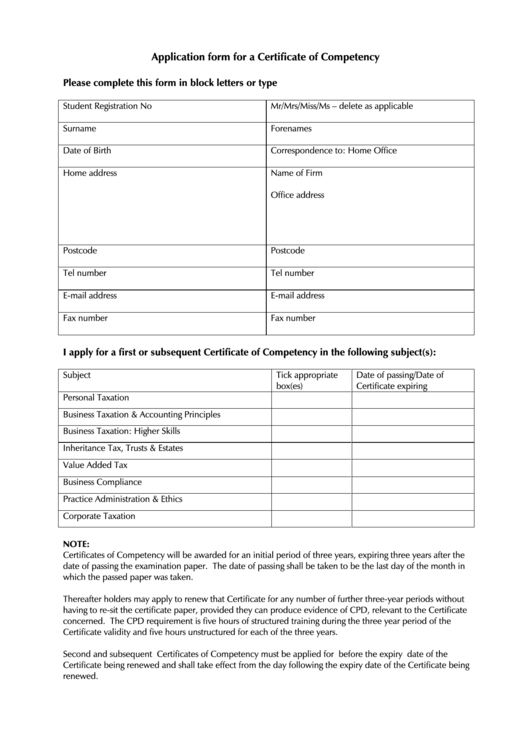

Application form for a Certificate of Competency

Please complete this form in block letters or type

Student Registration No

Mr/Mrs/Miss/Ms – delete as applicable

Surname

Forenames

Date of Birth

Correspondence to:

Home

Office

Home address

Name of Firm

Office address

Postcode

Postcode

Tel number

Tel number

E-mail address

E-mail address

Fax number

Fax number

I apply for a first or subsequent Certificate of Competency in the following subject(s):

Subject

Tick appropriate

Date of passing/Date of

box(es)

Certificate expiring

Personal Taxation

Business Taxation & Accounting Principles

Business Taxation: Higher Skills

Inheritance Tax, Trusts & Estates

Value Added Tax

Business Compliance

Practice Administration & Ethics

Corporate Taxation

NOTE:

Certificates of Competency will be awarded for an initial period of three years, expiring three years after the

date of passing the examination paper. The date of passing shall be taken to be the last day of the month in

which the passed paper was taken.

Thereafter holders may apply to renew that Certificate for any number of further three-year periods without

having to re-sit the certificate paper, provided they can produce evidence of CPD, relevant to the Certificate

concerned. The CPD requirement is five hours of structured training during the three year period of the

Certificate validity and five hours unstructured for each of the three years.

Second and subsequent Certificates of Competency must be applied for before the expiry date of the

Certificate being renewed and shall take effect from the day following the expiry date of the Certificate being

renewed.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1 2

2