Form Peo-1 - Certificate Of Employee Leasing Company

ADVERTISEMENT

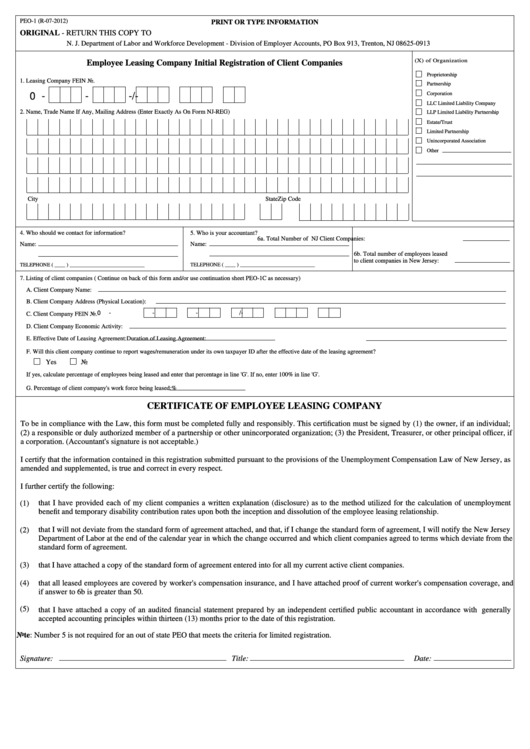

PEO-1 (R-07-2012)

PRINT OR TYPE INFORMATION

ORIGINAL - RETURN THIS COPY TO

N. J. Department of Labor and Workforce Development - Division of Employer Accounts, PO Box 913, Trenton, NJ 08625-0913

3.Check form (X) of Organization

Employee Leasing Company Initial Registration of Client Companies

Proprietorship

1. Leasing Company FEIN No.

Partnership

Corporation

0 -

-

-

/

-

LLC Limited Liability Company

2. Name, Trade Name If Any, Mailing Address (Enter Exactly As On Form NJ-REG)

LLP Limited Liability Partnership

Estate/Trust

Limited Partnership

Unincorporated Association

Other

City

State

Zip Code

4. Who should we contact for information?

5. Who is your accountant?

6a. Total Number of NJ Client Companies:

Name:

Name:

6b. Total number of employees leased

to client companies in New Jersey:

TELEPHONE ( ____ ) ____________________________

TELEPHONE ( ____ ) ____________________________

7. Listing of client companies ( Continue on back of this form and/or use continuation sheet PEO-1C as necessary)

A. Client Company Name:

B. Client Company Address (Physical Location):

0

-

-

-

/

-

C. Client Company FEIN No.

D. Client Company Economic Activity:

E. Effective Date of Leasing Agreement:

Duration of Leasing Agreement:

F. Will this client company continue to report wages/remuneration under its own taxpayer ID after the effective date of the leasing agreement?

Yes

No

If yes, calculate percentage of employees being leased and enter that percentage in line 'G'. If no, enter 100% in line 'G'.

G. Percentage of client company's work force being leased:

%

CERTIFICATE OF EMPLOYEE LEASING COMPANY

To be in compliance with the Law, this form must be completed fully and responsibly. This certification must be signed by (1) the owner, if an individual;

(2) a responsible or duly authorized member of a partnership or other unincorporated organization; (3) the President, Treasurer, or other principal officer, if

a corporation. (Accountant's signature is not acceptable.)

I certify that the information contained in this registration submitted pursuant to the provisions of the Unemployment Compensation Law of New Jersey, as

amended and supplemented, is true and correct in every respect.

I further certify the following:

that I have provided each of my client companies a written explanation (disclosure) as to the method utilized for the calculation of unemployment

(1)

benefit and temporary disability contribution rates upon both the inception and dissolution of the employee leasing relationship.

that I will not deviate from the standard form of agreement attached, and that, if I change the standard form of agreement, I will notify the New Jersey

(2)

Department of Labor at the end of the calendar year in which the change occurred and which client companies agreed to terms which deviate from the

standard form of agreement.

(3)

that I have attached a copy of the standard form of agreement entered into for all my current active client companies.

(4)

that all leased employees are covered by worker's compensation insurance, and I have attached proof of current worker's compensation coverage, and

if answer to 6b is greater than 50.

(5)

that I have attached a copy of an audited financial statement prepared by an independent certified public accountant in accordance with generally

accepted accounting principles within thirteen (13) months prior to the date of this registration.

Note: Number 5 is not required for an out of state PEO that meets the criteria for limited registration.

Signature:

Title:

Date:

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1 2

2