Form Pf - Reporting Form For Investment Advisers To Private Funds And Certain Commodity Pool Operators And Commodity Trading Advisors

ADVERTISEMENT

OMB APPROVAL

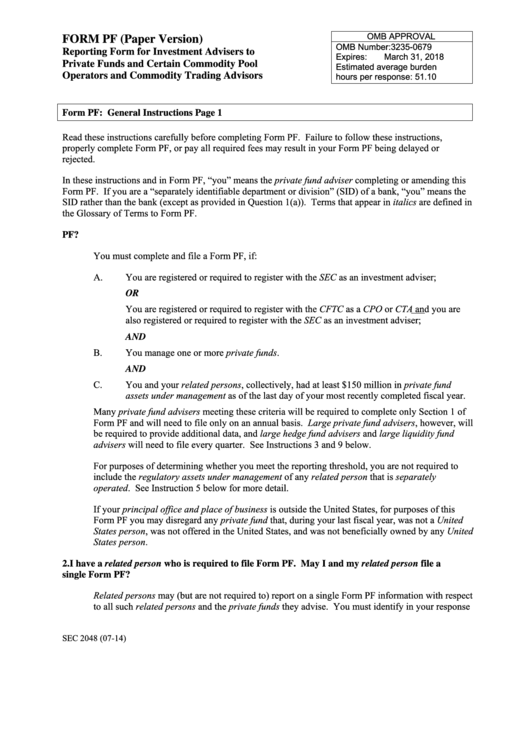

FORM PF (Paper Version)

OMB Number:

3235-0679

Reporting Form for Investment Advisers to

Expires:

March 31, 2018

Private Funds and Certain Commodity Pool

Estimated average burden

hours per response:

51.10

Operators and Commodity Trading Advisors

Form PF: General Instructions

Page 1

Read these instructions carefully before completing Form PF. Failure to follow these instructions,

properly complete Form PF, or pay all required fees may result in your Form PF being delayed or

rejected.

In these instructions and in Form PF, “you” means the private fund adviser completing or amending this

Form PF. If you are a “separately identifiable department or division” (SID) of a bank, “you” means the

SID rather than the bank (except as provided in Question 1(a)). Terms that appear in italics are defined in

the Glossary of Terms to Form PF.

1.

Who must complete and file a Form PF?

You must complete and file a Form PF, if:

You are registered or required to register with the SEC as an investment adviser;

A.

OR

You are registered or required to register with the CFTC as a CPO or CTA and you are

also registered or required to register with the SEC as an investment adviser;

AND

B.

You manage one or more private funds.

AND

C.

You and your related persons, collectively, had at least $150 million in private fund

assets under management as of the last day of your most recently completed fiscal year.

Many private fund advisers meeting these criteria will be required to complete only Section 1 of

Form PF and will need to file only on an annual basis. Large private fund advisers, however, will

be required to provide additional data, and large hedge fund advisers and large liquidity fund

advisers will need to file every quarter. See Instructions 3 and 9 below.

For purposes of determining whether you meet the reporting threshold, you are not required to

include the regulatory assets under management of any related person that is separately

operated. See Instruction 5 below for more detail.

If your principal office and place of business is outside the United States, for purposes of this

Form PF you may disregard any private fund that, during your last fiscal year, was not a United

States person, was not offered in the United States, and was not beneficially owned by any United

States person.

2.

I have a related person who is required to file Form PF. May I and my related person file a

single Form PF?

Related persons may (but are not required to) report on a single Form PF information with respect

to all such related persons and the private funds they advise. You must identify in your response

SEC 2048 (07-14)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13 14

14 15

15 16

16 17

17 18

18 19

19 20

20 21

21 22

22 23

23 24

24 25

25 26

26 27

27 28

28 29

29 30

30 31

31 32

32 33

33 34

34 35

35 36

36 37

37 38

38 39

39 40

40 41

41 42

42 43

43 44

44 45

45 46

46 47

47 48

48 49

49 50

50 51

51 52

52 53

53 54

54 55

55 56

56 57

57 58

58 59

59 60

60 61

61 62

62 63

63 64

64