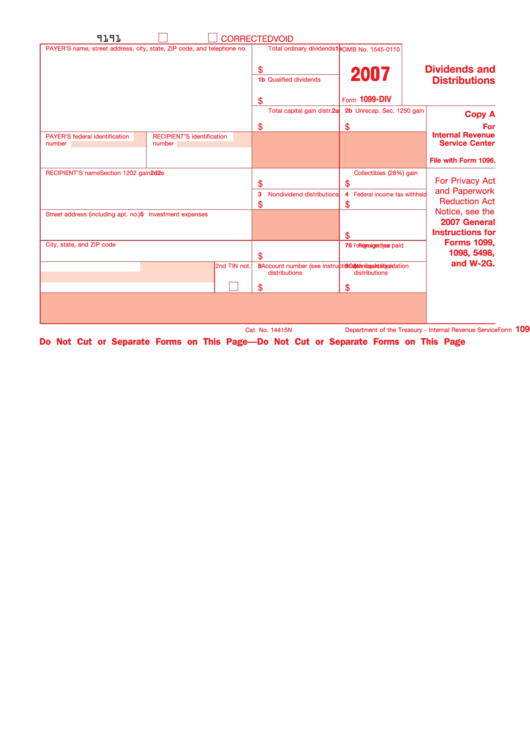

Form 1099-Div - Dividends And Distributions - 2007

ADVERTISEMENT

9191

VOID

CORRECTED

1a

Total ordinary dividends

PAYER’S name, street address, city, state, ZIP code, and telephone no.

OMB No. 1545-0110

Dividends and

$

2007

Distributions

1b Qualified dividends

1099-DIV

$

Form

2a

Total capital gain distr.

2b

Unrecap. Sec. 1250 gain

Copy A

$

$

For

Internal Revenue

PAYER’S federal identification

RECIPIENT’S identification

Service Center

number

number

File with Form 1096.

RECIPIENT’S name

2c

Section 1202 gain

2d

Collectibles (28%) gain

For Privacy Act

$

$

and Paperwork

3

Nondividend distributions

4 Federal income tax withheld

Reduction Act

$

$

Notice, see the

Street address (including apt. no.)

5 Investment expenses

2007 General

Instructions for

$

Forms 1099,

City, state, and ZIP code

6

Foreign tax paid

7

Foreign country or U.S. possession

1098, 5498,

$

and W-2G.

Account number (see instructions)

2nd TIN not.

8

Cash liquidation

9

Noncash liquidation

distributions

distributions

$

$

1099-DIV

Form

Cat. No. 14415N

Department of the Treasury - Internal Revenue Service

Do Not Cut or Separate Forms on This Page

—

Do Not Cut or Separate Forms on This Page

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3