__ __ __ . __ __ %

__ __ __ . __ __ %

__ __ __ . __ __ %

__ __ __ . __ __ %

__ __ __ . __ __ %

__ __ __ . __ __ %

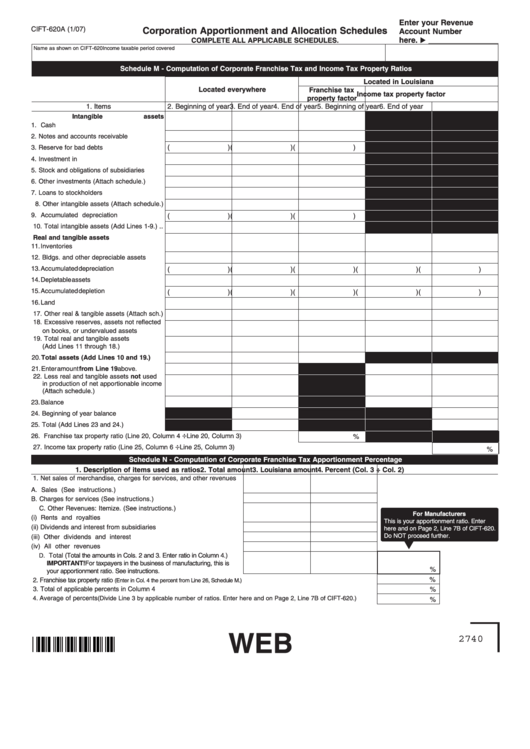

Enter your Revenue

CIFT-620A (1/07)

Corporation Apportionment and Allocation Schedules

Account Number

u

here.

________________

COMPLETE ALL APPLICABLE SCHEDULES.

Name as shown on CIFT-620

Income taxable period covered

Schedule M - Computation of Corporate Franchise Tax and Income Tax Property Ratios

Located in Louisiana

Located everywhere

Franchise tax

Income tax property factor

property factor

1. Items

2. Beginning of year

3. End of year

4. End of year

5. Beginning of year

6. End of year

Intangible assets

1. Cash .........................................................

2. Notes and accounts receivable ................

(

) (

) (

)

3. Reserve for bad debts ..............................

4. Investment in U.S. govt. obligations.........

5. Stock and obligations of subsidiaries .......

6. Other investments (Attach schedule.) ......

7. Loans to stockholders ..............................

8. Other intangible assets (Attach schedule.)

9. Accumulated depreciation ........................

(

) (

) (

)

10. Total intangible assets (Add Lines 1-9.) ..

Real and tangible assets

11. Inventories ................................................

12. Bldgs. and other depreciable assets ........

13. Accumulated depreciation ........................

(

) (

) (

) (

) (

)

14. Depletable assets .....................................

15. Accumulated depletion .............................

(

) (

) (

) (

) (

)

16. Land .........................................................

17. Other real & tangible assets (Attach sch.)

18. Excessive reserves, assets not reflected

on books, or undervalued assets .............

19. Total real and tangible assets

(Add Lines 11 through 18.) ......................

20. Total assets (Add Lines 10 and 19.) .....

21. Enter amount from Line 19 above. .........

22. Less real and tangible assets not used

in production of net apportionable income

(Attach schedule.) ....................................

23. Balance ....................................................

24. Beginning of year balance .........................

25. Total (Add Lines 23 and 24.) .....................

÷

26. Franchise tax property ratio (Line 20, Column 4

Line 20, Column 3) ............................

÷

27. Income tax property ratio (Line 25, Column 6

Line 25, Column 3) ..........................................................................................................

Schedule N - Computation of Corporate Franchise Tax Apportionment Percentage

1. Description of items used as ratios

2. Total amount

3. Louisiana amount 4. Percent (Col. 3 ÷ Col. 2)

1. Net sales of merchandise, charges for services, and other revenues

A. Sales (See instructions.) ....................................................................

B. Charges for services (See instructions.)............................................

C. Other Revenues: Itemize. (See instructions.)

For Manufacturers

(i) Rents and royalties .....................................................................

This is your apportionment ratio. Enter

(ii) Dividends and interest from subsidiaries ....................................

here and on Page 2, Line 7B of CIFT-620.

Do NOT proceed further.

(iii) Other dividends and interest .......................................................

▼

(iv) All other revenues .......................................................................

Total (Total the amounts in Cols. 2 and 3. Enter ratio in Column 4.)

D.

IMPORTANT! For taxpayers in the business of manufacturing, this is

your apportionment ratio. See instructions.

...............................................

2. Franchise tax property ratio

(Enter in Col. 4 the percent from Line 26, Schedule M.) .....................................................................................

3. Total of applicable percents in Column 4 ...........................................................................................................................

Average of percents

4.

(Divide Line 3 by applicable number of ratios. Enter here and on Page 2, Line 7B of CIFT-620.) .........

WEB

2740

1

1 2

2