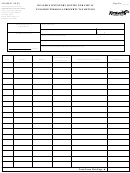

Form 62a500 - L - Lessee Tangible Personal Property Tax Return

ADVERTISEMENT

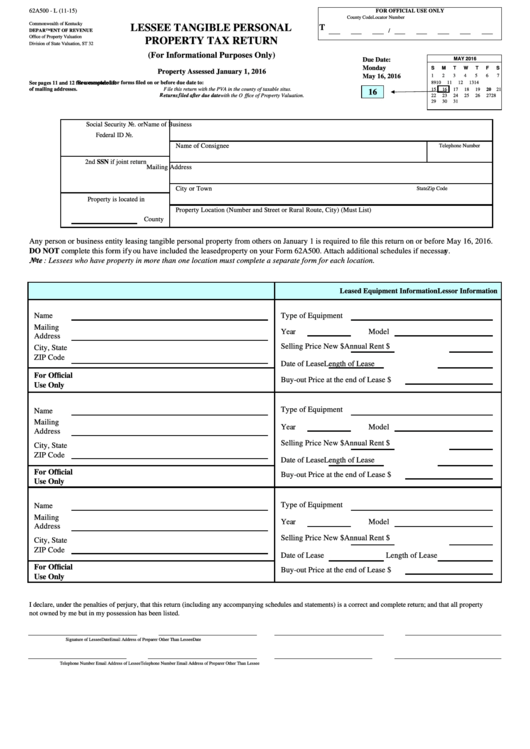

62A500 - L (11-15)

FOR OFFICIAL USE ONLY

County Code

Locator Number

Commonwealth of Kentucky

LESSEE TANGIBLE PERSONAL

T

DEPARTMENT OF REVENUE

/

Office of Property Valuation

PROPERTY TAX RETURN

Division of State Valuation, ST 32

(For Informational Purposes Only)

Due Date:

MAY 2016

Monday

S

M

T

W

T

F

S

Property Assessed January 1, 2016

May 16, 2016

1

2

3

4

5

6

7

Recommended for forms filed on or before due date to:

See pages 11 and 12 for a complete list

8

9

10

11

12

13

14

of mailing addresses.

File this return with the PVA in the county of taxable situs.

15

16

17

18

19

20

21

16

Returns filed after due date with the Office of Property Valuation.

22

23

24

25

26

27

28

29

30

31

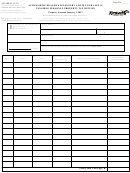

Social Security No. or

Name of Business

Federal ID No.

Name of Consignee

Telephone Number

2nd SSN if joint return

Mailing Address

City or Town

State

Zip Code

Property is located in

Property Location (Number and Street or Rural Route, City) (Must List)

County

Any person or business entity leasing tangible personal property from others on January 1 is required to file this return on or before May 16, 2016.

DO NOT complete this form if you have included the leased property on your Form 62A500. Attach additional schedules if necessary.

Note : Lessees who have property in more than one location must complete a separate form for each location.

Lessor Information

Leased Equipment Information

Name

Type of Equipment

Mailing

Year

Model

Address

Selling Price New $

Annual Rent $

City, State

ZIP Code

Date of Lease

Length of Lease

For Official

Buy-out Price at the end of Lease $

Use Only

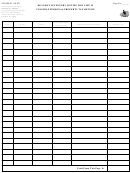

Type of Equipment

Name

Mailing

Year

Model

Address

Selling Price New $

Annual Rent $

City, State

ZIP Code

Date of Lease

Length of Lease

For Official

Buy-out Price at the end of Lease $

Use Only

Type of Equipment

Name

Mailing

Year

Model

Address

Selling Price New $

Annual Rent $

City, State

ZIP Code

Date of Lease

Length of Lease

For Official

Buy-out Price at the end of Lease $

Use Only

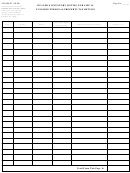

I declare, under the penalties of perjury, that this return (including any accompanying schedules and statements) is a correct and complete return; and that all property

not owned by me but in my possession has been listed.

Signature of Lessee

Date

Email Address of Preparer Other Than Lessee

Date

Telephone Number

Email Address of Lessee

Telephone Number

Email Address of Preparer Other Than Lessee

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1