Form Mo-Atc - Adoption Tax Credit Claim - 2011

ADVERTISEMENT

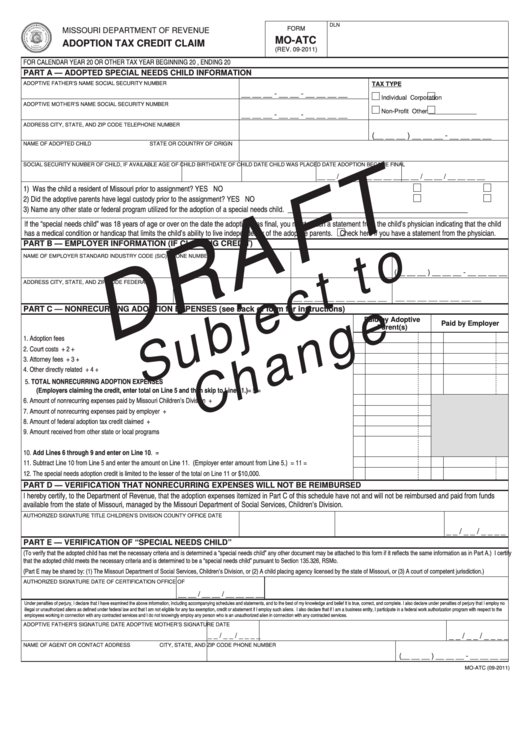

DLN

FORM

MISSOURI DEPARTMENT OF REVENUE

MO-ATC

ADOPTION TAX CREDIT CLAIM

(REV. 09-2011)

FOR CALENDAR YEAR 20

OR OTHER TAX YEAR BEGINNING

20

, ENDING

20

PART A — ADOPTED SPECIAL NEEDS CHILD INFORMATION

ADOPTIVE FATHER’S NAME

SOCIAL SECURITY NUMBER

TAX TYPE

__ __ __ - __ __ - __ __ __ __

Individual

Corporation

ADOPTIVE MOTHER’S NAME

SOCIAL SECURITY NUMBER

Non-Profit

Other ______________

__ __ __ - __ __ - __ __ __ __

ADDRESS

CITY, STATE, AND ZIP CODE

TELEPHONE NUMBER

(__ __ __ ) __ __ __ - __ __ __ __

NAME OF ADOPTED CHILD

STATE OR COUNTRY OF ORIGIN

SOCIAL SECURITY NUMBER OF CHILD, IF AVAILABLE

AGE OF CHILD

BIRTHDATE OF CHILD

DATE CHILD WAS PLACED

DATE ADOPTION BECAME FINAL

__ __ / __ __ / __ __ __ __ __ __ / __ __ / __ __ __ __

1) Was the child a resident of Missouri prior to assignment?

YES

NO

2) Did the adoptive parents have legal custody prior to the assignment?

YES

NO

3) Name any other state or federal program utilized for the adoption of a special needs child. ___________________________________________________

If the “special needs child” was 18 years of age or over on the date the adoption was final, you must attach a statement from the child’s physician indicating that the child

has a medical condition or handicap that limits the child’s ability to live independently of the adoptive parents.

Check here if you have a statement from the physician.

PART B — EMPLOYER INFORMATION (IF CLAIMING CREDIT)

NAME OF EMPLOYER

STANDARD INDUSTRY CODE (SIC)

PHONE NUMBER

(__ __ __ ) __ __ __ - __ __ __ __

ADDRESS

CITY, STATE, AND ZIP CODE

FEDERAL I.D. NUMBER

MO TAX I.D. NUMBER

__ __ __ __ __ __ __ __ __

__ __ __ __ __ __ __ __

PART C — NONRECURRING ADOPTION EXPENSES (see back of form for instructions)

Paid by Adoptive

Paid by Employer

Parent(s)

1. Adoption fees ...............................................................................................................................................................................

1

1

2. Court costs ...................................................................................................................................................................................

2

+

2 +

3. Attorney fees ................................................................................................................................................................................

3

+

3 +

4. Other directly related expenses....................................................................................................................................................

4

+

4 +

5. TOTAL NONRECURRING ADOPTION EXPENSES

(Employers claiming the credit, enter total on Line 5 and then skip to Line 11.) .................................................................

5

=

5 =

6. Amount of nonrecurring expenses paid by Missouri Children’s Division ......................................................................................

6

+

7. Amount of nonrecurring expenses paid by employer ...................................................................................................................

7

+

8. Amount of federal adoption tax credit claimed .............................................................................................................................

8

+

9. Amount received from other state or local programs ...................................................................................................................

9

10. Add Lines 6 through 9 and enter on Line 10. .......................................................................................................................... 10 =

11. Subtract Line 10 from Line 5 and enter the amount on Line 11. (Employer enter amount from Line 5.) .................................... 11 =

11 =

12. The special needs adoption credit is limited to the lesser of the total on Line 11 or $10,000. ..................................................... 12

12

PART D — VERIFICATION THAT NONRECURRING EXPENSES WILL NOT BE REIMBURSED

I hereby certify, to the Department of Revenue, that the adoption expenses itemized in Part C of this schedule have not and will not be reimbursed and paid from funds

available from the state of Missouri, managed by the Missouri Department of Social Services, Children’s Division.

AUTHORIZED SIGNATURE

TITLE

CHILDREN’S DIVISION COUNTY OFFICE

DATE

_ _ / _ _ / _ _ _ _

PART E — VERIFICATION OF “SPECIAL NEEDS CHILD”

(To verify that the adopted child has met the necessary criteria and is determined a “special needs child” any other document may be attached to this form if it reflects the same information as in Part A.) I certify

that the adopted child meets the necessary criteria and is determined to be a “special needs child” pursuant to Section 135.326, RSMo.

(Part E may be shared by: (1) The Missouri Department of Social Services, Children’s Division, or (2) A child placing agency licensed by the state of Missouri, or (3) A court of competent jurisdiction.)

AUTHORIZED SIGNATURE

DATE OF CERTIFICATION

OFFICE OF

__ __ / __ __ / __ __ __ __

Under penalties of perjury, I declare that I have examined the above information, including accompanying schedules and statements, and to the best of my knowledge and belief it is true, correct, and complete. I also declare under penalties of perjury that I employ no

illegal or unauthorized aliens as defined under federal law and that I am not eligible for any tax exemption, credit or abatement if I employ such aliens. I also declare that if I am a business entity, I participate in a federal work authorization program with respect to the

employees working in connection with any contracted services and I do not knowingly employ any person who is an unauthorized alien in connection with any contracted services.

ADOPTIVE FATHER’S SIGNATURE

DATE

ADOPTIVE MOTHER’S SIGNATURE

DATE

_ _ / _ _ / _ _ _ _

_ _ / _ _ / _ _ _ _

NAME OF AGENT OR CONTACT

ADDRESS

CITY, STATE, AND ZIP CODE

PHONE NUMBER

(__ __ __ ) __ __ __ - __ __ __ __

MO-ATC (09-2011)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2