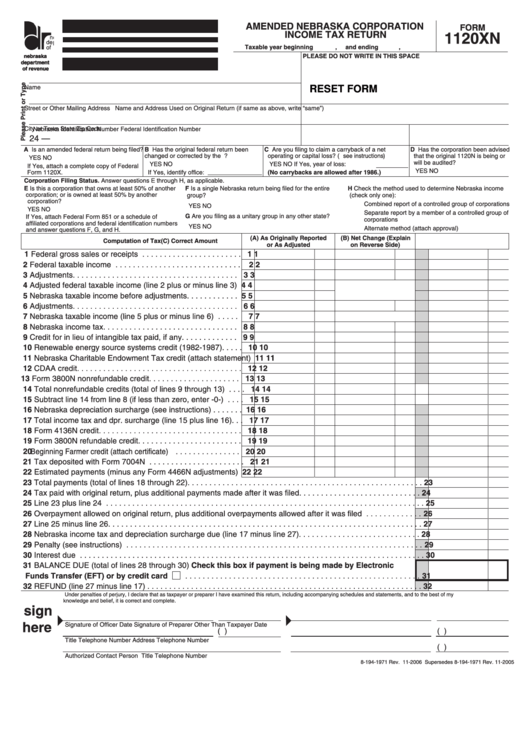

AMENDED NEBRASKA CORPORATION

FORM

INCOME TAX RETURN

1120XN

n e

de p

Taxable year beginning

,

and ending

,

of

PLEASE DO NOT WRITE IN THIS SPACE

nebraska

nebraska

department

department

of revenue

of revenue

Name

RESET FORM

Street or Other Mailing Address

Name and Address Used on Original Return (if same as above, write “same”)

City or Town

State

Zip Code

Nebraska Identification Number

Federal Identification Number

24 —

A Is an amended federal return being filed?

B Has the original federal return been

C Are you filing to claim a carryback of a net

D Has the corporation been advised

changed or corrected by the I.R.S.?

operating or capital loss? (see instructions)

that the original 1120N is being or

YES

NO

will be audited?

YES

NO

YES

NO If Yes, year of loss:

If Yes, attach a complete copy of Federal

YES

NO

Form 1120X.

If Yes, identify office:

(No carrybacks are allowed after 1986.)

Corporation Filing Status. Answer questions E through H, as applicable.

E Is this a corporation that owns at least 50% of another

H Check the method used to determine Nebraska income

F Is a single Nebraska return being filed for the entire

corporation; or is owned at least 50% by another

group?

(check only one):

corporation?

Combined report of a controlled group of corporations

YES

NO

YES

NO

Separate report by a member of a controlled group of

G Are you filing as a unitary group in any other state?

If Yes, attach Federal Form 851 or a schedule of

corporations

affiliated corporations and federal identification numbers

YES

NO

Alternate method (attach approval)

and answer questions F, G, and H.

(A) As Originally Reported

(B) Net Change (Explain

Computation of Tax

(C) Correct Amount

or As Adjusted

on Reverse Side)

1 Federal gross sales or receipts . . . . . . . . . . . . . . . . . . . . . . .

1

1

2 Federal taxable income . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

2

2

3 Adjustments . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

3

3

4 Adjusted federal taxable income (line 2 plus or minus line 3)

4

4

5 Nebraska taxable income before adjustments. . . . . . . . . . . .

5

5

6 Adjustments . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

6

6

7 Nebraska taxable income (line 5 plus or minus line 6) . . . . .

7

7

8 Nebraska income tax . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

8

8

9 Credit for in lieu of intangible tax paid, if any . . . . . . . . . . . . .

9

9

10 Renewable energy source systems credit (1982-1987). . . . . 10

10

11 Nebraska Charitable Endowment Tax credit (attach statement) 11

11

12 CDAA credit . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 12

12

13 Form 3800N nonrefundable credit . . . . . . . . . . . . . . . . . . . . . 13

13

14 Total nonrefundable credits (total of lines 9 through 13) . . . . 14

14

15 Subtract line 14 from line 8 (if less than zero, enter -0-) . . . . 15

15

16 Nebraska depreciation surcharge (see instructions) . . . . . . . 16

16

17 Total income tax and dpr. surcharge (line 15 plus line 16). . . 17

17

18 Form 4136N credit . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 18

18

19 Form 3800N refundable credit . . . . . . . . . . . . . . . . . . . . . . . . 19

19

20 Beginning Farmer credit (attach certificate) . . . . . . . . . . . . . . . 20

20

21 Tax deposited with Form 7004N . . . . . . . . . . . . . . . . . . . . . . 21

21

22 Estimated payments (minus any Form 4466N adjustments)

22

22

23 Total payments (total of lines 18 through 22) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 23

24 Tax paid with original return, plus additional payments made after it was filed . . . . . . . . . . . . . . . . . . . . . . . . . . . . 24

25 Line 23 plus line 24 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 25

26 Overpayment allowed on original return, plus additional overpayments allowed after it was filed . . . . . . . . . . . . . 26

27 Line 25 minus line 26. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 27

28 Nebraska income tax and depreciation surcharge due (line 17 minus line 27) . . . . . . . . . . . . . . . . . . . . . . . . . . . . 28

29 Penalty (see instructions) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 29

30 Interest due . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 30

31 BALANCE DUE (total of lines 28 through 30) Check this box if payment is being made by Electronic

Funds Transfer (EFT) or by credit card

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 31

32 REFUND (line 27 minus line 17) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 32

Under penalties of perjury, I declare that as taxpayer or preparer I have examined this return, including accompanying schedules and statements, and to the best of my

knowledge and belief, it is correct and complete.

sign

here

Signature of Officer

Date

Signature of Preparer Other Than Taxpayer

Date

(

)

(

)

Title

Telephone Number

Address

Telephone Number

(

)

Authorized Contact Person

Title

Telephone Number

8-194-1971 Rev. 11-2006 Supersedes 8-194-1971 Rev. 11-2005

1

1 2

2