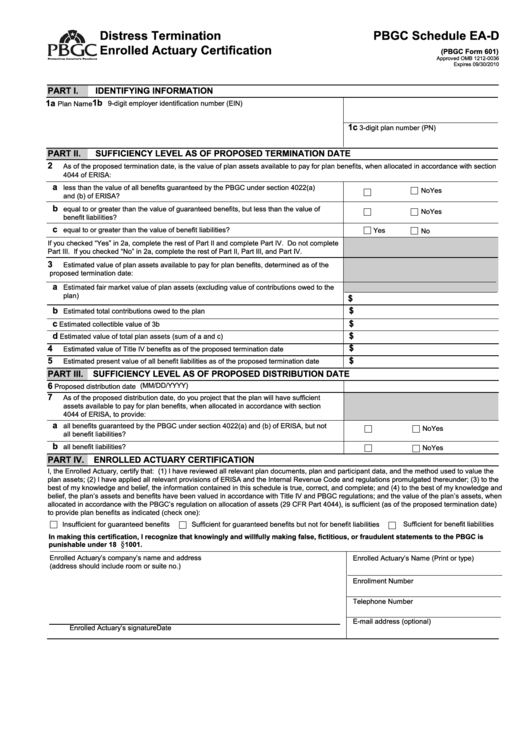

Pbgc Schedule Ea-D (Pbgc Form 601) - Distress Termination Enrolled Actuary Certification

ADVERTISEMENT

Distress Termination

PBGC Schedule EA-D

Enrolled Actuary Certification

(PBGC Form 601)

Approved OMB 1212-0036

Expires 09/30/2010

PART I.

IDENTIFYING INFORMATION

1b

1a

9-digit employer identification number (EIN)

Plan Name

1c

3-digit plan number (PN)

PART II.

SUFFICIENCY LEVEL AS OF PROPOSED TERMINATION DATE

2

As of the proposed termination date, is the value of plan assets available to pay for plan benefits, when allocated in accordance with section

4044 of ERISA:

a

less than the value of all benefits guaranteed by the PBGC under section 4022(a)

Yes

No

and (b) of ERISA?

b

equal to or greater than the value of guaranteed benefits, but less than the value of

Yes

No

benefit liabilities?

c

equal to or greater than the value of benefit liabilities?

Yes

No

If you checked “Yes” in 2a, complete the rest of Part II and complete Part IV. Do not complete

Part III. If you checked “No” in 2a, complete the rest of Part II, Part III, and Part IV.

3

Estimated value of plan assets available to pay for plan benefits, determined as of the

proposed termination date:

a

Estimated fair market value of plan assets (excluding value of contributions owed to the

plan)

$

b

$

Estimated total contributions owed to the plan

c

$

Estimated collectible value of 3b

d

$

Estimated value of total plan assets (sum of a and c)

$

4

Estimated value of Title IV benefits as of the proposed termination date

5

$

Estimated present value of all benefit liabilities as of the proposed termination date

PART III.

SUFFICIENCY LEVEL AS OF PROPOSED DISTRIBUTION DATE

6

(MM/DD/YYYY)

Proposed distribution date

7

As of the proposed distribution date, do you project that the plan will have sufficient

assets available to pay for plan benefits, when allocated in accordance with section

4044 of ERISA, to provide:

a

all benefits guaranteed by the PBGC under section 4022(a) and (b) of ERISA, but not

Yes

No

all benefit liabilities?

b

all benefit liabilities?

Yes

No

PART IV.

ENROLLED ACTUARY CERTIFICATION

I, the Enrolled Actuary, certify that: (1) I have reviewed all relevant plan documents, plan and participant data, and the method used to value the

plan assets; (2) I have applied all relevant provisions of ERISA and the Internal Revenue Code and regulations promulgated thereunder; (3) to the

best of my knowledge and belief, the information contained in this schedule is true, correct, and complete; and (4) to the best of my knowledge and

belief, the plan’s assets and benefits have been valued in accordance with Title IV and PBGC regulations; and the value of the plan’s assets, when

allocated in accordance with the PBGC’s regulation on allocation of assets (29 CFR Part 4044), is sufficient (as of the proposed termination date)

to provide plan benefits as indicated (check one):

Sufficient for benefit liabilities

Insufficient for guaranteed benefits

Sufficient for guaranteed benefits but not for benefit liabilities

In making this certification, I recognize that knowingly and willfully making false, fictitious, or fraudulent statements to the PBGC is

§

punishable under 18 U.S.C.

1001.

Enrolled Actuary’s company’s name and address

Enrolled Actuary’s Name (Print or type)

(address should include room or suite no.)

Enrollment Number

Telephone Number

E-mail address (optional)

Enrolled Actuary’s signature

Date

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1