Form R-B - Business Income Tax Return - Xenia City - 2015

ADVERTISEMENT

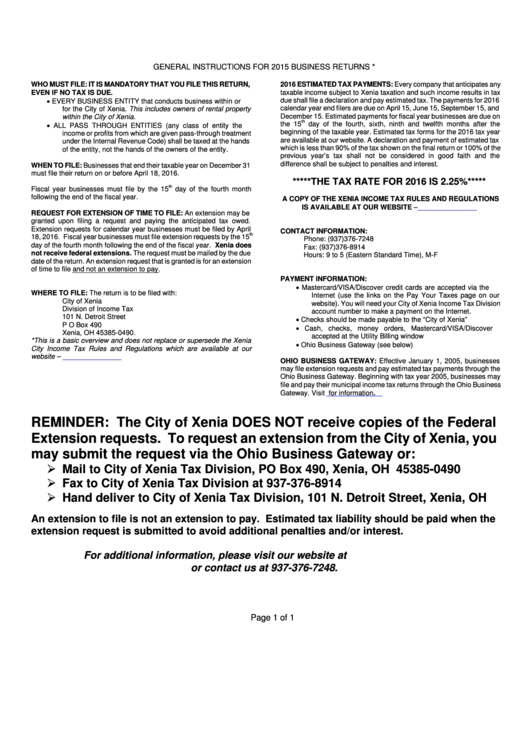

GENERAL INSTRUCTIONS FOR 2015 BUSINESS RETURNS *

WHO MUST FILE: IT IS MANDATORY THAT YOU FILE THIS RETURN,

2016 ESTIMATED TAX PAYMENTS: Every company that anticipates any

EVEN IF NO TAX IS DUE.

taxable income subject to Xenia taxation and such income results in tax

due shall file a declaration and pay estimated tax. The payments for 2016

EVERY BUSINESS ENTITY that conducts business within or

calendar year end filers are due on April 15, June 15, September 15, and

for the City of Xenia. This includes owners of rental property

December 15. Estimated payments for fiscal year businesses are due on

within the City of Xenia.

th

the 15

day of the fourth, sixth, ninth and twelfth months after the

ALL PASS THROUGH ENTITIES (any class of entity the

beginning of the taxable year. Estimated tax forms for the 2016 tax year

income or profits from which are given pass-through treatment

are available at our website. A declaration and payment of estimated tax

under the Internal Revenue Code) shall be taxed at the hands

which is less than 90% of the tax shown on the final return or 100% of the

of the entity, not the hands of the owners of the entity.

previous year’s tax shall not be considered in good faith and the

difference shall be subject to penalties and interest.

WHEN TO FILE: Businesses that end their taxable year on December 31

must file their return on or before April 18, 2016.

*****THE TAX RATE FOR 2016 IS 2.25%*****

th

Fiscal year businesses must file by the 15

day of the fourth month

following the end of the fiscal year.

A COPY OF THE XENIA INCOME TAX RULES AND REGULATIONS

IS AVAILABLE AT OUR WEBSITE –

REQUEST FOR EXTENSION OF TIME TO FILE: An extension may be

granted upon filing a request and paying the anticipated tax owed.

Extension requests for calendar year businesses must be filed by April

CONTACT INFORMATION:

th

18, 2016. Fiscal year businesses must file extension requests by the 15

Phone: (937)376-7248

day of the fourth month following the end of the fiscal year. Xenia does

Fax: (937)376-8914

not receive federal extensions. The request must be mailed by the due

Hours: 9 to 5 (Eastern Standard Time), M-F

date of the return. An extension request that is granted is for an extension

of time to file and not an extension to pay.

PAYMENT INFORMATION:

Mastercard/VISA/Discover credit cards are accepted via the

WHERE TO FILE: The return is to be filed with:

Internet (use the links on the Pay Your Taxes page on our

City of Xenia

website). You will need your City of Xenia Income Tax Division

Division of Income Tax

account number to make a payment on the Internet.

101 N. Detroit Street

Checks should be made payable to the “City of Xenia”

P O Box 490

Cash, checks, money orders, Mastercard/VISA/Discover

Xenia, OH 45385-0490.

accepted at the Utility Billing window

*This is a basic overview and does not replace or supersede the Xenia

Ohio Business Gateway (see below)

City Income Tax Rules and Regulations which are available at our

website –

OHIO BUSINESS GATEWAY: Effective January 1, 2005, businesses

may file extension requests and pay estimated tax payments through the

Ohio Business Gateway. Beginning with tax year 2005, businesses may

file and pay their municipal income tax returns through the Ohio Business

Gateway. Visit

for information.

REMINDER: The City of Xenia DOES NOT receive copies of the Federal

Extension requests. To request an extension from the City of Xenia, you

may submit the request via the Ohio Business Gateway or:

Mail to City of Xenia Tax Division, PO Box 490, Xenia, OH 45385-0490

Fax to City of Xenia Tax Division at 937-376-8914

Hand deliver to City of Xenia Tax Division, 101 N. Detroit Street, Xenia, OH

An extension to file is not an extension to pay. Estimated tax liability should be paid when the

extension request is submitted to avoid additional penalties and/or interest.

For additional information, please visit our website at

or contact us at 937-376-7248.

Page 1 of 1

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5