Instructions For Maine Estate Tax Return - 2013

ADVERTISEMENT

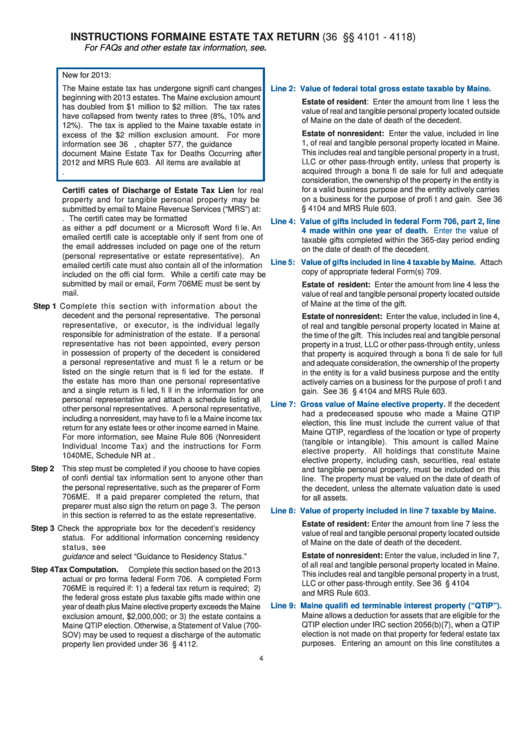

INSTRUCTIONS FOR MAINE ESTATE TAX RETURN (36 M.R.S.A. §§ 4101 - 4118)

For FAQs and other estate tax information, see

New for 2013:

The Maine estate tax has undergone signifi cant changes

Line 2: Value of federal total gross estate taxable by Maine.

beginning with 2013 estates. The Maine exclusion amount

Estate of resident: Enter the amount from line 1 less the

has doubled from $1 million to $2 million. The tax rates

value of real and tangible personal property located outside

have collapsed from twenty rates to three (8%, 10% and

of Maine on the date of death of the decedent.

12%). The tax is applied to the Maine taxable estate in

Estate of nonresident: Enter the value, included in line

excess of the $2 million exclusion amount. For more

1, of real and tangible personal property located in Maine.

information see 36 M.R.S.A., chapter 577, the guidance

This includes real and tangible personal property in a trust,

document Maine Estate Tax for Deaths Occurring after

LLC or other pass-through entity, unless that property is

2012 and MRS Rule 603. All items are available at www.

acquired through a bona fi de sale for full and adequate

maine.gov/revenue/incomeestate/estate.

consideration, the ownership of the property in the entity is

for a valid business purpose and the entity actively carries

Certifi cates of Discharge of Estate Tax Lien for real

on a business for the purpose of profi t and gain. See 36

property and for tangible personal property may be

M.R.S.A. § 4104 and MRS Rule 603.

submitted by email to Maine Revenue Services (“MRS”) at:

estatetax@maine.gov. The certifi cates may be formatted

Line 4: Value of gifts included in federal Form 706, part 2, line

as either a pdf document or a Microsoft Word fi le. An

4 made within one year of death. Enter the

value of

emailed certifi cate is acceptable only if sent from one of

taxable gifts completed within the 365-day period ending

the email addresses included on page one of the return

on the date of death of the decedent.

(personal representative or estate representative). An

Line 5: Value of gifts included in line 4 taxable by Maine.

Attach

emailed certifi cate must also contain all of the information

copy of appropriate federal Form(s) 709.

included on the offi cial form. While a certifi cate may be

submitted by mail or email, Form 706ME must be sent by

Estate of resident: Enter the amount from line 4 less the

mail.

value of real and tangible personal property located outside

of Maine at the time of the gift.

Step 1 Complete this section with information about the

decedent and the personal representative. The personal

Estate of nonresident: Enter the value, included in line 4,

representative, or executor, is the individual legally

of real and tangible personal property located in Maine at

responsible for administration of the estate. If a personal

the time of the gift. This includes real and tangible personal

representative has not been appointed, every person

property in a trust, LLC or other pass-through entity, unless

in possession of property of the decedent is considered

that property is acquired through a bona fi de sale for full

a personal representative and must fi le a return or be

and adequate consideration, the ownership of the property

listed on the single return that is fi led for the estate. If

in the entity is for a valid business purpose and the entity

the estate has more than one personal representative

actively carries on a business for the purpose of profi t and

and a single return is fi led, fi ll in the information for one

gain. See 36 M.R.S.A. § 4104 and MRS Rule 603.

personal representative and attach a schedule listing all

Line 7: Gross value of Maine elective property.

If the decedent

other personal representatives. A personal representative,

had a predeceased spouse who made a Maine QTIP

including a nonresident, may have to fi le a Maine income tax

election, this line must include the current value of that

return for any estate fees or other income earned in Maine.

Maine QTIP, regardless of the location or type of property

For more information, see Maine Rule 806 (Nonresident

(tangible or intangible). This amount is called Maine

Individual Income Tax) and the instructions for Form

elective property. All holdings that constitute Maine

1040ME, Schedule NR at

elective property, including cash, securities, real estate

Step 2 This step must be completed if you choose to have copies

and tangible personal property, must be included on this

of confi dential tax information sent to anyone other than

line. The property must be valued on the date of death of

the personal representative, such as the preparer of Form

the decedent, unless the alternate valuation date is used

706ME. If a paid preparer completed the return, that

for all assets.

preparer must also sign the return on page 3. The person

Line 8: Value of property included in line 7 taxable by Maine.

in this section is referred to as the estate representative.

Estate of resident: Enter the amount from line 7 less the

Step 3 Check the appropriate box for the decedent’s residency

value of real and tangible personal property located outside

status. For additional information concerning residency

of Maine on the date of death of the decedent.

status, see

Estate of nonresident: Enter the value, included in line 7,

guidance and select “Guidance to Residency Status.”

of all real and tangible personal property located in Maine.

Step 4 Tax Computation. Complete this section based on the 2013

This includes real and tangible personal property in a trust,

actual or pro forma federal Form 706. A completed Form

LLC or other pass-through entity. See 36 M.R.S.A. § 4104

706ME is required if: 1) a federal tax return is required; 2)

and MRS Rule 603.

the federal gross estate plus taxable gifts made within one

Line 9: Maine qualifi ed terminable interest property (“QTIP”).

year of death plus Maine elective property exceeds the Maine

Maine allows a deduction for assets that are eligible for the

exclusion amount, $2,000,000; or 3) the estate contains a

QTIP election under IRC section 2056(b)(7), when a QTIP

Maine QTIP election. Otherwise, a Statement of Value (700-

election is not made on that property for federal estate tax

SOV) may be used to request a discharge of the automatic

purposes. Entering an amount on this line constitutes a

property lien provided under 36 M.R.S.A. § 4112.

4

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3