Form 150-102-032 - Dependent Care Credits For Employers - Oregon Department Of Revenue

ADVERTISEMENT

O R E G O N

D E PA R T M E N T

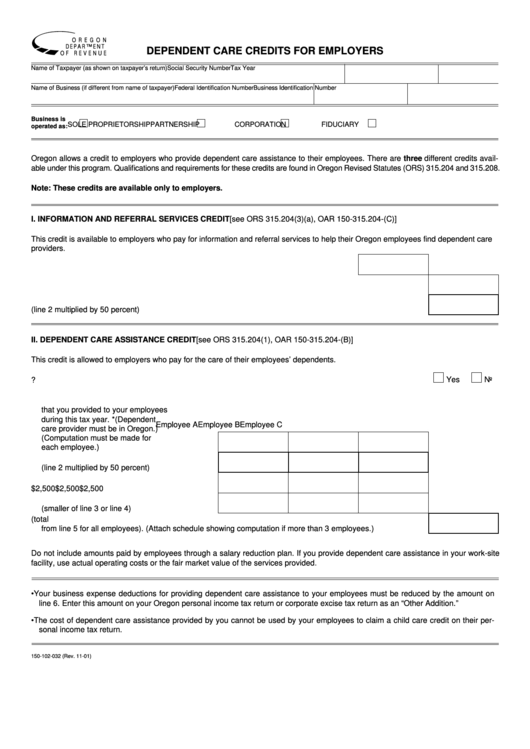

DEPENDENT CARE CREDITS FOR EMPLOYERS

O F R E V E N U E

Name of Taxpayer (as shown on taxpayer’s return)

Social Security Number

Tax Year

Name of Business (if different from name of taxpayer)

Federal Identification Number

Business Identification Number

Business is

SOLE PROPRIETORSHIP

PARTNERSHIP

CORPORATION

FIDUCIARY

operated as:

Oregon allows a credit to employers who provide dependent care assistance to their employees. There are three different credits avail-

able under this program. Qualifications and requirements for these credits are found in Oregon Revised Statutes (ORS) 315.204 and 315.208.

Note: These credits are available only to employers.

I. INFORMATION AND REFERRAL SERVICES CREDIT [see ORS 315.204(3)(a), OAR 150-315.204-(C)]

This credit is available to employers who pay for information and referral services to help their Oregon employees find dependent care

providers.

1. Number of employees who work in Oregon ......................................................................... 1

2. Cost to provide these services to Oregon employees during this tax year .......................................................... 2

3. Information and Referral Services credit for this year (line 2 multiplied by 50 percent) ....................................... 3

II. DEPENDENT CARE ASSISTANCE CREDIT [see ORS 315.204(1), OAR 150-315.204-(B)]

This credit is allowed to employers who pay for the care of their employees’ dependents.

1. Do you have a written dependent care assistance plan? ..................................................................................... 1

Yes

No

2. Cost of dependent care assistance

that you provided to your employees

during this tax year. *(Dependent

Employee A

Employee B

Employee C

care provider must be in Oregon.)

(Computation must be made for

each employee.) ................................................. 2

3. Potential credit based on cost

(line 2 multiplied by 50 percent) ......................... 3

4. Maximum credit per employee ........................... 4

$2,500

$2,500

$2,500

5. Allowable credit for each employee

(smaller of line 3 or line 4) .................................. 5

6. Total Dependent Care Assistance Credit (total

from line 5 for all employees). (Attach schedule showing computation if more than 3 employees.) .................... 6

Do not include amounts paid by employees through a salary reduction plan. If you provide dependent care assistance in your work-site

facility, use actual operating costs or the fair market value of the services provided.

• Your business expense deductions for providing dependent care assistance to your employees must be reduced by the amount on

line 6. Enter this amount on your Oregon personal income tax return or corporate excise tax return as an “Other Addition.”

• The cost of dependent care assistance provided by you cannot be used by your employees to claim a child care credit on their per-

sonal income tax return.

150-102-032 (Rev. 11-01)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2