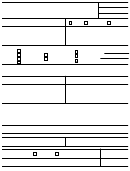

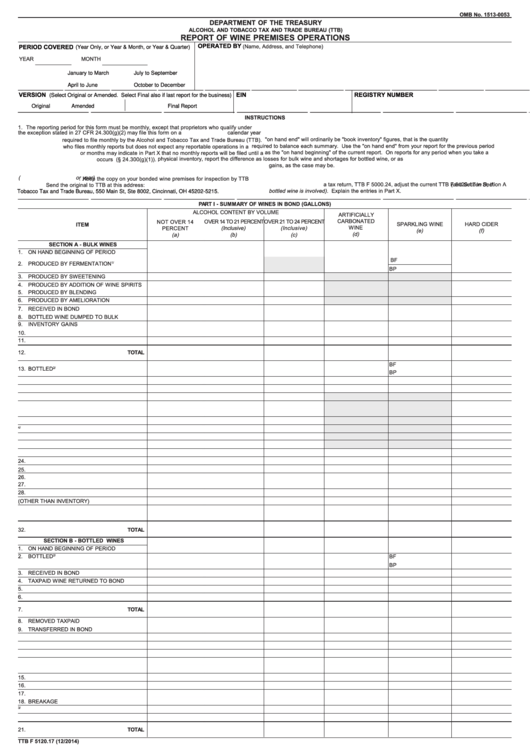

OMB No. 1513-0053

DEPARTMENT OF THE TREASURY

ALCOHOL AND TOBACCO TAX AND TRADE BUREAU (TTB)

REPORT OF WINE PREMISES OPERATIONS

OPERATED BY

PERIOD COVERED

(Name, Address, and Telephone)

(Year Only, or Year & Month, or Year & Quarter)

YEAR

MONTH

_______ _____

_______________

January to March

July to September

April to June

October to December

_______________ _______________ _______________

_______________ _______________ _______________ _______________ _______________ _______________ _______________ _______________

_______________

VERSION

EIN

REGISTRY NUMBER

(Select Original or Amended. Select Final also if last report for the business)

_______________

_______________ _______________ _______________

_______________

_______________

_______________ _______________ _______________

_________

Original

Amended

Final Report

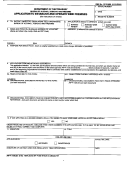

INSTRUCTIONS

3. Explain any unusual operations in Part X.

1. The reporting period for this form must be monthly, except that proprietors who qualify under

the exception stated in 27 CFR 24.300(g)(2) may file this form on a

calendar year

4. The quantities "on hand end" will ordinarily be "book inventory" figures, that is the quantity

required to file monthly by the Alcohol and Tobacco Tax and Trade Bureau (TTB).

required to balance each summary. Use the "on hand end" from your report for the previous period

who files monthly reports but does not expect any reportable operations in a

as the "on hand beginning" of the current report. On reports for any period when you take a

or months may indicate in Part X that no monthly reports will be filed until a

physical inventory, report the difference as losses for bulk wine and shortages for bottled wine, or as

occurs (§ 24.300(g)(1)).

gains, as the case may be.

2. Prepare this form in duplicate and file it by the fifteenth day after the end of the report period

5. If the quantity of wine previously reported on TTB F 5120.17 is affected by adjustments made on

(

or year) . Keep the copy on your bonded wine premises for inspection by TTB

a tax return, TTB F 5000.24, adjust the current TTB F 5120.17 in Section A (and Section B, if

Send the original to TTB at this address:

bottled wine is involved) . Explain the entries in Part X.

Tobacco Tax and Trade Bureau, 550 Main St, Ste 8002, Cincinnati, OH 45202-5215.

_______________

_______________ _______________ _______________

_______________

_______________

_______________ _______________ _______________

_________

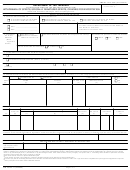

PART I - SUMMARY OF WINES IN BOND (GALLONS)

ALCOHOL CONTENT BY VOLUME

ARTIFICIALLY

CARBONATED

NOT OVER 14

OVER 14 TO 21 PERCENT

OVER 21 TO 24 PERCENT

SPARKLING WINE

HARD CIDER

ITEM

WINE

PERCENT

(Inclusive)

(Inclusive)

(e)

(f)

(d)

(a)

(b)

(c)

SECTION A - BULK WINES

1. ON HAND BEGINNING OF PERIOD

BF

2. PRODUCED BY FERMENTATION

1/

BP

3. PRODUCED BY SWEETENING

4. PRODUCED BY ADDITION OF WINE SPIRITS

5. PRODUCED BY BLENDING

6. PRODUCED BY AMELIORATION

7. RECEIVED IN BOND

8. BOTTLED WINE DUMPED TO BULK

9. INVENTORY GAINS

10.

11.

12.

TOTAL

BF

13. BOTTLED

2/

BP

14. REMOVED TAXPAID

15. TRANSFERS IN BOND

16. REMOVED FOR DISTILLING MATERIAL

17. REMOVED TO VINEGAR PLANT

18. USED FOR SWEETENING

19. USED FOR ADDITION OF WINE SPIRITS

20. USED FOR BLENDING

4/

21. USED FOR AMELIORATION

22. USED FOR EFFERVESCENT WINE

23. USED FOR TESTING

24.

25.

26.

27.

28.

29. LOSSES (OTHER THAN INVENTORY)

30. INVENTORY LOSSES

31. ON HAND END OF PERIOD

32.

TOTAL

SECTION B - BOTTLED WINES

1. ON HAND BEGINNING OF PERIOD

2. BOTTLED

BF

2/

BP

3. RECEIVED IN BOND

4. TAXPAID WINE RETURNED TO BOND

5.

6.

7.

TOTAL

8. REMOVED TAXPAID

9. TRANSFERRED IN BOND

10. DUMPED TO BULK

11. USED FOR TASTING

12. REMOVED FOR EXPORT

13. REMOVED FOR FAMILY USE

14. USED FOR TESTING

15.

16.

17.

18. BREAKAGE

19. INVENTORY SHORTAGE

3/

20. ON HAND END OF PERIOD

21.

TOTAL

TTB F 5120.17 (12/2014)

Enter in col. (e) on line marked "BF" the quantity of spar ling wine produced by fermentation in bottles, and on line marked "BP" the quantity of spar ling wine produced by bulk process.

1/

Section A line 13 and Section B line 2 should sho the same quantities. Enter in col. (e) on line marked "BF" the quantity of finished bottle fermented sparkling wine bottled, and on line mar ed "BP" the quantity of finished b lk process wine

2/

bottled.

Fully explain in either Part X, or on a sepa te signed statement submitted with this report. Failure to satisfactorily explain shortages of bottled wine ma result in the assessment of tax s applicable to those shortages.

3/

Only report blending if wines of diff rent tax classes are b ended together.

4/

Page 1 of 2

1

1 2

2