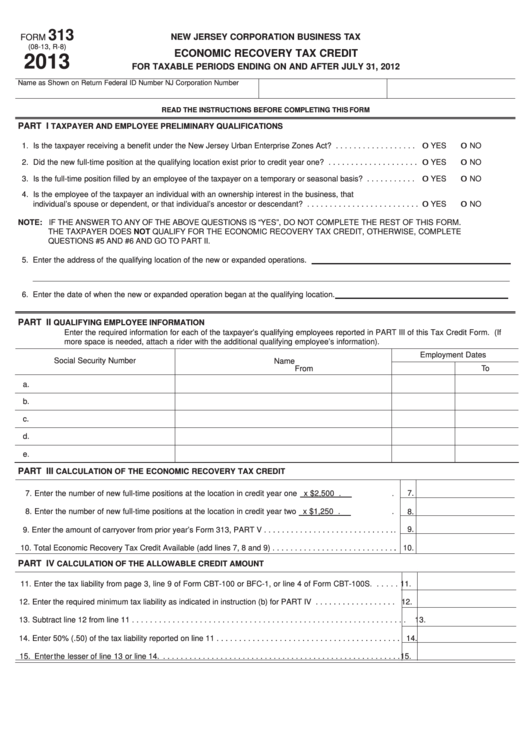

Form 313 - Economic Recovery Tax Credit - 2013

ADVERTISEMENT

313

FORM

NEW JERSEY CORPORATION BUSINESS TAX

(08-13, R-8)

ECONOMIC RECOVERY TAX CREDIT

2013

FOR TAXABLE PERIODS ENDING ON AND AFTER JULY 31, 2012

Name as Shown on Return

Federal ID Number

NJ Corporation Number

READ THE INSTRUCTIONS BEFORE COMPLETING THIS FORM

PART I

TAXPAYER AND EMPLOYEE PRELIMINARY QUALIFICATIONS

1. Is the taxpayer receiving a benefit under the New Jersey Urban Enterprise Zones Act? . . . . . . . . . . . . . . . . . . 0 YES

0 NO

2. Did the new full-time position at the qualifying location exist prior to credit year one? . . . . . . . . . . . . . . . . . . . . 0 YES

0 NO

3. Is the full-time position filled by an employee of the taxpayer on a temporary or seasonal basis? . . . . . . . . . . . 0 YES

0 NO

4. Is the employee of the taxpayer an individual with an ownership interest in the business, that

individual’s spouse or dependent, or that individual’s ancestor or descendant? . . . . . . . . . . . . . . . . . . . . . . . . . 0 YES

0 NO

NOTE: IF THE ANSWER TO ANY OF THE ABOVE QUESTIONS IS “YES”, DO NOT COMPLETE THE REST OF THIS FORM.

THE TAXPAYER DOES NOT QUALIFY FOR THE ECONOMIC RECOVERY TAX CREDIT, OTHERWISE, COMPLETE

QUESTIONS #5 AND #6 AND GO TO PART II.

5. Enter the address of the qualifying location of the new or expanded operations.

6. Enter the date of when the new or expanded operation began at the qualifying location.

PART II

QUALIFYING EMPLOYEE INFORMATION

Enter the required information for each of the taxpayer’s qualifying employees reported in PART III of this Tax Credit Form. (If

more space is needed, attach a rider with the additional qualifying employee’s information).

Employment Dates

Social Security Number

Name

From

To

a.

b.

c.

d.

e.

PART III

CALCULATION OF THE ECONOMIC RECOVERY TAX CREDIT

7. Enter the number of new full-time positions at the location in credit year one

x $2,500 . .

7.

8. Enter the number of new full-time positions at the location in credit year two

x $1,250 . .

8.

9.

9. Enter the amount of carryover from prior year’s Form 313, PART V . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

10. Total Economic Recovery Tax Credit Available (add lines 7, 8 and 9) . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

10.

PART IV

CALCULATION OF THE ALLOWABLE CREDIT AMOUNT

11. Enter the tax liability from page 3, line 9 of Form CBT-100 or BFC-1, or line 4 of Form CBT-100S. . . . . .

11.

12. Enter the required minimum tax liability as indicated in instruction (b) for PART IV . . . . . . . . . . . . . . . . . .

12.

13. Subtract line 12 from line 11 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

13.

14. Enter 50% (.50) of the tax liability reported on line 11 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

14.

15. Enter the lesser of line 13 or line 14. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

15.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4