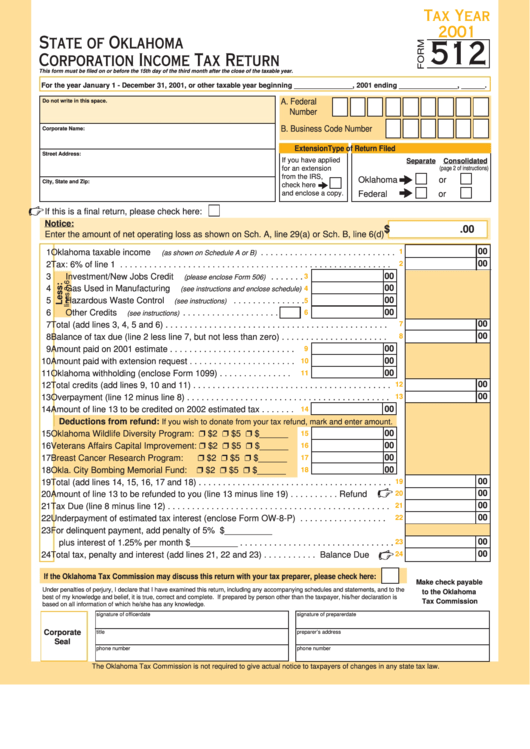

Form 512 - Corporation Income Tax Return - 2001

ADVERTISEMENT

Tax Year

2001

State of Oklahoma

512

Corporation Income Tax Return

This form must be filed on or before the 15th day of the third month after the close of the taxable year.

For the year January 1 - December 31, 2001, or other taxable year beginning _______________, 2001 ending _______________, ______.

A. Federal I.D.

Do not write in this space.

Number

B. Business Code Number

Corporate Name:

Extension

Type of Return Filed

Street Address:

If you have applied

Separate

Consolidated

for an extension

(page 2 of instructions)

from the IRS,

Oklahoma

or

City, State and Zip:

check here

and enclose a copy.

Federal

or

If this is a final return, please check here:

Notice:

$

.00

Enter the amount of net operating loss as shown on Sch. A, line 29(a) or Sch. B, line 6(d)

00

1 Oklahoma taxable income

. . . . . . . . . . . . . . . . . . . . . . . . . . . .

1

(as shown on Schedule A or B)

00

2 Tax: 6% of line 1 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

2

00

3

Investment/New Jobs Credit

. . . . . . .

3

(please enclose Form 506)

00

4

Gas Used in Manufacturing

4

(see instructions and enclose schedule)

5

Hazardous Waste Control

. . . . . . . . . . . . . . .

00

5

(see instructions)

00

6

Other Credits

. . . . . . . . . . . . . . . . . . . .

6

(see instructions)

00

7

7 Total (add lines 3, 4, 5 and 6) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

00

8

8 Balance of tax due (line 2 less line 7, but not less than zero) . . . . . . . . . . . . . . . . . . . . . .

9 Amount paid on 2001 estimate . . . . . . . . . . . . . . . . . . . . . . . . . .

00

9

00

10 Amount paid with extension request . . . . . . . . . . . . . . . . . . . . . .

10

00

11 Oklahoma withholding (enclose Form 1099) . . . . . . . . . . . . . . .

11

00

12 Total credits (add lines 9, 10 and 11) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

12

00

13 Overpayment (line 12 minus line 8) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

13

00

14 Amount of line 13 to be credited on 2002 estimated tax . . . . . . .

14

Deductions from refund:

If you wish to donate from your tax refund, mark and enter amount.

15 Oklahoma Wildlife Diversity Program:

$2

$5

$______

00

15

00

16 Veterans Affairs Capital Improvement:

$2

$5

$______

16

00

17 Breast Cancer Research Program:

$2

$5

$______

17

00

18 Okla. City Bombing Memorial Fund:

$2

$5

$______

18

00

19 Total (add lines 14, 15, 16, 17 and 18) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

19

00

20 Amount of line 13 to be refunded to you (line 13 minus line 19) . . . . . . . . . . Refund

20

00

21

21 Tax Due (line 8 minus line 12) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

00

22

22 Underpayment of estimated tax interest (enclose Form OW-8-P) . . . . . . . . . . . . . . . . . .

23 For delinquent payment, add penalty of 5% $__________

00

plus interest of 1.25% per month $__________ . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

23

00

24

24 Total tax, penalty and interest (add lines 21, 22 and 23) . . . . . . . . . . . Balance Due

If the Oklahoma Tax Commission may discuss this return with your tax preparer, please check here:

Make check payable

Under penalties of perjury, I declare that I have examined this return, including any accompanying schedules and statements, and to the

to the Oklahoma

best of my knowledge and belief, it is true, correct and complete. If prepared by person other than the taxpayer, his/her declaration is

Tax Commission

based on all information of which he/she has any knowledge.

signature of officer

date

signature of preparer

date

Corporate

title

preparer’s address

Seal

phone number

phone number

The Oklahoma Tax Commission is not required to give actual notice to taxpayers of changes in any state tax law.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4