Form Nc-478 - Summary Of Tax Credits Limited To 50% Of Tax

ADVERTISEMENT

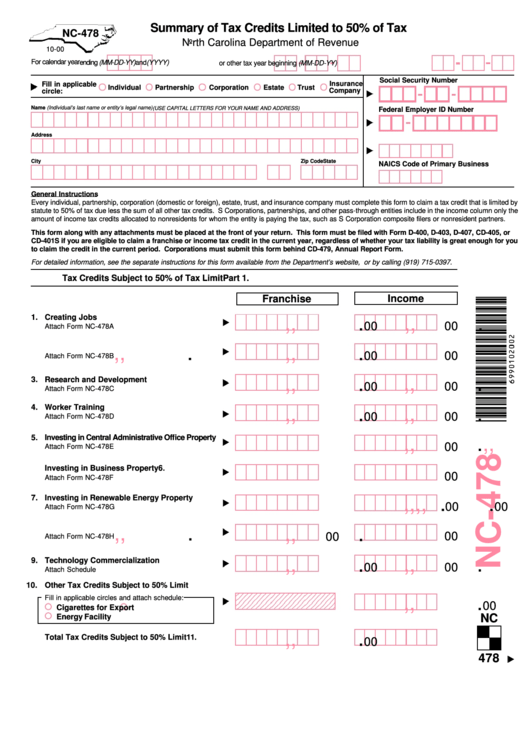

Summary of Tax Credits Limited to 50% of Tax

NC-478

North Carolina Department of Revenue

10-00

For calendar year

(YYYY)

and

ending (MM-DD-YY)

or other tax year beginning (MM-DD-YY)

Social Security Number

Insurance

Fill in applicable

Individual

Partnership

Corporation

Estate

Trust

Company

circle:

Name (Individual’s last name or entity’s legal name) (USE CAPITAL LETTERS FOR YOUR NAME AND ADDRESS)

Federal Employer ID Number

Address

N.C. Secretary of State ID Number

City

State

Zip Code

NAICS Code of Primary Business

General Instructions

Every individual, partnership, corporation (domestic or foreign), estate, trust, and insurance company must complete this form to claim a tax credit that is limited by

statute to 50% of tax due less the sum of all other tax credits. S Corporations, partnerships, and other pass-through entities include in the income column only the

amount of income tax credits allocated to nonresidents for whom the entity is paying the tax, such as S Corporation composite filers or nonresident partners.

This form along with any attachments must be placed at the front of your return. This form must be filed with Form D-400, D-403, D-407, CD-405, or

CD-401S if you are eligible to claim a franchise or income tax credit in the current year, regardless of whether your tax liability is great enough for you

to claim the credit in the current period. Corporations must submit this form behind CD-479, Annual Report Form.

For detailed information, see the separate instructions for this form available from the Department’s website, , or by calling (919) 715-0397.

Part 1.

Tax Credits Subject to 50% of Tax Limit

Income

Franchise

1.

Creating Jobs

,

,

.

,

,

.

00

00

Attach Form NC-478A

2. Investing in Machinery and Equipment

,

,

.

,

,

.

00

00

Attach Form NC-478B

,

,

.

,

,

.

3.

Research and Development

00

00

Attach Form NC-478C

4.

Worker Training

,

,

.

,

,

.

00

00

Attach Form NC-478D

5.

Investing in Central Administrative Office Property

,

,

.

,

,

.

00

00

Attach Form NC-478E

6.

Investing in Business Property

,

,

.

,

,

.

00

00

Attach Form NC-478F

7.

Investing in Renewable Energy Property

,

,

.

,

,

.

00

00

Attach Form NC-478G

8. Low-Income Housing

,

,

.

,

,

.

00

00

Attach Form NC-478H

,

,

.

,

,

.

9.

Technology Commercialization

00

00

Attach Schedule

10.

Other Tax Credits Subject to 50% Limit

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3

Fill in applicable circles and attach schedule:

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3

,

,

.

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3

00

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3

N.C. Ports

Cigarettes for Export

Energy Facility

NC

,

,

.

,

,

.

11.

Total Tax Credits Subject to 50% Limit

00

00

478

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2