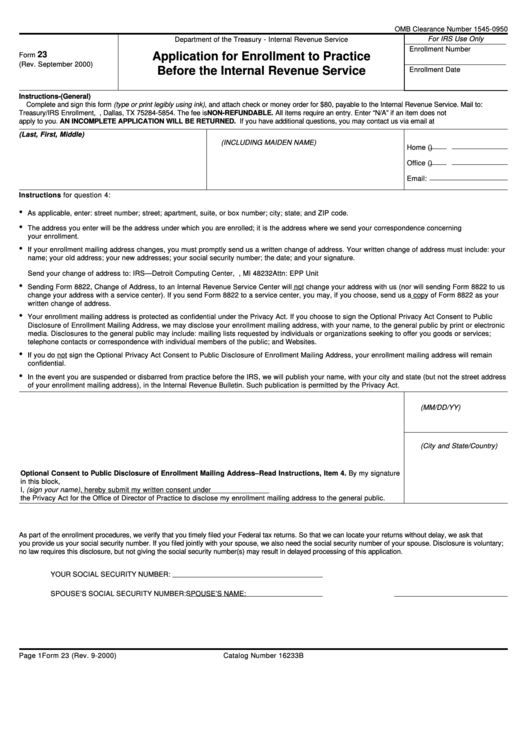

Form 23 - Application For Enrollment To Practicebefore The Internal Revenue Service - 2000

ADVERTISEMENT

OMB Clearance Number 1545-0950

For IRS Use Only

Department of the Treasury - Internal Revenue Service

Enrollment Number

23

Application for Enrollment to Practice

Form

(Rev. September 2000)

Before the Internal Revenue Service

Enrollment Date

Instructions-(General)

Complete and sign this form (type or print legibly using ink), and attach check or money order for $80, payable to the Internal Revenue Service. Mail to: U.S.

Treasury/IRS Enrollment, P.O. Box 845854, Dallas, TX 75284-5854. The fee is NON-REFUNDABLE. All items require an entry. Enter “N/A” if an item does not

apply to you. AN INCOMPLETE APPLICATION WILL BE RETURNED. If you have additional questions, you may contact us via email at EPP@IRS.GOV

1. Legal Name (Last, First, Middle)

2. Other Names Used and Dates Used

3. Telephone Numbers

(INCLUDING MAIDEN NAME)

Home (

)

Office (

)

Email:

Instructions for question 4:

•

As applicable, enter: street number; street; apartment, suite, or box number; city; state; and ZIP code.

•

The address you enter will be the address under which you are enrolled; it is the address where we send your correspondence concerning

your enrollment.

•

If your enrollment mailing address changes, you must promptly send us a written change of address. Your written change of address must include: your

name; your old address; your new addresses; your social security number; the date; and your signature.

Send your change of address to: IRS—Detroit Computing Center, P.O. Box 33968 Detroit, MI 48232

Attn: EPP Unit

•

Sending Form 8822, Change of Address, to an Internal Revenue Service Center will not change your address with us (nor will sending Form 8822 to us

change your address with a service center). If you send Form 8822 to a service center, you may, if you choose, send us a copy of Form 8822 as your

written change of address.

•

Your enrollment mailing address is protected as confidential under the Privacy Act. If you choose to sign the Optional Privacy Act Consent to Public

Disclosure of Enrollment Mailing Address, we may disclose your enrollment mailing address, with your name, to the general public by print or electronic

media. Disclosures to the general public may include: mailing lists requested by individuals or organizations seeking to offer you goods or services;

telephone contacts or correspondence with individual members of the public; and Websites.

•

If you do not sign the Optional Privacy Act Consent to Public Disclosure of Enrollment Mailing Address, your enrollment mailing address will remain

confidential.

•

In the event you are suspended or disbarred from practice before the IRS, we will publish your name, with your city and state (but not the street address

of your enrollment mailing address), in the Internal Revenue Bulletin. Such publication is permitted by the Privacy Act.

4. Enrollment Mailing Address

5a. Date of Birth

(MM/DD/YY)

5b. Place of Birth

(City and State/Country)

Optional Consent to Public Disclosure of Enrollment Mailing Address–Read Instructions, Item 4. By my signature

in this block,

I, (sign your name)

, hereby submit my written consent under

the Privacy Act for the Office of Director of Practice to disclose my enrollment mailing address to the general public.

6. Social Security Number

As part of the enrollment procedures, we verify that you timely filed your Federal tax returns. So that we can locate your returns without delay, we ask that

you provide us your social security number. If you filed jointly with your spouse, we also need the social security number of your spouse. Disclosure is voluntary;

no law requires this disclosure, but not giving the social security number(s) may result in delayed processing of this application.

YOUR SOCIAL SECURITY NUMBER:

SPOUSE’S SOCIAL SECURITY NUMBER:

SPOUSE’S NAME:

Page 1

Catalog Number 16233B

Form 23 (Rev. 9-2000)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4