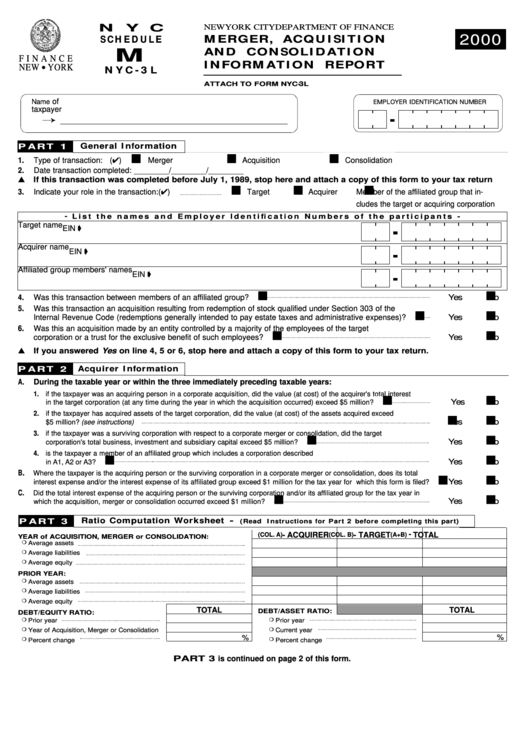

Nyc Schedule M (Form Nyc-3l) - Merger, Aquisition And Consolidation Information Report - 2000

ADVERTISEMENT

N Y C

NEW YORK CITY DEPARTMENT OF FINANCE

2000

S C H E D U L E

MERGER, ACQUISITION

M

AND CONSOLIDATION

F I N A N C E

INFORMATION REPORT

NEW YORK

N Y C - 3 L

3

ATTACH TO FORM NYC-

L

of

Name

EMPLOYER IDENTIFICATION NUMBER

taxpayer

General Infor mation

P A R T 1

1.

Type of transaction: ( )

Merger

Acquisition

Consolidation

....................................................................

2.

Date transaction completed: ________/________/________

If this transaction was completed before July 1, 1989, stop here and attach a copy of this form to your tax return

3.

Indicate your role in the transaction: ( )

Target

Acquirer

Member of the affiliated group that in-

cludes the target or acquiring corporation

-

L i s t t h e n a m e s a n d E m p l o y e r I d e n t i f i c a t i o n N u m b e r s o f t h e p a r t i c i p a n t s -

Target name

EIN

Acquirer name

EIN

Affiliated group members' names

EIN

4.

Was this transaction between members of an affiliated group?

Yes

No

5.

Was this transaction an acquisition resulting from redemption of stock qualified under Section 303 of the

Internal Revenue Code (redemptions generally intended to pay estate taxes and administrative expenses)?

Yes

No

6.

Was this an acquisition made by an entity controlled by a majority of the employees of the target

corporation or a trust for the exclusive benefit of such employees?

Yes

No

If you answered Yes on line 4, 5 or 6, stop here and attach a copy of this form to your tax return.

Acquirer Infor mation

P A R T 2

A

.

During the taxable year or within the three immediately preceding taxable years:

1. if the taxpayer was an acquiring person in a corporate acquisition, did the value (at cost) of the acquirer's total interest

Yes

No

in the target corporation (at any time during the year in which the acquisition occurred) exceed $5 million?

2. if the taxpayer has acquired assets of the target corporation, did the value (at cost) of the assets acquired exceed

Yes

No

$5 million? (see instructions)

3. if the taxpayer was a surviving corporation with respect to a corporate merger or consolidation, did the target

Yes

No

corporation's total business, investment and subsidiary capital exceed $5 million?

4. is the taxpayer a member of an affiliated group which includes a corporation described

Yes

No

in A1, A2 or A3?

B.

Where the taxpayer is the acquiring person or the surviving corporation in a corporate merger or consolidation, does its total

Yes

No

interest expense and/or the interest expense of its affiliated group exceed $1 million for the tax year for which this form is filed?

C.

Did the total interest expense of the acquiring person or the surviving corporation and/or its affiliated group for the tax year in

Yes

No

which the acquisition, merger or consolidation occurred exceed $1 million?

Ratio Computation Worksheet -

P A R T 3

(Read Instr uctions for Par t 2 before completing this par t)

- TOTAL

(COL. A)

- ACQUIRER

(COL. B)

- TARGET

(A+B)

YEAR of ACQUISITION, MERGER or CONSOLIDATION:

Average assets

Average liabilities

Average equity

PRIOR YEAR:

Average assets

Average liabilities

Average equity

TOTAL

TOTAL

DEBT/ASSET RATIO:

DEBT/EQUITY RATIO:

Prior year

Prior year

Year of Acquisition, Merger or Consolidation

Current year

%

%

Percent change

Percent change

PART 3 is continued on page 2 of this form.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2