Instructions For Delaware Form 400-I - Fiduciary Income Tax Return

ADVERTISEMENT

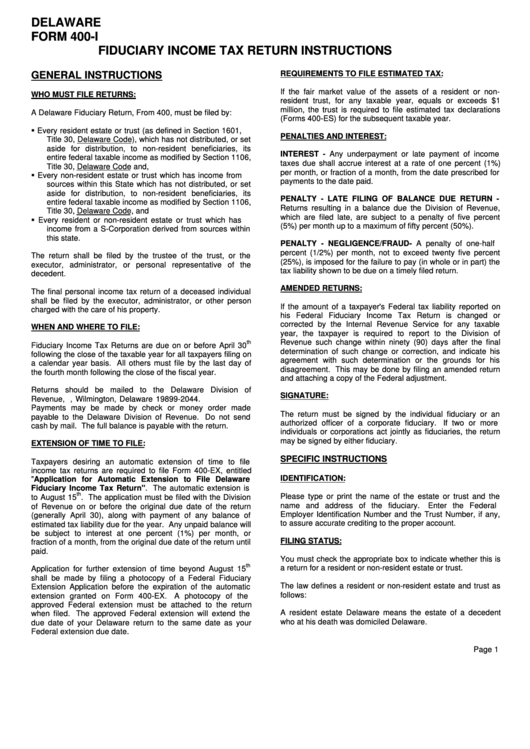

DELAWARE

FORM 400-I

FIDUCIARY INCOME TAX RETURN INSTRUCTIONS

REQUIREMENTS TO FILE ESTIMATED TAX:

GENERAL INSTRUCTIONS

If the fair market value of the assets of a resident or non-

WHO MUST FILE RETURNS:

resident trust, for any taxable year, equals or exceeds $1

million, the trust is required to file estimated tax declarations

A Delaware Fiduciary Return, From 400, must be filed by:

(Forms 400-ES) for the subsequent taxable year.

!

Every resident estate or trust (as defined in Section 1601,

PENALTIES AND INTEREST:

Title 30, Delaware Code), which has not distributed, or set

aside for distribution, to non-resident beneficiaries, its

INTEREST - Any underpayment or late payment of income

entire federal taxable income as modified by Section 1106,

taxes due shall accrue interest at a rate of one percent (1%)

Title 30, Delaware Code and,

per month, or fraction of a month, from the date prescribed for

!

Every non-resident estate or trust which has income from

payments to the date paid.

sources within this State which has not distributed, or set

aside for distribution, to non-resident beneficiaries, its

PENALTY - LATE FILING OF BALANCE DUE RETURN -

entire federal taxable income as modified by Section 1106,

Returns resulting in a balance due the Division of Revenue,

Title 30, Delaware Code, and

which are filed late, are subject to a penalty of five percent

!

Every resident or non-resident estate or trust which has

(5%) per month up to a maximum of fifty percent (50%).

income from a S-Corporation derived from sources within

this state.

PENALTY - NEGLIGENCE/FRAUD - A penalty of one-half

percent (1/2%) per month, not to exceed twenty five percent

The return shall be filed by the trustee of the trust, or the

(25%), is imposed for the failure to pay (in whole or in part) the

executor, administrator, or personal representative of the

tax liability shown to be due on a timely filed return.

decedent.

AMENDED RETURNS:

The final personal income tax return of a deceased individual

shall be filed by the executor, administrator, or other person

If the amount of a taxpayer's Federal tax liability reported on

charged with the care of his property.

his Federal Fiduciary Income Tax Return is changed or

corrected by the Internal Revenue Service for any taxable

WHEN AND WHERE TO FILE:

year, the taxpayer is required to report to the Division of

Revenue such change within ninety (90) days after the final

th

Fiduciary Income Tax Returns are due on or before April 30

determination of such change or correction, and indicate his

following the close of the taxable year for all taxpayers filing on

agreement with such determination or the grounds for his

a calendar year basis. All others must file by the last day of

disagreement. This may be done by filing an amended return

the fourth month following the close of the fiscal year.

and attaching a copy of the Federal adjustment.

Returns should be mailed to the Delaware Division of

SIGNATURE:

Revenue, P.O. Box 2044, Wilmington, Delaware 19899-2044.

Payments may be made by check or money order made

The return must be signed by the individual fiduciary or an

payable to the Delaware Division of Revenue. Do not send

authorized officer of a corporate fiduciary.

If two or more

cash by mail. The full balance is payable with the return.

individuals or corporations act jointly as fiduciaries, the return

may be signed by either fiduciary.

EXTENSION OF TIME TO FILE:

SPECIFIC INSTRUCTIONS

Taxpayers desiring an automatic extension of time to file

income tax returns are required to file Form 400-EX, entitled

IDENTIFICATION:

"Application for Automatic Extension to File Delaware

Fiduciary Income Tax Return". The automatic extension is

th

Please type or print the name of the estate or trust and the

to August 15

. The application must be filed with the Division

name and address of the fiduciary.

Enter the Federal

of Revenue on or before the original due date of the return

Employer Identification Number and the Trust Number, if any,

(generally April 30), along with payment of any balance of

to assure accurate crediting to the proper account.

estimated tax liability due for the year. Any unpaid balance will

be subject to interest at one percent (1%) per month, or

FILING STATUS:

fraction of a month, from the original due date of the return until

paid.

You must check the appropriate box to indicate whether this is

th

a return for a resident or non-resident estate or trust.

Application for further extension of time beyond August 15

shall be made by filing a photocopy of a Federal Fiduciary

The law defines a resident or non-resident estate and trust as

Extension Application before the expiration of the automatic

follows:

extension granted on Form 400-EX.

A photocopy of the

approved Federal extension must be attached to the return

A resident estate Delaware means the estate of a decedent

when filed. The approved Federal extension will extend the

who at his death was domiciled Delaware.

due date of your Delaware return to the same date as your

Federal extension due date.

Page 1

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3