Reset Form

Print Form

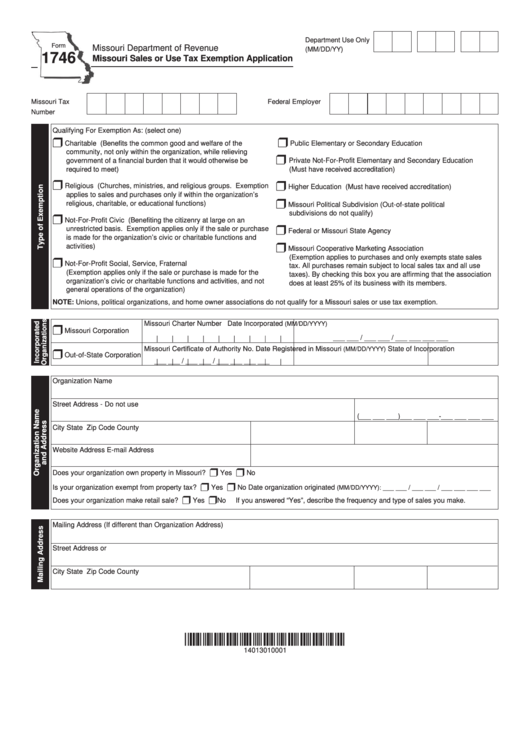

Department Use Only

Form

Missouri Department of Revenue

(MM/DD/YY)

1746

Missouri Sales or Use Tax Exemption Application

Missouri Tax I.D.

Federal Employer

Number

I.D. Number

Qualifying For Exemption As: (select one)

r

r

Charitable (Benefits the common good and welfare of the

Public Elementary or Secondary Education

community, not only within the organization, while relieving

r

government of a financial burden that it would otherwise be

Private Not-For-Profit Elementary and Secondary Education

required to meet)

(Must have received accreditation)

r

r

Religious (Churches, ministries, and religious groups. Exemption

Higher Education (Must have received accreditation)

applies to sales and purchases only if within the organization’s

r

religious, charitable, or educational functions)

Missouri Political Subdivision (Out-of-state political

subdivisions do not qualify)

r

Not-For-Profit Civic (Benefiting the citizenry at large on an

r

unrestricted basis. Exemption applies only if the sale or purchase

Federal or Missouri State Agency

is made for the organization’s civic or charitable functions and

r

activities)

Missouri Cooperative Marketing Association

(Exemption applies to purchases and only exempts state sales

r

Not-For-Profit Social, Service, Fraternal

tax. All purchases remain subject to local sales tax and all use

(Exemption applies only if the sale or purchase is made for the

taxes). By checking this box you are affirming that the association

organization’s civic or charitable functions and activities, and not

does at least 25% of its business with its members.

general operations of the organization)

NOTE: Unions, political organizations, and home owner associations do not qualify for a Missouri sales or use tax exemption.

Missouri Charter Number

Date Incorporated

(MM/DD/YYYY)

r

Missouri Corporation

___ ___ / ___ ___ / ___ ___ ___ ___

|

|

|

|

|

|

|

|

|

Missouri Certificate of Authority No.

Date Registered in Missouri

State of Incorporation

(MM/DD/YYYY)

r

Out-of-State Corporation

___ ___ / ___ ___ / ___ ___ ___ ___

|

|

|

|

|

|

|

|

|

Organization Name

Street Address - Do not use P.O. Box or Rural Route

Phone Number

(___ ___ ___)___ ___ ___-___ ___ ___ ___

City

State

Zip Code

County

Website Address

E-mail Address

r

r

Does your organization own property in Missouri?

Yes

No

r

r

Is your organization exempt from property tax?

Yes

No

Date organization originated

___ ___ / ___ ___ / ___ ___ ___ ___

(MM/DD/YYYY):

r

r

Does your organization make retail sale?

Yes

No

If you answered “Yes”, describe the frequency and type of sales you make.

Mailing Address (If different than Organization Address)

Street Address or P.O. Box

City

State

Zip Code

County

*14013010001*

14013010001

1

1 2

2