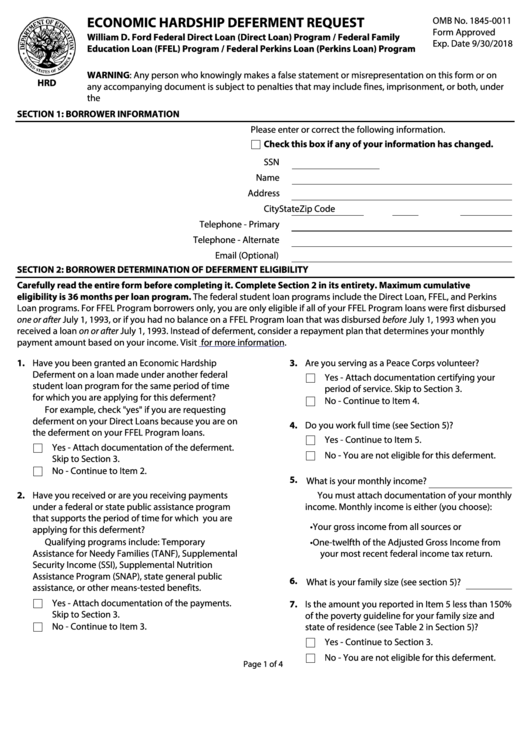

ECONOMIC HARDSHIP DEFERMENT REQUEST

OMB No. 1845-0011

Form Approved

William D. Ford Federal Direct Loan (Direct Loan) Program / Federal Family

Exp. Date 9/30/2018

Education Loan (FFEL) Program / Federal Perkins Loan (Perkins Loan) Program

WARNING: Any person who knowingly makes a false statement or misrepresentation on this form or on

HRD

any accompanying document is subject to penalties that may include fines, imprisonment, or both, under

the U.S. Criminal Code and 20 U.S.C. 1097.

SECTION 1: BORROWER INFORMATION

Please enter or correct the following information.

Check this box if any of your information has changed.

SSN

Name

Address

City

State

Zip Code

Telephone - Primary

Telephone - Alternate

Email (Optional)

SECTION 2: BORROWER DETERMINATION OF DEFERMENT ELIGIBILITY

Carefully read the entire form before completing it. Complete Section 2 in its entirety. Maximum cumulative

eligibility is 36 months per loan program. The federal student loan programs include the Direct Loan, FFEL, and Perkins

Loan programs. For FFEL Program borrowers only, you are only eligible if all of your FFEL Program loans were first disbursed

one or after July 1, 1993, or if you had no balance on a FFEL Program loan that was disbursed before July 1, 1993 when you

received a loan on or after July 1, 1993. Instead of deferment, consider a repayment plan that determines your monthly

StudentAid.gov/IDR

payment amount based on your income. Visit

for more information.

1. Have you been granted an Economic Hardship

3. Are you serving as a Peace Corps volunteer?

Deferment on a loan made under another federal

Yes - Attach documentation certifying your

student loan program for the same period of time

period of service. Skip to Section 3.

for which you are applying for this deferment?

No - Continue to Item 4.

For example, check "yes" if you are requesting

deferment on your Direct Loans because you are on

4. Do you work full time (see Section 5)?

the deferment on your FFEL Program loans.

Yes - Continue to Item 5.

Yes - Attach documentation of the deferment.

No - You are not eligible for this deferment.

Skip to Section 3.

No - Continue to Item 2.

5. What is your monthly income?

2. Have you received or are you receiving payments

You must attach documentation of your monthly

under a federal or state public assistance program

income. Monthly income is either (you choose):

that supports the period of time for which you are

• Your gross income from all sources or

applying for this deferment?

Qualifying programs include: Temporary

• One-twelfth of the Adjusted Gross Income from

Assistance for Needy Families (TANF), Supplemental

your most recent federal income tax return.

Security Income (SSI), Supplemental Nutrition

Assistance Program (SNAP), state general public

6. What is your family size (see section 5)?

assistance, or other means-tested benefits.

Yes - Attach documentation of the payments.

7. Is the amount you reported in Item 5 less than 150%

Skip to Section 3.

of the poverty guideline for your family size and

No - Continue to Item 3.

state of residence (see Table 2 in Section 5)?

Yes - Continue to Section 3.

No - You are not eligible for this deferment.

Page 1 of 4

1

1 2

2 3

3 4

4