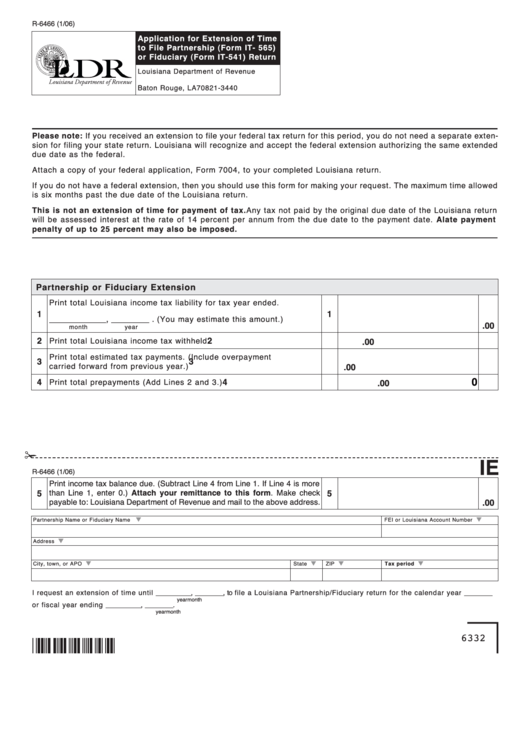

R-6466 (1/06)

Application for Extension of Time

to File Partnership (Form IT- 565)

or Fiduciary (Form IT-541) Return

Louisiana Department of Revenue

P.O. Box 3440

Baton Rouge, LA 70821-3440

Please note: If you received an extension to file your federal tax return for this period, you do not need a separate exten-

sion for filing your state return. Louisiana will recognize and accept the federal extension authorizing the same extended

due date as the federal.

Attach a copy of your federal application, Form 7004, to your completed Louisiana return.

If you do not have a federal extension, then you should use this form for making your request. The maximum time allowed

is six months past the due date of the Louisiana return.

This is not an extension of time for payment of tax. Any tax not paid by the original due date of the Louisiana return

will be assessed interest at the rate of 14 percent per annum from the due date to the payment date. A late payment

penalty of up to 25 percent may also be imposed.

Partnership or Fiduciary Extension

Print total Louisiana income tax liability for tax year ended.

1

1

____________, ________ .

(You may estimate this amount.)

.00

month

year

2

2

Print total Louisiana income tax withheld

.00

Print total estimated tax payments. (Include overpayment

3

3

carried forward from previous year.)

.00

0

4

4

Print total prepayments (Add Lines 2 and 3.)

.00

✁

IE

R-6466 (1/06)

Print income tax balance due. (Subtract Line 4 from Line 1. If Line 4 is more

than Line 1, enter 0.) Attach your remittance to this form. Make check

5

5

payable to: Louisiana Department of Revenue and mail to the above address.

.00

▼

▼

Partnership Name or Fiduciary Name

FEI or Louisiana Account Number

▼

Address

▼

▼

▼

▼

City, town, or APO

State

ZIP

Tax period

I request an extension of time until __________, ________, to file a Louisiana Partnership/Fiduciary return for the calendar year ________

month

year

or fiscal year ending __________, ________.

month

year

6332

1

1