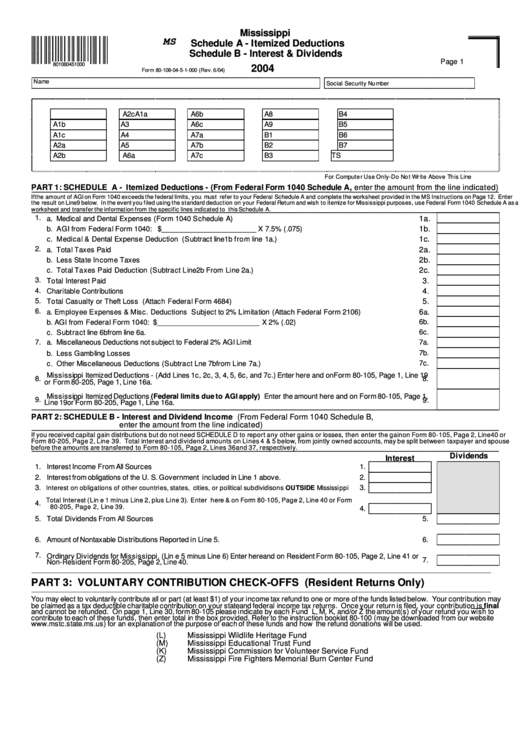

Form 80-108-04-5-1-000 - Mississippi Schedule A - Itemized Deductions & Schedule B - Interest & Dividends - 2004

ADVERTISEMENT

Mississippi

MS

Schedule A - Itemized Deductions

Schedule B - Interest & Dividends

Page 1

801080451000

2004

Form 80-108-04-5-1-000 (Rev. 6/04)

Name

Social Security Nu mb er

A1a

A2c

A6b

A8

B4

A1b

A3

A6c

A9

B5

A1c

A4

A7a

B1

B6

A2a

A5

A7b

B2

B7

A2b

A6a

A7c

B3

TS

For Comp ute r Use On ly-Do No t Wr ite Above Th is Line

PART 1: SCHEDULE A - Itemized Deductions - (From Federal Form 1040 Schedule A, enter the amount from the line indicated)

If the amount of AGI on Form 1040 exceeds the federal limits, you must refer to your Federal Schedule A and complete the worksheet provided in the MS Instructions on Page 12. Enter

the result on Line 9 below. In the event you filed using the standard deduction on your Federal Return and wish to itemize for Mississippi purposes, use Federal Form 1040 Schedule A as a

worksheet and transfer the information from the specific lines indicated to this Schedule A.

1.

1a.

a. Medical and Dental Expenses (Form 1040 Schedule A)

1b.

b. AGI from Federal Form 1040: $________________________ X 7.5% (.075)

1c.

c. Medical & Dental Expense Deduction (Subtract line 1b from line 1a.)

2.

2a.

a. Total Taxes Paid

2b.

b. Less State Income Taxes

2c.

c. Total Taxes Paid Deduction (Subtract Line 2b From Line 2a.)

3.

3.

Total Interest Paid

4.

4.

Charitable Contributions

5.

5.

Total Casualty or Theft Loss (Attach Federal Form 4684)

6.

a. Employee Expenses & Misc. Deductions Subject to 2% Limitation (Attach Federal Form 2106)

6

a.

6b.

b. AGI from Federal Form 1040: $__________________________ X 2% (.02)

6c.

c. Subtract line 6b from line 6a.

7.

a. Miscellaneous Deductions not subject to Federal 2% AGI Limit

7a.

7b.

b. Less Gambling Losses

7c.

c. Other Miscellaneous Deductions (Subtract Lne 7b from Line 7a.)

Mississippi Itemized Deductions - (Add Lines 1c, 2c, 3, 4, 5, 6c, and 7c.) Enter here and on Form 80-105, Page 1, Line 19

8.

8.

or Form 80-205, Page 1, Line 16a.

Mississippi Itemized Deductions (Federal limits due to AGI apply) Enter the amount here and on Form 80-105, Page 1,

9.

9.

Line 19 or Form 80-205, Page 1, Line 16a.

PART 2: SCHEDULE B - Interest and Dividend Income (From Federal Form 1040 Schedule B,

enter the amount from the line indicated)

If you received capital gain distributions but do not need SCHEDULE D to report any other gains or losses, then enter the gain on Form 80-105, Page 2, Line 40 or

Form 80-205, Page 2, Line 39. Total interest and dividend amounts on Lines 4 & 5 below, from jointly owned accounts, may be split between taxpayer and spouse

before the amounts are transferred to Form 80-105, Page 2, Lines 36 and 37, respectively.

Dividends

Interest

1.

Interest Income From All Sources

1.

2.

Interest from obligations of the U. S. Government included in Line 1 above.

2.

3.

3.

Interest on obligations of other countries, states, cities, or political subdividisons OUTSIDE Mississippi

Total Interest (Line 1 minus Line 2, plus Line 3). Enter here & on Form 80-105, Page 2, Line 40 or Form

4.

80-205, Page 2, Line 39.

4.

5.

Total Dividends From All Sources

5.

6.

Amount of Nontaxable Distributions Reported in Line 5.

6.

7.

Ordinary Dividends for Mississippi. (Line 5 minus Line 6) Enter here and on Resident Form 80-105, Page 2, Line 41 or

7.

Non-Resident Form 80-205, Page 2, Line 40.

PART 3: VOLUNTARY CONTRIBUTION CHECK-OFFS (Resident Returns Only)

You may elect to voluntarily contribute all or part (at least $1) of your income tax refund to one or more of the funds listed below. Your contribution may

be claimed as a tax deductible charitable contribution on your state and federal income tax returns. Once your return is filed, your contribution is final

and cannot be refunded. On page 1, Line 30, form 80-105 please indicate by each Fund L, M, K, and/or Z the amount(s) of your refund you wish to

contribute to each of these funds, then enter total in the box provided. Refer to the instruction booklet 80-100 (may be downloaded from our website

) for an explanation of the purpose of each of these funds and how the refund donations will be used.

(L)

Mississippi Wildlife Heritage Fund

(M)

Mississippi Educational Trust Fund

(K)

Mississippi Commission for Volunteer Service Fund

(Z)

Mississippi Fire Fighters Memorial Burn Center Fund

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2