Advance Draft For Form 100s Schedule B And C - S Corporation Depreciation And Amortization And Tax Credits - 2016

ADVERTISEMENT

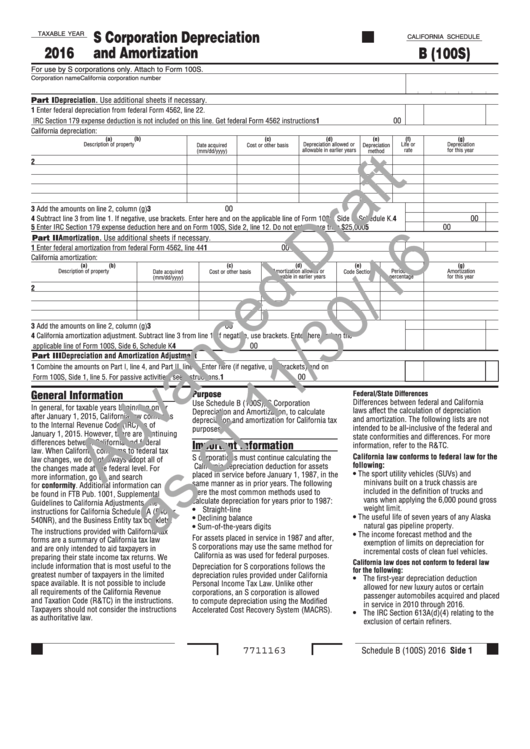

S Corporation Depreciation

TAXABLE YEAR

CALIFORNIA SCHEDULE

2016

and Amortization

B (100S)

For use by S corporations only. Attach to Form 100S.

Corporation name

California corporation number

Part I Depreciation. Use additional sheets if necessary.

1 Enter federal depreciation from federal Form 4562, line 22.

IRC Section 179 expense deduction is not included on this line. Get federal Form 4562 instructions . . . . . . . . . . . . . . . . . . . .

1

00

California depreciation:

(a)

(b)

(c)

(d)

(e)

(f)

(g)

Description of property

Depreciation allowed or

Life or

Depreciation

Date acquired

Cost or other basis

Depreciation

allowable in earlier years

rate

for this year

(mm/dd/yyyy)

method

2

00

3 Add the amounts on line 2, column (g) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

3

00

4 Subtract line 3 from line 1. If negative, use brackets. Enter here and on the applicable line of Form 100S, Side 6, Schedule K.

4

00

5 Enter IRC Section 179 expense deduction here and on Form 100S, Side 2, line 12. Do not enter more than $25,000 . . . . . . .

5

Part II Amortization. Use additional sheets if necessary.

00

1 Enter federal amortization from federal Form 4562, line 44 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

1

California amortization:

(a)

(b)

(c)

(d)

(e)

(f)

(g)

Description of property

Amortization allowed or

Period or

Amortization

Date acquired

Cost or other basis

Code Section

allowable in earlier years

percentage

for this year

(mm/dd/yyyy)

2

00

3 Add the amounts on line 2, column (g) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

3

4 California amortization adjustment. Subtract line 3 from line 1. If negative, use brackets. Enter here and on the

00

applicable line of Form 100S, Side 6, Schedule K . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

4

Part III Depreciation and Amortization Adjustment

1

Combine the amounts on Part I, line 4, and Part II, line 4. Enter here (if negative, use brackets) and on

00

Form 100S, Side 1, line 5. For passive activities, see instructions. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

1

General Information

Purpose

Federal/State Differences

Differences between federal and California

Use Schedule B (100S), S Corporation

In general, for taxable years beginning on or

laws affect the calculation of depreciation

Depreciation and Amortization, to calculate

after January 1, 2015, California law conforms

and amortization. The following lists are not

depreciation and amortization for California tax

to the Internal Revenue Code (IRC) as of

intended to be all-inclusive of the federal and

purposes.

January 1, 2015. However, there are continuing

state conformities and differences. For more

differences between California and federal

Important Information

information, refer to the R&TC.

law. When California conforms to federal tax

California law conforms to federal law for the

S corporations must continue calculating the

law changes, we do not always adopt all of

following:

California depreciation deduction for assets

the changes made at the federal level. For

• The sport utility vehicles (SUVs) and

placed in service before January 1, 1987, in the

more information, go to ftb.ca.gov and search

minivans built on a truck chassis are

same manner as in prior years. The following

for conformity. Additional information can

included in the definition of trucks and

were the most common methods used to

be found in FTB Pub. 1001, Supplemental

vans when applying the 6,000 pound gross

calculate depreciation for years prior to 1987:

Guidelines to California Adjustments, the

weight limit.

• Straight-line

instructions for California Schedule CA (540 or

• The useful life of seven years of any Alaska

• Declining balance

540NR), and the Business Entity tax booklets.

natural gas pipeline property.

• Sum-of-the-years digits

The instructions provided with California tax

• The income forecast method and the

For assets placed in service in 1987 and after,

forms are a summary of California tax law

exemption of limits on depreciation for

S corporations may use the same method for

and are only intended to aid taxpayers in

incremental costs of clean fuel vehicles.

California as was used for federal purposes.

preparing their state income tax returns. We

California law does not conform to federal law

include information that is most useful to the

Depreciation for S corporations follows the

for the following:

greatest number of taxpayers in the limited

depreciation rules provided under California

• The first-year depreciation deduction

space available. It is not possible to include

Personal Income Tax Law. Unlike other

allowed for new luxury autos or certain

all requirements of the California Revenue

corporations, an S corporation is allowed

passenger automobiles acquired and placed

and Taxation Code (R&TC) in the instructions.

to compute depreciation using the Modified

in service in 2010 through 2016.

Taxpayers should not consider the instructions

Accelerated Cost Recovery System (MACRS).

• The IRC Section 613A(d)(4) relating to the

as authoritative law.

exclusion of certain refiners.

7711163

Schedule B (100S) 2016 Side 1

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3