Form It-140 Draft - Schedule T And Tax Credit Recap Schedule - 2009

ADVERTISEMENT

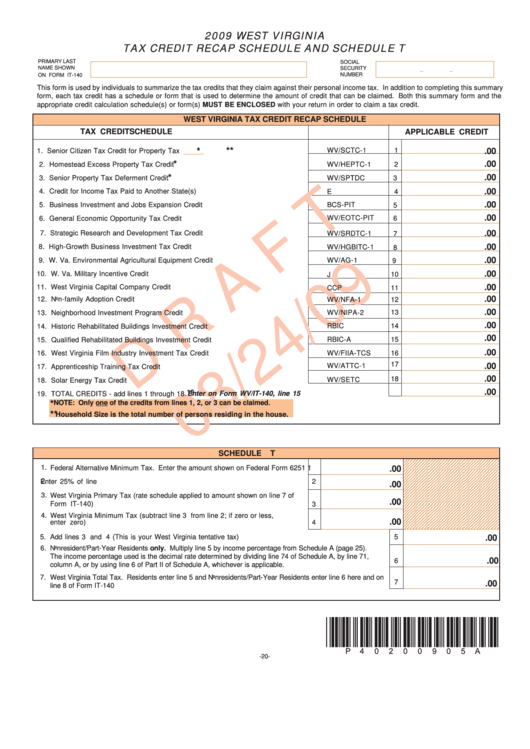

2009 WEST VIRGINIA

TAX CREDIT RECAP SCHEDULE AND SCHEDULE T

PRIMARY LAST

SOCIAL

NAME SHOWN

SECURITY

NUMBER

ON FORM IT-140

This form is used by individuals to summarize the tax credits that they claim against their personal income tax. In addition to completing this summary

form, each tax credit has a schedule or form that is used to determine the amount of credit that can be claimed. Both this summary form and the

appropriate credit calculation schedule(s) or form(s) MUST BE ENCLOSED with your return in order to claim a tax credit.

WEST VIRGINIA TAX CREDIT RECAP SCHEDULE

TAX CREDIT

SCHEDULE

APPLICABLE CREDIT

**

*

WV/SCTC-1

1

.00

1. Senior Citizen Tax Credit for Property Tax Paid.............

Household Size

_____

*

.00

2. Homestead Excess Property Tax Credit ....................................................................

WV/HEPTC-1

2

*

.00

3. Senior Property Tax Deferment Credit .......................................................................

WV/SPTDC

3

.00

4. Credit for Income Tax Paid to Another State(s) ........................................................

E

4

.00

5. Business Investment and Jobs Expansion Credit ....................................................

BCS-PIT

5

.00

WV/EOTC-PIT

6. General Economic Opportunity Tax Credit ................................................................

6

.00

7. Strategic Research and Development Tax Credit ....................................................

WV/SRDTC-1

7

.00

8. High-Growth Business Investment Tax Credit ...........................................................

WV/HGBITC-1

8

.00

9. W. Va. Environmental Agricultural Equipment Credit ................................................

WV/AG-1

9

.00

10. W. Va. Military Incentive Credit ..................................................................................

J

10

.00

11. West Virginia Capital Company Credit ......................................................................

CCP

11

.00

12. Non-family Adoption Credit ........................................................................................

12

WV/NFA-1

.00

13

13. Neighborhood Investment Program Credit ................................................................

WV/NIPA-2

.00

RBIC

14. Historic Rehabilitated Buildings Investment Credit ...................................................

14

.00

RBIC-A

15

15. Qualified Rehabilitated Buildings Investment Credit ................................................

.00

16

16. West Virginia Film Industry Investment Tax Credit ...................................................

WV/FIIA-TCS

17

WV/ATTC-1

.00

17. Apprenticeship Training Tax Credit ............................................................................

.00

18

WV/SETC

18. Solar Energy Tax Credit .............................................................................................

.00

19

Enter on Form WV/IT-140, line 15..............................................

19. TOTAL CREDITS - add lines 1 through 18.

NOTE: Only one of the credits from lines 1, 2, or 3 can be claimed.

*

**

Household Size is the total number of persons residing in the house.

SCHEDULE

T

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 1 2

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 1 2

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 1 2

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 1 2

1.

Federal Alternative Minimum Tax. Enter the amount shown on Federal Form 6251 1

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 1 2

.00

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 1 2

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 1 2

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 1 2

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 1 2

2.

Enter 25% of line 1...................................................................................................

2

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 1 2

.00

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 1 2

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 1 2

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 1 2

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 1 2

3.

West Virginia Primary Tax (rate schedule applied to amount shown on line 7 of

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 1 2

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 1 2

.00

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 1 2

Form IT-140)...........................................................................................................

3

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 1 2

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 1 2

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 1 2

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 1 2

4.

West Virginia Minimum Tax (subtract line 3 from line 2; if zero or less,

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 1 2

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 1 2

.00

enter zero)...............................................................................................................

4

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 1 2

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 1 2

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 1 2

Add lines 3 and 4 (This is your West Virginia tentative tax)...........................................................................

5.

5

.00

6.

Nonresident/Part-Year Residents only. Multiply line 5 by income percentage from Schedule A (page 25). .......

The income percentage used is the decimal rate determined by dividing line 74 of Schedule A, by line 71,

.00

6

column A, or by using line 6 of Part II of Schedule A, whichever is applicable. ....................................................

7.

West Virginia Total Tax. Residents enter line 5 and Nonresidents/Part-Year Residents enter line 6 here and on

7

.00

line 8 of Form IT-140 .............................................................................................................................................

*P40200905A*

-20-

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2