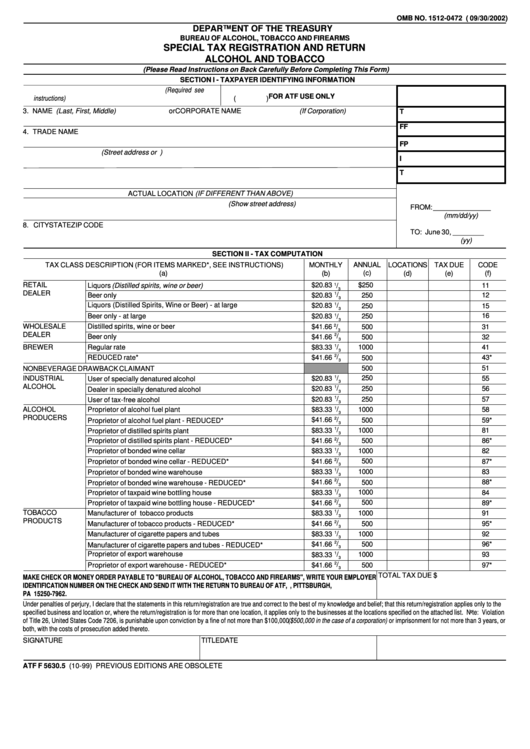

Form Atf F 5630.5 - Special Tax Registration And Return Alcohol And Tobacco

ADVERTISEMENT

OMB NO. 1512-0472 ( 09/30/2002)

DEPARTMENT OF THE TREASURY

BUREAU OF ALCOHOL, TOBACCO AND FIREARMS

SPECIAL TAX REGISTRATION AND RETURN

ALCOHOL AND TOBACCO

(Please Read Instructions on Back Carefully Before Completing This Form)

SECTION I - TAXPAYER IDENTIFYING INFORMATION

1. EMPLOYER IDENTIFICATION NUMBER (Required see

2. BUSINESS TELEPHONE NUMBER

FOR ATF USE ONLY

instructions)

(

)

3. NAME (Last, First, Middle)

or

CORPORATE NAME (If Corporation)

T

FF

4. TRADE NAME

FP

5. MAILING ADDRESS (Street address or P.O. box number)

I

T

6. CITY

STATE

ZIP CODE

9. TAX PERIOD COVERING

ACTUAL LOCATION (IF DIFFERENT THAN ABOVE)

7. PHYSICAL ADDRESS OF PRINCIPAL PLACE OF BUSINESS (Show street address)

FROM: _______________

(mm/dd/yy)

8. CITY

STATE

ZIP CODE

TO: June 30, ________

(yy)

SECTION II - TAX COMPUTATION

TAX CLASS DESCRIPTION (FOR ITEMS MARKED*, SEE INSTRUCTIONS)

MONTHLY

ANNUAL

LOCATIONS

TAX DUE

CODE

(c)

(a)

(b)

(d)

(e)

(f)

RETAIL

$20.83

1

$250

Liquors (Distilled spirits, wine or beer)

/

11

3

DEALER

1

/

Beer only

$20.83

250

12

3

Liquors (Distilled Spirits, Wine or Beer) - at large

1

$20.83

/

250

15

3

16

Beer only - at large

$20.83

1

/

250

3

WHOLESALE

2

Distilled spirits, wine or beer

$41.66

/

500

31

3

DEALER

2

/

Beer only

$41.66

500

32

3

1

BREWER

Regular rate

$83.33

/

1000

41

3

2

/

REDUCED rate*

$41.66

500

43*

3

500

51

NONBEVERAGE DRAWBACK CLAIMANT

1

INDUSTRIAL

$20.83

/

250

User of specially denatured alcohol

55

3

ALCOHOL

1

/

250

$20.83

56

Dealer in specially denatured alcohol

3

1

$20.83

/

250

57

User of tax-free alcohol

3

ALCOHOL

1

/

Proprietor of alcohol fuel plant

$83.33

1000

58

3

PRODUCERS

2

/

$41.66

500

Proprietor of alcohol fuel plant - REDUCED*

59*

3

1

/

1000

81

$83.33

Proprietor of distilled spirits plant

3

2

/

Proprietor of distilled spirits plant - REDUCED*

$41.66

500

86*

3

1

Proprietor of bonded wine cellar

$83.33

/

1000

82

3

2

/

500

Proprietor of bonded wine cellar - REDUCED*

$41.66

87*

3

1

/

$83.33

1000

83

Proprietor of bonded wine warehouse

3

2

/

$41.66

88*

500

Proprietor of bonded wine warehouse - REDUCED*

3

1

/

1000

Proprietor of taxpaid wine bottling house

$83.33

84

3

2

/

Proprietor of taxpaid wine bottling house - REDUCED*

$41.66

500

89*

3

1

/

TOBACCO

Manufacturer of tobacco products

$83.33

1000

91

3

PRODUCTS

2

/

Manufacturer of tobacco products - REDUCED*

$41.66

500

95*

3

1

/

92

Manufacturer of cigarette papers and tubes

$83.33

1000

3

2

/

500

96*

$41.66

Manufacturer of cigarette papers and tubes - REDUCED*

3

Proprietor of export warehouse

1

$83.33

/

1000

93

3

2

/

Proprietor of export warehouse - REDUCED*

$41.66

500

97*

3

TOTAL TAX DUE $

MAKE CHECK OR MONEY ORDER PAYABLE TO "BUREAU OF ALCOHOL, TOBACCO AND FIREARMS", WRITE YOUR EMPLOYER

IDENTIFICATION NUMBER ON THE CHECK AND SEND IT WITH THE RETURN TO BUREAU OF ATF, P.O. BOX 371962, PITTSBURGH,

PA 15250-7962.

Under penalties of perjury, I declare that the statements in this return/registration are true and correct to the best of my knowledge and belief; that this return/registration applies only to the

specified business and location or, where the return/registration is for more than one location, it applies only to the businesses at the locations specified on the attached list. Note: Violation

of Title 26, United States Code 7206, is punishable upon conviction by a fine of not more than $100,000 ($500,000 in the case of a corporation) or imprisonment for not more than 3 years, or

both, with the costs of prosecution added thereto.

SIGNATURE

TITLE

DATE

ATF F 5630.5 (10-99) PREVIOUS EDITIONS ARE OBSOLETE

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1 2

2