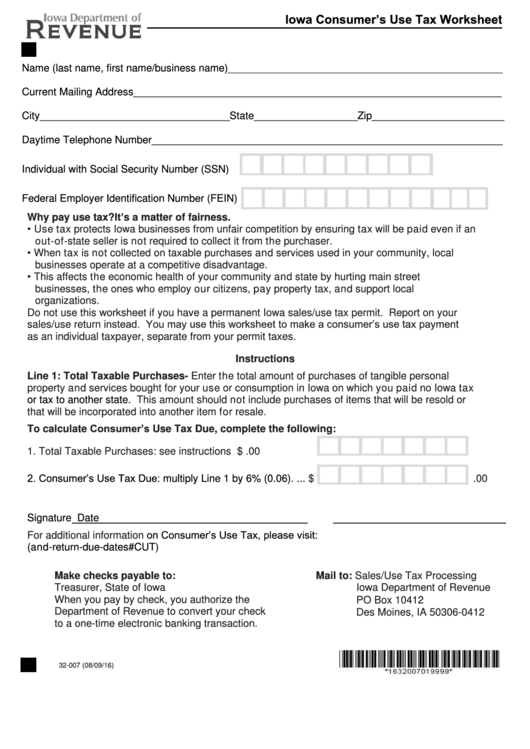

Iowa Consumer’s Use Tax Worksheet

https://tax.iowa.gov

Name (last name, first name/business name)________________________________________________

Current Mailing Address________________________________________________________________

City_________________________________State__________________Zip_______________________

Daytime Telephone Number_____________________________________________________________

Individual with Social Security Number (SSN)

Federal Employer Identification Number (FEIN)

Why pay use tax? It’s a matter of fairness.

• Use tax protects Iowa businesses from unfair competition by ensuring tax will be paid even if an

out-of-state seller is not required to collect it from the purchaser.

• When tax is not collected on taxable purchases and services used in your community, local

businesses operate at a competitive disadvantage.

• This affects the economic health of your community and state by hurting main street

businesses, the ones who employ our citizens, pay property tax, and support local

organizations.

Do not use this worksheet if you have a permanent Iowa sales/use tax permit. Report on your

sales/use return instead. You may use this worksheet to make a consumer’s use tax payment

as an individual taxpayer, separate from your permit taxes.

Instructions

Line 1: Total Taxable Purchases - Enter the total amount of purchases of tangible personal

property and services bought for your use or consumption in Iowa on which you paid no Iowa tax

or tax to another state.

This amount should not include purchases of items that will be resold or

that will be incorporated into another item for resale.

To calculate Consumer’s Use Tax Due, complete the following:

1. Total Taxable Purchases: see instructions ......................... $

.00

2. Consumer’s Use Tax Due: multiply Line 1 by 6% (0.06). ...

$

.00

Signature

Date

on Consumer’s Use Tax, please visit:

For additional information

(https://tax.iowa.gov/businesses/filing-frequencies-and-return-due-dates#CUT)

Make checks payable to:

Mail to: Sales/Use Tax Processing

Treasurer, State of Iowa

Iowa Department of Revenue

When you pay by check, you authorize the

PO Box 10412

Department of Revenue to convert your check

Des Moines, IA 50306-0412

to a one-time electronic banking transaction.

32-007 (08/09/16)

1

1