State Form 44469 - Sales And Use Tax - Indiana Department Of Revenue

ADVERTISEMENT

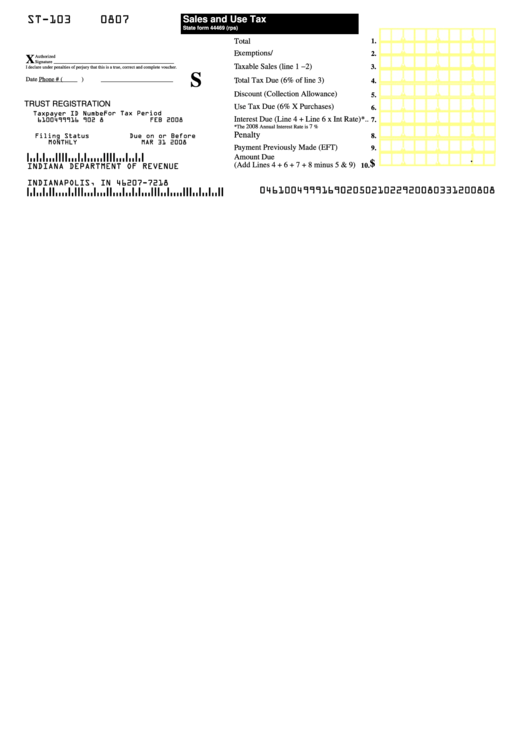

ST-103

0807

Sales and Use Tax

State form 44469 (rps)

.

,

,

Total Sales....................................................

1.

.

,

,

Exemptions/Deductions................................

2.

X

Authorized

.

Signature

,

,

Taxable Sales (line 1 −2).............................

3.

I declare under penalties of perjury that this is a true, correct and complete voucher.

S

.

,

,

Date

Phone # (

)

Total Tax Due (6% of line 3).......................

4.

.

,

,

Discount (Collection Allowance).................

5.

TRUST REGISTRATION

.

,

,

Use Tax Due (6% X Purchases)...................

6.

Taxpayer ID Number

For Tax Period

.

,

,

Interest Due (Line 4 + Line 6 x Int Rate)*..

7.

6100499916 902 8

FEB 2008

2008

7

*The

Annual Interest Rate is

%

.

,

,

Penalty Due...........................................

Filing Status

Due on or Before

8.

MONTHLY

MAR 31 2008

.

,

,

Payment Previously Made (EFT).................

9.

(2109108(

Amount Due

.

,

,

$

(Add Lines 4 + 6 + 7 + 8 minus 5 & 9)

10.

INDIANA DEPARTMENT OF REVENUE

P.O. Box 7218

INDIANAPOLIS, IN 46207-7218

(462077218184(

04610049991690205021022920080331200808

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1