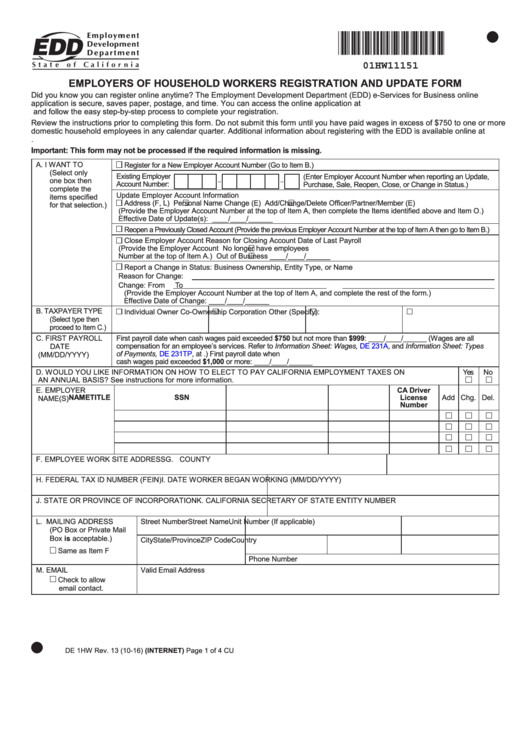

01HW11151

EMPLOYERS OF HOUSEHOLD WORKERS REGISTRATION AND UPDATE FORM

Did you know you can register online anytime? The Employment Development Department (EDD) e-Services for Business online

application is secure, saves paper, postage, and time. You can access the online application at

and follow the easy step-by-step process to complete your registration.

Review the instructions prior to completing this form. Do not submit this form until you have paid wages in excess of $750 to one or more

domestic household employees in any calendar quarter. Additional information about registering with the EDD is available online at

Important: This form may not be processed if the required information is missing.

A. I WANT TO

Register for a New Employer Account Number (Go to Item B.)

(Select only

Existing Employer

(Enter Employer Account Number when reporting an Update,

one box then

–

–

Account Number:

Purchase, Sale, Reopen, Close, or Change in Status.)

complete the

Update Employer Account Information

items specified

Address (F, L)

Personal Name Change (E)

Add/Change/Delete Officer/Partner/Member (E)

for that selection.)

(Provide the Employer Account Number at the top of Item A, then complete the Items identified above and Item O.)

Effective Date of Update(s): ____/____/______

Reopen a Previously Closed Account (Provide the previous Employer Account Number at the top of Item A then go to Item B.)

Close Employer Account

Reason for Closing Account

Date of Last Payroll

(Provide the Employer Account

No longer have employees

Number at the top of Item A.)

Out of Business

____/____/______

Report a Change in Status: Business Ownership, Entity Type, or Name

Reason for Change:

Change: From

To

(Provide the Employer Account Number at the top of Item A, and complete the rest of the form.)

Effective Date of Change: ____/____/______

B. TAXPAYER TYPE

Individual Owner

Co-Ownership

Corporation

Other (Specify):

(Select type then

proceed to Item C.)

C. FIRST PAYROLL

First payroll date when cash wages paid exceeded $750 but not more than $999: ____/____/______ (Wages are all

DATE

compensation for an employee’s services. Refer to Information Sheet: Wages,

DE

231A, and Information Sheet: Types

of Payments,

DE

231TP, at ) First payroll date when

(MM/DD/YYYY)

cash wages paid exceeded $1,000 or more: ____/____/______

D. WOULD YOU LIKE INFORMATION ON HOW TO ELECT TO PAY CALIFORNIA EMPLOYMENT TAXES ON

Yes

No

AN ANNUAL BASIS? See instructions for more information.

CA Driver

E. EMPLOYER

NAME

TITLE

SSN

License

Add Chg. Del.

NAME(S)

Number

F.

EMPLOYEE WORK SITE ADDRESS

G. COUNTY

H. FEDERAL TAX ID NUMBER (FEIN)

I.

DATE WORKER BEGAN WORKING (MM/DD/YYYY)

J.

STATE OR PROVINCE OF INCORPORATION

K. CALIFORNIA SECRETARY OF STATE ENTITY NUMBER

L.

MAILING ADDRESS

Street Number

Street Name

Unit Number (If applicable)

(PO Box or Private Mail

Box is acceptable.)

City

State/Province

ZIP Code

Country

Same as Item F

Phone Number

M. EMAIL

Valid Email Address

Check to allow

email contact.

DE 1HW Rev. 13 (10-16) (INTERNET)

Page 1 of 4

CU

1

1 2

2