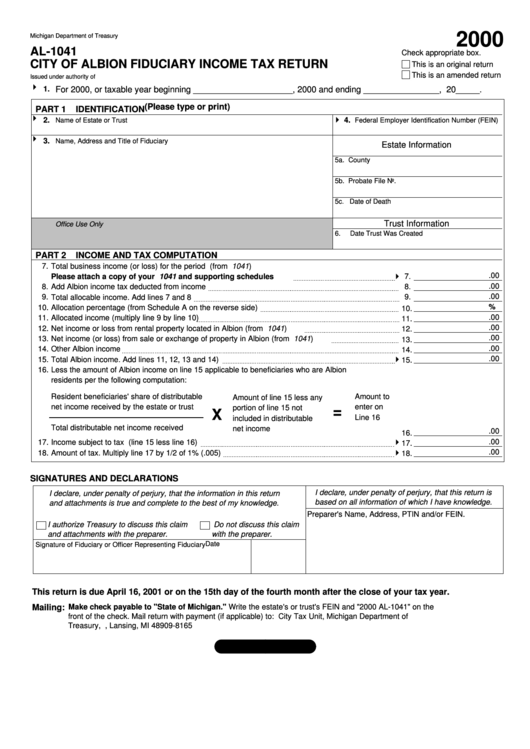

Form Al-1041 - City Of Albion Fiduciary Income Tax Return - 2000

ADVERTISEMENT

2000

Michigan Department of Treasury

AL-1041

Check appropriate box.

CITY OF ALBION FIDUCIARY INCOME TAX RETURN

This is an original return

This is an amended return

Issued under authority of P.A. 284 of 1964. Filing is mandatory.

1.

For 2000, or taxable year beginning _____________________, 2000 and ending ________________, 20_____.

(Please type or print)

PART 1

IDENTIFICATION

2.

4.

Name of Estate or Trust

Federal Employer Identification Number (FEIN)

3.

Name, Address and Title of Fiduciary

Estate Information

5a. County

5b. Probate File No.

5c. Date of Death

Trust Information

Office Use Only

6.

Date Trust Was Created

PART 2

INCOME AND TAX COMPUTATION

7.

Total business income (or loss) for the period (from U.S. 1041)

.00

7.

Please attach a copy of your U.S. 1041 and supporting schedules

.00

8.

8.

Add Albion income tax deducted from income

.00

9.

9.

Total allocable income. Add lines 7 and 8

%

10.

Allocation percentage (from Schedule A on the reverse side)

10.

.00

11.

Allocated income (multiply line 9 by line 10)

11.

.00

12.

Net income or loss from rental property located in Albion (from U.S. 1041)

12.

.00

13.

Net income (or loss) from sale or exchange of property in Albion (from U.S. 1041)

13.

.00

14.

Other Albion income

14.

.00

15.

Total Albion income. Add lines 11, 12, 13 and 14)

15.

16.

Less the amount of Albion income on line 15 applicable to beneficiaries who are Albion

residents per the following computation:

Resident beneficiaries' share of distributable

Amount to

Amount of line 15 less any

net income received by the estate or trust

enter on

portion of line 15 not

=

X

Line 16

included in distributable

Total distributable net income received

net income

.00

16.

.00

17.

Income subject to tax (line 15 less line 16)

17.

.00

18.

Amount of tax. Multiply line 17 by 1/2 of 1% (.005)

18.

SIGNATURES AND DECLARATIONS

I declare, under penalty of perjury, that this return is

I declare, under penalty of perjury, that the information in this return

based on all information of which I have knowledge.

and attachments is true and complete to the best of my knowledge.

Preparer's Name, Address, PTIN and/or FEIN.

I authorize Treasury to discuss this claim

Do not discuss this claim

and attachments with the preparer.

with the preparer.

Date

Signature of Fiduciary or Officer Representing Fiduciary

This return is due April 16, 2001 or on the 15th day of the fourth month after the close of your tax year.

Make check payable to "State of Michigan." Write the estate's or trust's FEIN and "2000 AL-1041" on the

Mailing:

front of the check. Mail return with payment (if applicable) to: City Tax Unit, Michigan Department of

Treasury, P.O. Box 30665, Lansing, MI 48909-8165

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3