Form W-9s - Taxicab Driver'S Income & Expense Worksheet

ADVERTISEMENT

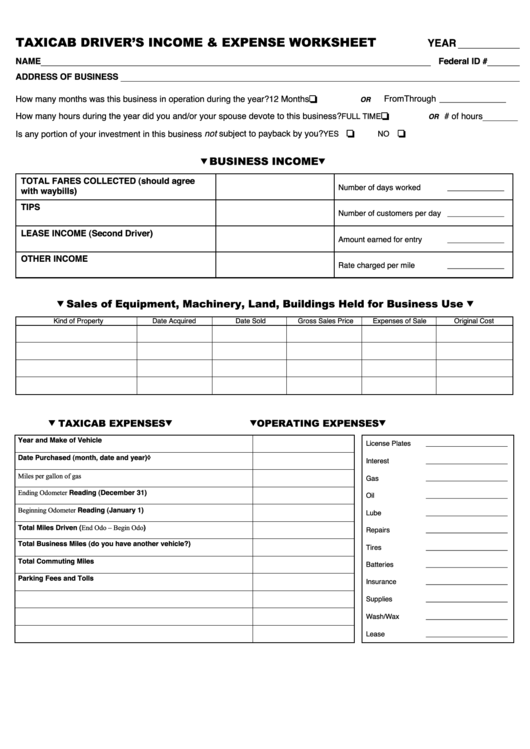

TAXICAB DRIVER’S INCOME & EXPENSE WORKSHEET

YEAR

________________

NAME_________________________________________________________________________________________ Federal ID # ______________________________

ADDRESS OF BUSINESS _________________________________________________________________________________________________________________

❏

How many months was this business in operation during the year?

12 Months

From

Through ______________

OR

❏

# of hours ________

How many hours during the year did you and/or your spouse devote to this business?

FULL TIME

OR

❏

❏

Is any portion of your investment in this business not subject to payback by you?

YES

NO

BUSINESS INCOME

TOTAL FARES COLLECTED (should agree

Number of days worked

_____________

with waybills)

TIPS

Number of customers per day _____________

LEASE INCOME (Second Driver)

Amount earned for entry

_____________

OTHER INCOME

Rate charged per mile

_____________

Sales of Equipment, Machinery, Land, Buildings Held for Business Use

Kind of Property

Date Acquired

Date Sold

Gross Sales Price

Expenses of Sale

Original Cost

TAXICAB EXPENSES

OPERATING EXPENSES

Year and Make of Vehicle

License Plates

_____________________

Date Purchased (month, date and year)◊

Interest

_____________________

Miles per gallon of gas

Gas

_____________________

Ending Odometer Reading (December 31)

Oil

_____________________

Beginning Odometer Reading (January 1)

Lube

_____________________

Total Miles Driven (End Odo – Begin Odo)

Repairs

_____________________

Total Business Miles (do you have another vehicle?)

Tires

_____________________

Total Commuting Miles

Batteries

_____________________

Parking Fees and Tolls

Insurance

_____________________

Supplies

_____________________

Wash/Wax

_____________________

Lease

_____________________

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2