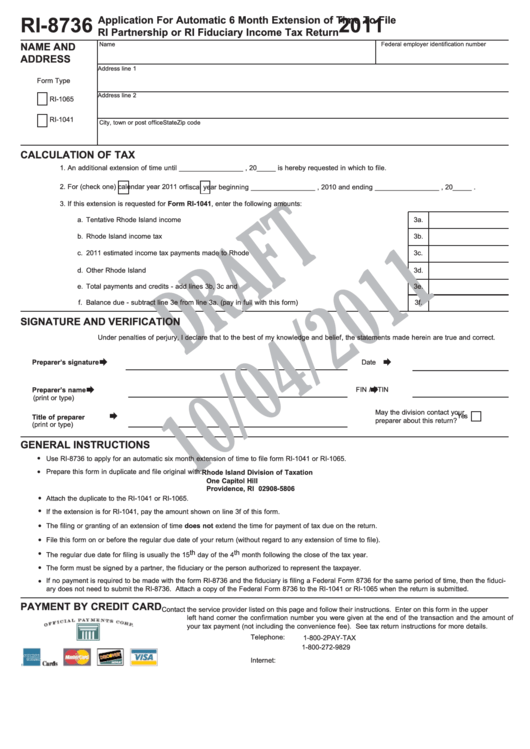

Form Ri-8736 - Application For Automatic 6 Month Exrtnership Or Tension Of Time To File Ri Pari Fiduciary Income Tax Return - 2011

ADVERTISEMENT

Application For Automatic 6 Month Extension of Time To File

RI-8736

2011

RI Partnership or RI Fiduciary Income Tax Return

Federal employer identification number

Name

NAME AND

ADDRESS

Address line 1

Form Type

Address line 2

RI-1065

RI-1041

City, town or post office

State

Zip code

CALCULATION OF TAX

1. An additional extension of time until _________________ , 20_____ is hereby requested in which to file.

2. For (check one)

calendar year 2011 or

fiscal year beginning _________________ , 2010 and ending _________________ , 20_____ .

3. If this extension is requested for Form RI-1041, enter the following amounts:

a.

Tentative Rhode Island income tax...................................................................................................................

3a.

b.

Rhode Island income tax withheld....................................................................................................................

3b.

c.

2011 estimated income tax payments made to Rhode Island..........................................................................

3c.

d.

Other Rhode Island credits................................................................................................................................

3d.

e.

Total payments and credits - add lines 3b, 3c and 3d......................................................................................

3e.

f.

Balance due - subtract line 3e from line 3a. (pay in full with this form)............................................................

3f.

SIGNATURE AND VERIFICATION

Under penalties of perjury, I declare that to the best of my knowledge and belief, the statements made herein are true and correct.

Preparer’s signature

Date

Preparer’s name

FIN / PTIN

(print or type)

May the division contact your

Yes

Title of preparer

preparer about this return?

(print or type)

GENERAL INSTRUCTIONS

•

Use RI-8736 to apply for an automatic six month extension of time to file form RI-1041 or RI-1065.

•

Prepare this form in duplicate and file original with:

Rhode Island Division of Taxation

One Capitol Hill

Providence, RI 02908-5806

•

Attach the duplicate to the RI-1041 or RI-1065.

•

If the extension is for RI-1041, pay the amount shown on line 3f of this form.

•

The filing or granting of an extension of time does not extend the time for payment of tax due on the return.

•

File this form on or before the regular due date of your return (without regard to any extension of time to file).

•

The regular due date for filing is usually the 15 th day of the 4 th month following the close of the tax year.

•

The form must be signed by a partner, the fiduciary or the person authorized to represent the taxpayer.

•

If no payment is required to be made with the form RI-8736 and the fiduciary is filing a Federal Form 8736 for the same period of time, then the fiduci-

ary does not need to submit the RI-8736. Attach a copy of the Federal Form 8736 to the RI-1041 or RI-1065 when the return is submitted.

PAYMENT BY CREDIT CARD

Contact the service provider listed on this page and follow their instructions. Enter on this form in the upper

left hand corner the confirmation number you were given at the end of the transaction and the amount of

your tax payment (not including the convenience fee). See tax return instructions for more details.

Telephone:

1-800-2PAY-TAX

1-800-272-9829

Internet:

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1