Form 105 - Colorado Fiduciary Income Tax Return - 2000

ADVERTISEMENT

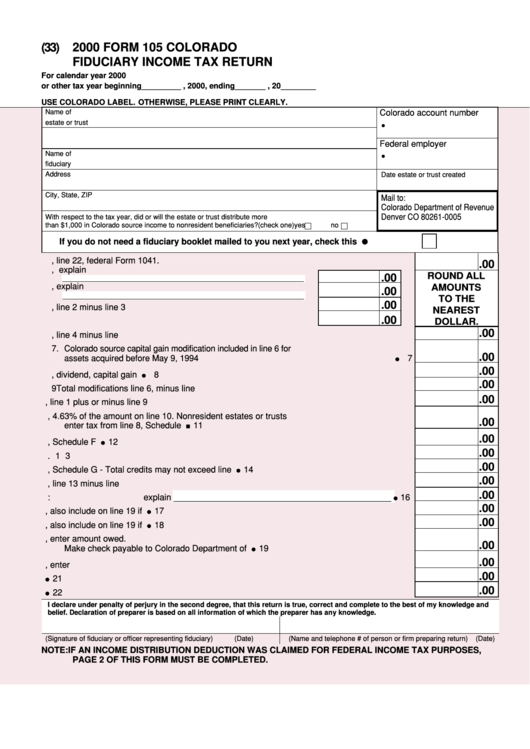

2000 FORM 105 COLORADO

(33)

FIDUCIARY INCOME TAX RETURN

For calendar year 2000

or other tax year beginning _________ , 2000, ending _______ , 20________

USE COLORADO LABEL. OTHERWISE, PLEASE PRINT CLEARLY.

Name of

Colorado account number

estate or trust

•

Federal employer I.D. No.

Name of

•

fiduciary

Address

Date estate or trust created

City, State, ZIP

Mail to:

Colorado Department of Revenue

Denver CO 80261-0005

With respect to the tax year, did or will the estate or trust distribute more

than $1,000 in Colorado source income to nonresident beneficiaries? (check one)

yes

no

If you do not need a fiduciary booklet mailed to you next year, check this box .............

1. Federal taxable income, line 22, federal Form 1041. ......................................................... 1

.00

2. Modifications increasing federal taxable income, explain

ROUND ALL

.00

.................................................................................................... 2

3. Modifications decreasing federal taxable income, explain

AMOUNTS

.00

.................................................................................................... 3

TO THE

.00

4. Net modifications, line 2 minus line 3 ......................................... 4

NEAREST

.00

5. Net modifications allocated to beneficiaries ............................... 5

DOLLAR.

.00

6. Net modifications allocated to the estate or trust, line 4 minus line 5 ...............................

6

7. Colorado source capital gain modification included in line 6 for

.00

assets acquired before May 9, 1994 .................................................................................

7

.00

8. Interest, dividend, capital gain modification ....................................................................

8

.00

9 Total modifications line 6, minus line 8 .............................................................................

9

.00

10. Colorado taxable income of the estate or trust, line 1 plus or minus line 9 ...................... 10

11. Normal Tax, 4.63% of the amount on line 10. Nonresident estates or trusts

.00

enter tax from line 8, Schedule E ...................................................................................

11

.00

12. Alternative minimum tax from line 8, Schedule F ...........................................................

12

.00

13. Total lines 11 and 12 ........................................................................................................ 13

.00

14. Credits from line 4, Schedule G - Total credits may not exceed line 13 ........................

14

.00

15. Net tax, line 13 minus line 14 ........................................................................................... 15

.00

16. Prepayment credits: explain _______________________________________________

16

.00

17. Penalty, also include on line 19 if applicable .................................................................

17

.00

18. Interest, also include on line 19 if applicable .................................................................

18

19. If amount on line 15 exceeds amount on line 16, enter amount owed.

.00

Make check payable to Colorado Department of Revenue. ...........................................

19

.00

20. If line 16 is larger than line 15, enter overpayment. .......................................................... 20

.00

21. Overpayment to be credited to 2001 estimated tax ........................................................

21

.00

22. Overpayment to be refunded ..........................................................................................

22

I declare under penalty of perjury in the second degree, that this return is true, correct and complete to the best of my knowledge and

belief. Declaration of preparer is based on all information of which the preparer has any knowledge.

(Signature of fiduciary or officer representing fiduciary)

(Date)

(Name and telephone # of person or firm preparing return)

(Date)

NOTE: IF AN INCOME DISTRIBUTION DEDUCTION WAS CLAIMED FOR FEDERAL INCOME TAX PURPOSES,

PAGE 2 OF THIS FORM MUST BE COMPLETED.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5