Quarterly Utility Tax Return - City Of Blaine

ADVERTISEMENT

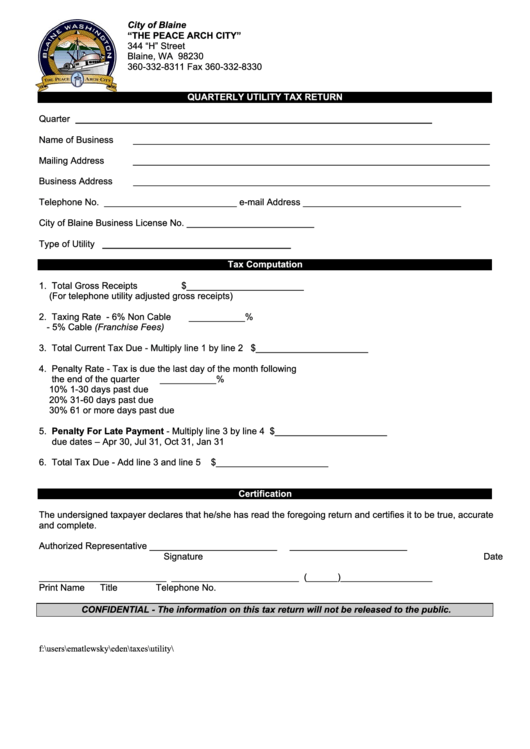

City of Blaine

“THE PEACE ARCH CITY”

344 “H” Street

Blaine, WA 98230

360-332-8311 Fax 360-332-8330

QUARTERLY UTILITY TAX RETURN

Quarter

______________________________________________________________________

Name of Business

______________________________________________________________________

Mailing Address

______________________________________________________________________

Business Address

______________________________________________________________________

Telephone No.

__________________________ e-mail Address _______________________________

City of Blaine Business License No.

_________________________

Type of Utility

_____________________________________

Tax Computation

1. Total Gross Receipts

$_______________________

(For telephone utility adjusted gross receipts)

2. Taxing Rate - 6% Non Cable

___________%

- 5% Cable (Franchise Fees)

3. Total Current Tax Due - Multiply line 1 by line 2

$______________________

4. Penalty Rate - Tax is due the last day of the month following

the end of the quarter

___________%

10% 1-30 days past due

20% 31-60 days past due

30% 61 or more days past due

5. Penalty For Late Payment - Multiply line 3 by line 4

$______________________

due dates – Apr 30, Jul 31, Oct 31, Jan 31

6. Total Tax Due - Add line 3 and line 5

$______________________

Certification

The undersigned taxpayer declares that he/she has read the foregoing return and certifies it to be true, accurate

and complete.

Authorized Representative

_________________________

_______________________

Signature

Date

_________________________ _________________________ (______)__________________

Print Name

Title

Telephone No.

CONFIDENTIAL - The information on this tax return will not be released to the public.

f:\users\ematlewsky\eden\taxes\utility\utilfrm.doc

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1