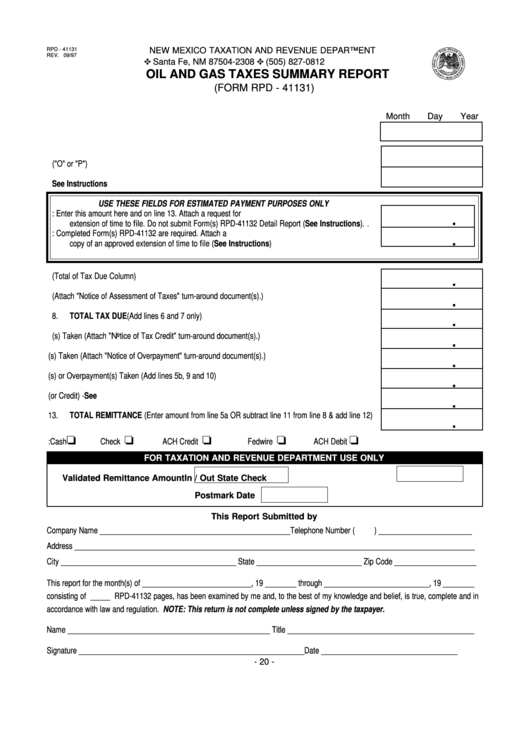

RPD - 41131

NEW MEXICO TAXATION AND REVENUE DEPARTMENT

REV. 09/97

P.O. Box 2308

Santa Fe, NM 87504-2308

(505) 827-0812

OIL AND GAS TAXES SUMMARY REPORT

(FORM RPD - 41131)

1.

Date Submitted .............................................................................................................................

_____ / _____ / _____

Month

Day

Year

2.

OGRID Number .............................................................................................................................

3.

Operator or Purchaser ("O" or "P") ................................................................................................

4.

Final Return - See Instructions ...................................................................................................

USE THESE FIELDS FOR ESTIMATED PAYMENT PURPOSES ONLY

5a. Estimated Payment Remittance: Enter this amount here and on line 13. Attach a request for

.

extension of time to file. Do not submit Form(s) RPD-41132 Detail Report (See Instructions). .

5b. Previous Estimated Payment Remittance: Completed Form(s) RPD-41132 are required. Attach a

.

copy of an approved extension of time to file (See Instructions).................................................

.

6.

Total Oil and Gas Taxes from RPD-41132 (Total of Tax Due Column) ........................................

.

7.

Total Assessments Paid (Attach "Notice of Assessment of Taxes" turn-around document(s).) ....

.

8.

TOTAL TAX DUE (Add lines 6 and 7 only)...................................................................................

.

9.

Total Credit(s) Taken (Attach "Notice of Tax Credit" turn-around document(s).) ..........................

.

10.

Total Overpayment(s) Taken (Attach "Notice of Overpayment" turn-around document(s).) .........

11.

Total Credit(s) or Overpayment(s) Taken (Add lines 5b, 9 and 10) ...............................................

.

12.

Net Advance Payment (or Credit) - See Instructions ..................................................................

.

13.

TOTAL REMITTANCE (Enter amount from line 5a OR subtract line 11 from line 8 & add line 12)

.

14.

Type of Payment:

Cash

Check

ACH Credit

Fedwire

ACH Debit

FOR TAXATION AND REVENUE DEPARTMENT USE ONLY

Validated Remittance Amount

In / Out State Check

Postmark Date

This Report Submitted by

Company Name _________________________________________________ Telephone Number (

) ________________________

Address _______________________________________________________________________________________________________

City _____________________________________________ State ___________________________ Zip Code _____________________

This report for the month(s) of ____________________________, 19 ________ through ___________________________, 19 ________

consisting of _____ RPD-41132 pages, has been examined by me and, to the best of my knowledge and belief, is true, complete and in

accordance with law and regulation. NOTE: This return is not complete unless signed by the taxpayer.

Name ____________________________________________________ Title ________________________________________________

Signature __________________________________________________________

Date ___________________________________

- 20 -

1

1