Instructions For Form 707 - Amendment To Appointment Of Statutory Agent - Texas Secretary Of State

ADVERTISEMENT

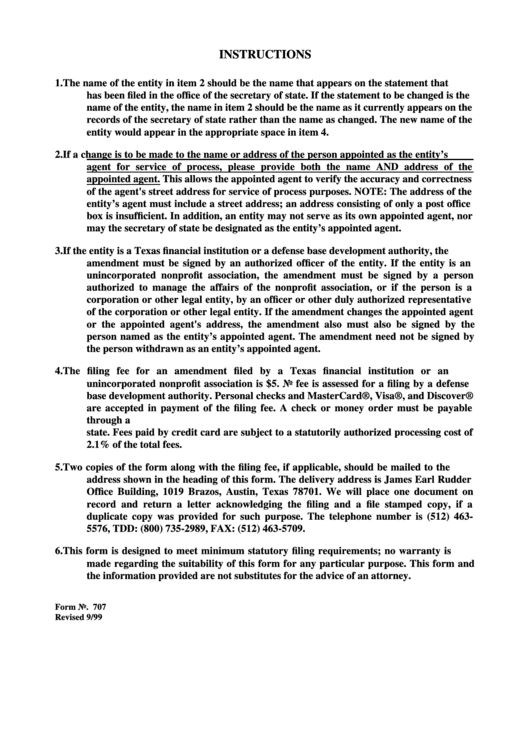

INSTRUCTIONS

1.

The name of the entity in item 2 should be the name that appears on the statement that

has been filed in the office of the secretary of state. If the statement to be changed is the

name of the entity, the name in item 2 should be the name as it currently appears on the

records of the secretary of state rather than the name as changed. The new name of the

entity would appear in the appropriate space in item 4.

2.

If a change is to be made to the name or address of the person appointed as the entity’s

agent for service of process, please provide both the name AND address of the

appointed agent. This allows the appointed agent to verify the accuracy and correctness

of the agent's street address for service of process purposes. NOTE: The address of the

entity’s agent must include a street address; an address consisting of only a post office

box is insufficient. In addition, an entity may not serve as its own appointed agent, nor

may the secretary of state be designated as the entity’s appointed agent.

3.

If the entity is a Texas financial institution or a defense base development authority, the

amendment must be signed by an authorized officer of the entity. If the entity is an

unincorporated nonprofit association, the amendment must be signed by a person

authorized to manage the affairs of the nonprofit association, or if the person is a

corporation or other legal entity, by an officer or other duly authorized representative

of the corporation or other legal entity. If the amendment changes the appointed agent

or the appointed agent's address, the amendment also must also be signed by the

person named as the entity’s appointed agent. The amendment need not be signed by

the person withdrawn as an entity’s appointed agent.

4.

The filing fee for an amendment filed by a Texas financial institution or an

unincorporated nonprofit association is $5. No fee is assessed for a filing by a defense

base development authority. Personal checks and MasterCard®, Visa®, and Discover®

are accepted in payment of the filing fee. A check or money order must be payable

through a U.S. bank or other financial institution and made payable to the secretary of

state. Fees paid by credit card are subject to a statutorily authorized processing cost of

2.1% of the total fees.

5.

Two copies of the form along with the filing fee, if applicable, should be mailed to the

address shown in the heading of this form. The delivery address is James Earl Rudder

Office Building, 1019 Brazos, Austin, Texas 78701. We will place one document on

record and return a letter acknowledging the filing and a file stamped copy, if a

duplicate copy was provided for such purpose. The telephone number is (512) 463-

5576, TDD: (800) 735-2989, FAX: (512) 463-5709.

6.

This form is designed to meet minimum statutory filing requirements; no warranty is

made regarding the suitability of this form for any particular purpose. This form and

the information provided are not substitutes for the advice of an attorney.

Form No. 707

Revised 9/99

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1