Instructions For Employee Payroll Withholding Fee - City Of Paducah

ADVERTISEMENT

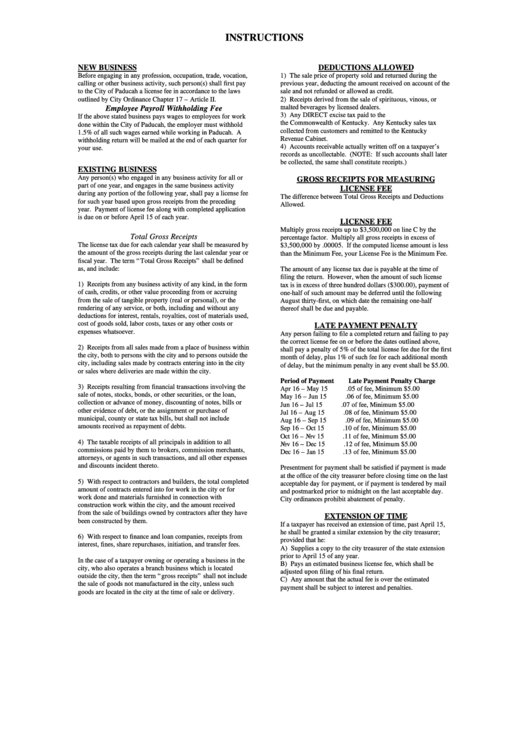

INSTRUCTIONS

NEW BUSINESS

DEDUCTIONS ALLOWED

Before engaging in any profession, occupation, trade, vocation,

1) The sale price of property sold and returned during the

calling or other business activity, such person(s) shall first pay

previous year, deducting the amount received on account of the

to the City of Paducah a license fee in accordance to the laws

sale and not refunded or allowed as credit.

outlined by City Ordinance Chapter 17 – Article II.

2) Receipts derived from the sale of spirituous, vinous, or

malted beverages by licensed dealers.

Employee Payroll Withholding Fee

3) Any DIRECT excise tax paid to the U.S. Government or to

If the above stated business pays wages to employees for work

the Commonwealth of Kentucky. Any Kentucky sales tax

done within the City of Paducah, the employer must withhold

collected from customers and remitted to the Kentucky

1.5% of all such wages earned while working in Paducah. A

Revenue Cabinet.

withholding return will be mailed at the end of each quarter for

4) Accounts receivable actually written off on a taxpayer’ s

your use.

records as uncollectable. (NOTE: If such accounts shall later

be collected, the same shall constitute receipts.)

EXISTING BUSINESS

Any person(s) who engaged in any business activity for all or

GROSS RECEIPTS FOR MEASURING

part of one year, and engages in the same business activity

LICENSE FEE

during any portion of the following year, shall pay a license fee

The difference between Total Gross Receipts and Deductions

for such year based upon gross receipts from the preceding

Allowed.

year. Payment of license fee along with completed application

is due on or before April 15 of each year.

LICENSE FEE

Multiply gross receipts up to $3,500,000 on line C by the

Total Gross Receipts

percentage factor. Multiply all gross receipts in excess of

The license tax due for each calendar year shall be measured by

$3,500,000 by .00005. If the computed license amount is less

the amount of the gross receipts during the last calendar year or

than the Minimum Fee, your License Fee is the Minimum Fee.

fiscal year. The term “Total Gross Receipts” shall be defined

as, and include:

The amount of any license tax due is payable at the time of

filing the return. However, when the amount of such license

1) Receipts from any business activity of any kind, in the form

tax is in excess of three hundred dollars ($300.00), payment of

of cash, credits, or other value proceeding from or accruing

one-half of such amount may be deferred until the following

from the sale of tangible property (real or personal), or the

August thirty-first, on which date the remaining one-half

rendering of any service, or both, including and without any

thereof shall be due and payable.

deductions for interest, rentals, royalties, cost of materials used,

cost of goods sold, labor costs, taxes or any other costs or

LATE PAYMENT PENALTY

expenses whatsoever.

Any person failing to file a completed return and failing to pay

the correct license fee on or before the dates outlined above,

2) Receipts from all sales made from a place of business within

shall pay a penalty of 5% of the total license fee due for the first

the city, both to persons with the city and to persons outside the

month of delay, plus 1% of such fee for each additional month

city, including sales made by contracts entering into in the city

of delay, but the minimum penalty in any event shall be $5.00.

or sales where deliveries are made within the city.

Period of Payment

Late Payment Penalty Charge

3) Receipts resulting from financial transactions involving the

Apr 16 – May 15

.05 of fee, Minimum $5.00

sale of notes, stocks, bonds, or other securities, or the loan,

May 16 – Jun 15

.06 of fee, Minimum $5.00

collection or advance of money, discounting of notes, bills or

Jun 16 – Jul 15

.07 of fee, Minimum $5.00

other evidence of debt, or the assignment or purchase of

Jul 16 – Aug 15

.08 of fee, Minimum $5.00

municipal, county or state tax bills, but shall not include

Aug 16 – Sep 15

.09 of fee, Minimum $5.00

amounts received as repayment of debts.

Sep 16 – Oct 15

.10 of fee, Minimum $5.00

Oct 16 – Nov 15

.11 of fee, Minimum $5.00

4) The taxable receipts of all principals in addition to all

Nov 16 – Dec 15

.12 of fee, Minimum $5.00

commissions paid by them to brokers, commission merchants,

Dec 16 – Jan 15

.13 of fee, Minimum $5.00

attorneys, or agents in such transactions, and all other expenses

and discounts incident thereto.

Presentment for payment shall be satisfied if payment is made

at the office of the city treasurer before closing time on the last

5) With respect to contractors and builders, the total completed

acceptable day for payment, or if payment is tendered by mail

amount of contracts entered into for work in the city or for

and postmarked prior to midnight on the last acceptable day.

work done and materials furnished in connection with

City ordinances prohibit abatement of penalty.

construction work within the city, and the amount received

from the sale of buildings owned by contractors after they have

EXTENSION OF TIME

been constructed by them.

If a taxpayer has received an extension of time, past April 15,

he shall be granted a similar extension by the city treasurer;

6) With respect to finance and loan companies, receipts from

provided that he:

interest, fines, share repurchases, initiation, and transfer fees.

A) Supplies a copy to the city treasurer of the state extension

prior to April 15 of any year.

In the case of a taxpayer owning or operating a business in the

B) Pays an estimated business license fee, which shall be

city, who also operates a branch business which is located

adjusted upon filing of his final return.

outside the city, then the term “gross receipts” shall not include

C) Any amount that the actual fee is over the estimated

the sale of goods not manufactured in the city, unless such

payment shall be subject to interest and penalties.

goods are located in the city at the time of sale or delivery.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1